Steel pricing insights for Middle East trade platforms.

The price of steel is influenced by the cost of raw materials, primarily iron ore and scrap metal. Monitor the prices of these inputs, as fluctuations can impact the overall steel prices. Analyze the demand and supply dynamics of the steel market. Factors such as construction activity, infrastructure projects, manufacturing output, and global economic conditions can influence demand. Supply factors include production capacity, import/export volumes, and inventories.

Consider the costs associated with steel production, including energy costs, labor expenses, transportation, and overheads. These costs can vary based on the location and efficiency of the steel mills. Evaluate the competitive landscape within the steel industry. Competitors' pricing strategies, market share, and product differentiation can impact pricing decisions. Stay updated on market trends and forecasts provided by industry experts, analysts, and research reports. Factors such as trade policies, technological advancements, and environmental regulations can shape the steel market's outlook.

The price of hardware and steel products in general directly affects the price of housing, cars and energy; so it's very important to know how to price them. The steel industry plays an important and key role in the production, economy and industrialization of any country. The production of this metal creates many jobs from the stage of extracting iron ore from the mine to production and consumption, and in this way also causes economic prosperity. Cars, buildings, weapons, and power lines are some of the uses of steel in our daily lives.

The prosperity of shipbuilding, automotive, packaging, transportation, energy production and transmission industries, hard machinery, mining, piping and construction profiles is very influential in the industrial and economic growth and development of steel in any country. Given the great importance of steel in the economy of societies, it is clear that the price of iron and steel will directly affect all economic dimensions of countries. Various factors affect the final price of iron and steel. In this article, we will discuss how to determine the prices of iron and steel products. If you are unsure about the cause of fluctuations in steel products, join us.

Supply and demand is one of the most basic concepts and one of the pillars of economics. The supply and demand of steel ingots, like any other commodity, is the main national base for determining the price of other steel products and sections. The current price of iron and steel as an important commodity is affected by factors such as supply chain of raw materials, production in factories as well as supply of goods in the factory and can have a great impact on the market.

Demand refers to the amount of product or service that is favorable to buyers. In fact, the amount of demand is the amount of product that people are willing to buy at a certain price. The amount of demand for each product depends on factors such as the quality and cost of that product. The number of alternative products available, the amount of advertising and changes in the price of complementary products are all factors that will affect the amount of demand.

Against demand, there is supply. Supply is the amount of product that the manufacturer is willing to supply at a specified price. In fact, supply represents the amount brought to market. The relationship between price and demand reflects the fact that the price of anything is a reflection of supply and demand. In fact, if other factors are equal, the higher the price of a product, the lower the demand for that product.

As the price of a commodity increases, so does the amount of commodity that buyers buy at a higher price. Because as the price of a product increases, so does the opportunity cost (which is the cost of rejecting the best alternative when making a decision). As a result, people will naturally ignore buying that product. On the other hand, the higher the price of goods, the higher the supply. Manufacturers increase supply at higher prices. Because selling a large number of products at a higher price will increase their revenue.

Analyze historical pricing data to identify trends, seasonal fluctuations, and price cycles in the steel market. This data can provide insights into price patterns and help in making informed pricing decisions. Regularly gather information from industry publications, trade associations, market reports, and industry conferences to stay informed about the latest developments and pricing trends in the steel industry.

For international trade, fluctuations in currency exchange rates can affect the price of steel products. Monitor currency markets and consider their impact on import/export costs. Consider any value-added services, such as processing, finishing, or customizations, which may warrant additional charges. Determine your pricing strategy based on your business objectives. Factors such as market positioning, brand reputation, customer segmentation, and desired profit margins will influence your pricing decisions.

-

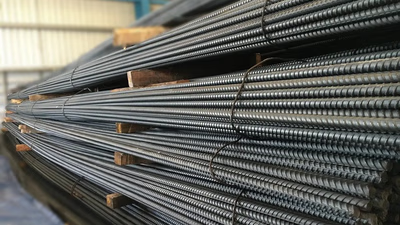

The price of steel wire is significantly influenced by the cost of raw materials, particularly steel billets and rods. Fluctuations in the prices of iron ore, coal, and other inputs directly affect production costs. Demand dynamics play a crucial role; increased demand from sectors like construction can drive prices up, while oversupply can lead to price drops. The global economic climate, including growth rates and inflation, also impacts pricing indirectly. Government regulations regarding taxes, duties, and environmental compliance can alter cost structures and pricing strategies. The complexity of the steel industry means that various interconnected factors influence prices over time and across regions. Steel wire is essential in multiple industries such as carpentry and manufacturing, with different types available including black and white rod wire. Black wire is produced through high-temperature processes that enhance flexibility, while tensile wire undergoes cold drawing for desired thickness.

International trade dynamics further complicate pricing; currency exchange rates and trade policies like tariffs can affect import/export costs. Additionally, manufacturing costs related to labor and energy impact pricing strategies among competitors in the market.

-

The price of steel products is primarily influenced by the costs of raw materials like iron ore and scrap metal, alongside demand and supply dynamics. Key factors affecting demand include construction activity, manufacturing output, and global economic conditions. On the supply side, production capacity, import/export volumes, and inventory levels play significant roles. Additionally, production costs such as energy, labor, and transportation vary by location and efficiency of steel mills. The competitive landscape also impacts pricing strategies through competitors" market share and product differentiation. Staying updated on market trends from industry experts is crucial as trade policies and technological advancements can shape the steel market"s future. The price of steel directly affects various sectors including housing, automotive, and energy production. Understanding these dynamics is essential for businesses involved in the steel industry to make informed pricing decisions.

Historical pricing data can reveal trends that assist in forecasting future prices. Currency fluctuations also impact international trade costs for steel products. Businesses must consider value-added services when determining their pricing strategy to align with market positioning and profit margins.

-

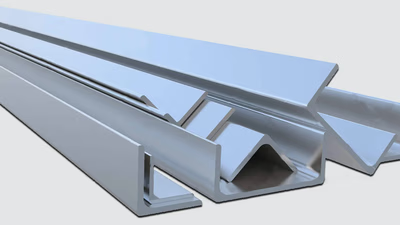

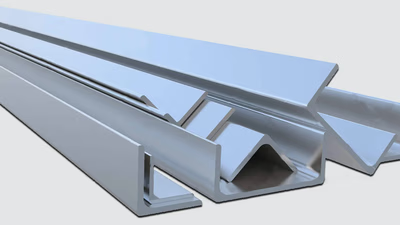

West Asia"s steel profiles industry is thriving, driven by advanced manufacturing facilities that produce a variety of steel products, including beams, channels, and custom profiles. These products are essential for construction and infrastructure projects across the region. Governments are actively supporting the sector through investment incentives and favorable policies to stimulate growth. Manufacturers are adopting cutting-edge technologies like CAD and CAM systems to improve efficiency and quality, ensuring they meet international standards. The region"s strategic location enhances its export potential, allowing manufacturers to reach global markets effectively. The demand for steel profiles is fueled by rapid urbanization and government initiatives in construction, making West Asia a key player in the global steel market. Studs, a specific type of steel profile, are widely used in various applications such as trusses and bridges. They come in different grades based on their specifications and applications, with variations including light and heavy types as well as mesh and simple designs. The ongoing growth in construction activities across West Asia indicates a robust future for the steel profiles industry.

-

Steel corner profiles, or angle bars, are essential components in construction and manufacturing, made from hot-rolled or cold-formed steel. Their strength and durability depend on the steel grade and thickness, with common materials including carbon, stainless, and alloy steel. These profiles are widely used for structural support in buildings, bridges, and towers, as well as in fabricating machinery and equipment. They also serve decorative purposes in architectural design and are popular among DIY enthusiasts for custom projects. The L-shape of these profiles provides stability and load-bearing capacity, making them suitable for various applications. Steel angles can be connected through welding or bolts to enhance structural integrity. Available in different sizes and finishes, including galvanized options for corrosion resistance, the choice of equal or unequal leg lengths is determined by specific project requirements. Understanding the properties of steel corner profiles is crucial for selecting the right type for any construction or manufacturing project.

-

Galvanized wire, produced in thicknesses ranging from 1. 2 to 4 mm, is essential in various applications including fencing, agriculture, and construction. It is categorized into soft and hard types based on carbon content, affecting its hardness. The production methods include hot and cold galvanizing, with hot galvanizing being prevalent in Western Asia and Iran. Rabitz wire, a specific type of galvanized wire at 1. 2 mm thickness, is commonly used for rabbit enclosures. Additionally, wire scoops (1. 5 mm thick) are utilized for granite rock handling.

Cold rolled sheets undergo a process that enhances strength and surface quality post hot rolling, which occurs at high temperatures above 926 °C. This method allows for easy shaping but may result in surface imperfections requiring further finishing. Hot rolled sheets are characterized by their non-shiny surface and are often referred to as black sheets due to their exposure to air during production. Saba Steel Complex is a notable producer of hot rolled sheets in the region.

-

West Asia"s steel industry is robust, with key players like Saudi Arabia, Iran, Turkey, and the UAE producing a variety of steel profiles, particularly angle bars. The construction sector is the primary consumer of these steel corner (L) profiles due to ongoing infrastructure development and urbanization in the region. Steel angles are essential for building frames, supports, and reinforcements in both construction and industrial applications. The demand for these profiles is further fueled by the region"s industrialization and diversification efforts. West Asia not only meets local needs but also serves as a significant exporter of steel profiles to neighboring regions such as North Africa. Factors influencing the market include domestic production capacities, economic conditions, and regional trade dynamics. Governments are actively promoting the steel industry through favorable policies and investments to enhance local production capabilities. Industry associations play a crucial role in supporting growth through collaboration and knowledge sharing among stakeholders. Steel corner (L) profiles from West Asia typically comply with international quality standards like ISO 9001, ensuring their competitiveness in global markets.

-

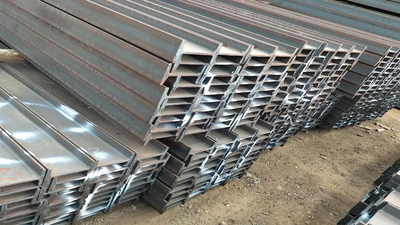

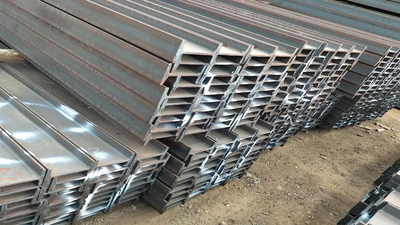

Emirates Steel stands out as a premier steel producer in the Middle East, specializing in structural steel products like girders. Their advanced facility in Abu Dhabi caters to various sectors, including construction and oil and gas. While Saba Steel Industrial Nigeria Limited is not based in West Asia, it plays a crucial role in supplying girders to West Africa. Understanding the different types of beams—IPE, INP, and IPB—is essential for buyers, as each has unique specifications and applications. IPE beams are prevalent in Iran due to their European standards, while INP beams follow Russian and Chinese standards. The IPB standard features wider wings compared to IPE. Notable manufacturers such as Iran National Steel Group and Teba Steel contribute significantly to the regional market by producing diverse steel products for both domestic use and export. Buyers should also consider technical specifications when selecting beams, as indicators like "V" for heavy or "L" for light can influence their choice.

Overall, the Middle East"s steel industry is characterized by a variety of producers that meet local and international demands. "

-

Commodity prices, particularly for rebars and iron products, are primarily influenced by supply and demand dynamics within the commodity exchange. Market participants, including traders and producers, engage in buying and selling based on their assessments of market conditions. The trading process involves executing orders based on matching bids and offers, which leads to price discovery. Various commodity exchanges, such as the London Metal Exchange and Chicago Mercantile Exchange, facilitate this trading but have different rules and structures. Regional factors like local supply dynamics and transportation costs also play a crucial role in pricing. The establishment of commodity exchanges aims to create transparent markets for trading industrial products, including steel. Notable companies in the Iranian Commodity Exchange include Isfahan Mobarakeh Steel and Khorasan Steel Complex, which contribute significantly to the supply of iron products. Futures contracts for rebar allow participants to trade at predetermined prices, reflecting market expectations that can influence spot prices.

Continuous trading activity aids in price determination as buyers and sellers interact based on current market data. Additionally, external factors such as economic indicators and geopolitical events can lead to price fluctuations.

-

A free market enhances efficiency by allowing supply and demand to dictate prices, fostering competition among steel producers. This leads to improved production processes, cost reductions, and innovation. The price discovery mechanism in a free market provides transparency, enabling informed decision-making based on current conditions. Producers can adjust their strategies flexibly in response to market changes, promoting a diverse range of steel products tailored to customer needs. International trade flourishes as barriers like tariffs are removed, allowing access to global markets and comparative advantages. However, the benefits of a free market can vary based on regulatory frameworks and specific contexts. Governments can mitigate disadvantages through regulations and support for strategic industries. While competition is essential in a free market, it may also lead to speculative activities that introduce volatility and distort the market.

Additionally, external costs associated with steel production may not be reflected in prices, raising concerns about sustainability and social impacts. Market failures such as imperfect information and monopolistic behavior can result in inefficiencies and unequal benefits distribution.

-

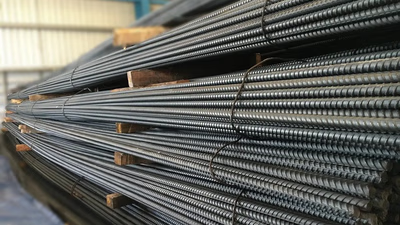

West Asian countries possess abundant raw materials for steel production, particularly iron ore and scrap metal. Their strategic location between major steel-consuming regions like Europe, Asia, and Africa enhances their export capabilities. Turkey leads the rebar market with significant exports, while the UAE and Saudi Arabia also have robust steel industries catering to both domestic and international demands. Iran"s steel sector faces challenges due to sanctions but remains a key player in rebar production. The region"s construction boom, driven by large-scale projects, has increased the demand for steel rebar. Governments are investing heavily in the steel industry to foster self-sufficiency and reduce import reliance. Competitive advantages such as lower labor costs and favorable energy prices allow West Asian producers to offer attractive pricing. However, the dynamic nature of the steel market means that supply and demand fluctuations continually influence pricing strategies.

Economic diversification efforts in these countries emphasize developing a strong steel industry as a means to create jobs and reduce oil dependency. Infrastructure development fueled by urbanization and population growth further drives the need for rebar in construction projects across West Asia.

-

The price of studs is influenced by various factors, primarily the cost of raw materials like iron ore and scrap metal. Global commodity market fluctuations, supply and demand dynamics, and production costs significantly contribute to price volatility in the steel industry. Labor, energy, and overhead costs also play a crucial role in determining the overall price of steel sections. Infrastructure development, construction activities, and economic growth in different regions impact demand for steel sections, creating a balance that affects pricing. Competition among manufacturers can lead to price adjustments as companies strive to attract customers or maintain profitability. Additionally, international trade dynamics such as currency exchange rates and trade policies influence pricing strategies. The type, grade, and length of studs further affect their prices, which are not fixed due to market fluctuations. Consulting specialists can provide accurate pricing based on these influencing factors.

The versatility of studs makes them essential in construction processes; thus, engineers must consider their prices when estimating overall construction costs. Market dynamics such as mergers and acquisitions within the steel industry can also impact pricing strategies. Lastly, government regulations regarding labor and environmental compliance can alter production costs and affect prices.

-

Hot rolled sheets are produced at high temperatures, typically above 1,000°F (538°C), resulting in a rough surface and lower dimensional accuracy. They are thicker and larger, suitable for structural applications where precision is not critical. In contrast, cold rolled sheets are processed at room temperature, yielding a smoother finish and higher hardness. The production of cold rolled sheets involves additional steps like polishing and lubrication, making them more expensive—often twice the price of hot rolled sheets. Cold rolled sheets offer better dimensional accuracy and tighter thickness tolerances, making them ideal for industries requiring precise specifications such as automotive and appliances. Both types have distinct applications: hot rolled sheets are used in construction and manufacturing of pipes, while cold rolled sheets find use in metal furniture and other precision-demanding sectors.

-

West Asia"s construction sector is booming, leading to a surge in demand for beams, essential structural components. The establishment of local beam production facilities in the Middle East is a response to this demand, driven by urbanization and economic growth. Local production reduces reliance on imports, ensuring timely supply for ongoing construction projects. Isfahan Steel Factory stands out as a top producer, known for high-quality beams that meet technical specifications. The ESCO logo indicates authenticity and quality, distinguishing Isfahan beams from lower-quality imports. As West Asian countries diversify their economies away from oil dependence, developing a robust steel industry becomes crucial for job creation and export potential. Government support through investment incentives and infrastructure development fosters the growth of beam manufacturing facilities. The region"s strategic location enhances logistics and transportation capabilities, facilitating access to various markets. Additionally, the availability of raw materials like iron ore and coal supports local steel production efforts.