How is the metals industry shaping trade in the Middle East?

The metals industry in the Middle East and West Asia plays a pivotal role in shaping the region’s economy, trade, and industrialization. Aluminum, widely used after iron, is a cornerstone of industrial applications due to its lightweight properties, corrosion resistance, and affordability. Countries like Saudi Arabia and the UAE are emerging as key players in aluminum production, leveraging advanced technologies and abundant resources to dominate the regional market. Similarly, steel and iron are fundamental to infrastructure development, with Western Asia witnessing growing demand driven by urbanization and industrial projects. The Asia Iron and Steel Market is becoming increasingly competitive, with price fluctuations influenced by global supply chains and local production capacities. Precious metals like gold and silver hold significant economic and cultural importance in West Asia. The Middle East Gold Market is thriving, with Arab nations such as Saudi Arabia and the UAE being major traders and consumers. Gold prices are shaped by global trends, local demand, and mining reserves within the region.

Silver, valued for its industrial and ornamental uses, sees steady demand, with factors like mining output and technological applications affecting its price. Copper and zinc are integral to the region’s industrial growth. The West Asia Copper Exchange facilitates trade and pricing, while zinc remains a vital component in construction and biological applications. Platinum and nickel represent emerging opportunities, with Middle Eastern markets increasingly integrating these metals into supply chains for high-tech industries. Trade platforms like Aritral enhance connectivity among verified exporters and importers, offering AI-driven solutions for product listing, communication, and marketing. By connecting businesses across the Middle East, such platforms streamline supply chain operations and foster growth in the metals sector. The region’s vast metal reserves and strategic trade networks position it as a key global player in the commodities market, with opportunities for expansion in both traditional and high-tech industries.

-

Saudi Arabia

Mualim Alminyum Tarkeeb wa Siyanat Mataabikh fi Sharurah

Saudi Arabia

Mualim Alminyum Tarkeeb wa Siyanat Mataabikh fi Sharurah

Aluminum installer and kitchen maintenance in SharurahDetails

-

Nizk Thalji F 3 weeks ago

Nizk Thalji F 3 weeks ago Egypt

Snowy Color Meteor

Egypt

Snowy Color Meteor

Snowy Colored MeteorDetails

-

Yahya 3 weeks ago

Yahya 3 weeks ago Mauritania

Stone

Mauritania

Stone

Raw stoneDetails

-

Masi Sami 4 months ago

Masi Sami 4 months ago Iran

Brass Bar & Rod

Iran

Brass Bar & Rod

We could provide you Brass Bar & Rod in best quality and best offer.Details

-

Ahjar Karima Wa Niyazk 1 months ago

Ahjar Karima Wa Niyazk 1 months ago United Arab Emirates

Stones and Meteorites

United Arab Emirates

Stones and Meteorites

Precious and semi-precious stones, rare and common, meteorites, and volcanic rocksDetails

-

Behinboronz.Co 3 weeks ago

Behinboronz.Co 3 weeks ago Iran

Brass pipe and rod

Iran

Brass pipe and rod

Manufacture of all kind of brass section. In round-hexagonal shape in lowest priceDetails

-

Ahmet Ebu Halıl 1 months ago

Ahmet Ebu Halıl 1 months ago Turkey

Existing

Turkey

Existing

Iron raw materialDetails

-

Baran 3 weeks ago

Baran 3 weeks ago Iraq

Meteor

Iraq

Meteor

$$Details

-

Feysal Mohammad Abdulla 5 months ago

Feysal Mohammad Abdulla 5 months ago Ethiopia

Meteorite, platinum, carbonado

Ethiopia

Meteorite, platinum, carbonado

Name feysal Mohammad Abdulla - Meteorite, carbonado and platinumDetails

-

Shahzaib 5 months ago

Shahzaib 5 months ago Pakistan

Meteorite

Pakistan

Meteorite

MeteoriteDetails

-

Ali Abdul Karim 5 months ago

Ali Abdul Karim 5 months ago Yemen

Platinum

Yemen

Platinum

Pure platinum stone with its certificateDetails

-

Salama 1 months ago

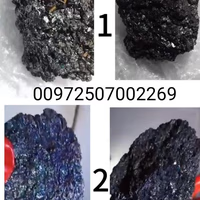

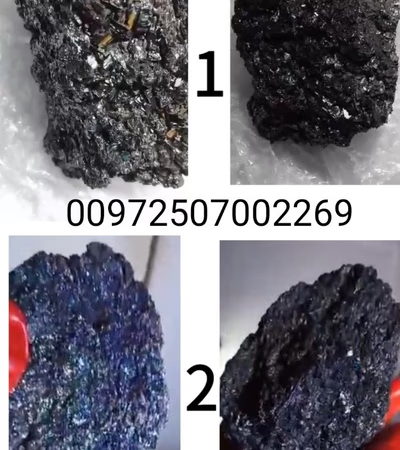

Salama 1 months ago Israel

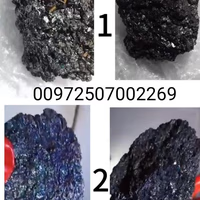

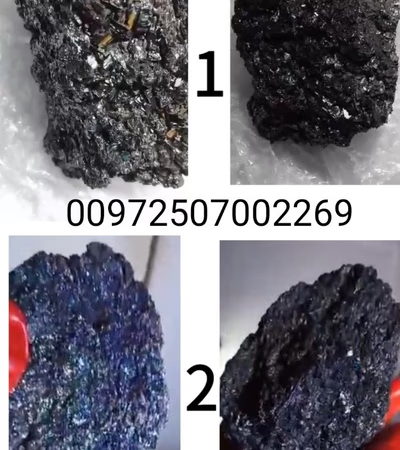

Diamond meteorite stones black and blue

Israel

Diamond meteorite stones black and blue

I have two diamond meteorite stones for sale, one is black and the other is blue. They are located in Jordan. Those interested can contact me on Whats...Details

-

Veronica 5 months ago

Veronica 5 months ago China

silicon metal

China

silicon metal

We can supply Silicon metal 553,441,3303,2202 and so on. Silicon metal products with low phosphorous and low titanium can also be supplied.Details

-

Mohammad 5 months ago

Mohammad 5 months ago Kuwait

Meteorite

Kuwait

Meteorite

A meteoriteDetails

-

Halit Kurt 1 months ago

Halit Kurt 1 months ago Turkey

Pistachio hazelnut, construction materials

Turkey

Pistachio hazelnut, construction materials

Wholesale hazelnut, pistachio, construction materialsDetails

-

Shiny Star 1 months ago

Shiny Star 1 months ago Armenia

Shipwreck waste and metal waste

Armenia

Shipwreck waste and metal waste

25000tons) of ship waste, one ship shaft and propellerDetails

-

Belatnium 4 weeks ago

Belatnium 4 weeks ago Libya

Stones

Libya

Stones

Raw lapis lazuli stone, other precious stones available, including rubies, platinum, and black diamonds.Details

-

Exploring Aluminum Trade and Industry in West Asia and the Middle East

Aluminum, known for its versatility, lightweight nature, and corrosion resistance, has emerged as one of the most widely used metals after iron. In the Middle East, aluminum plays a key role in trade and industrialization, with West Asia serving as a vital hub for its production, export, and import. The aluminum industry in the region is supported by robust supply chain solutions, verified exporters and importers, and growing demand from various sectors such as construction, transportation, and packaging. West Asia’s aluminum industry thrives due to its access to abundant raw materials like bauxite and cost-effective energy resources. Aluminum products in the market include ingots, slabs, wires, and foils, each catering to distinct industries. For instance, aluminum foil finds widespread applications in packaging and insulation, while ribbed aluminum foil is highly valued in architectural design. Aluminum ingots, classified by alloy series such as 1000, 3000, and 5000, serve as a benchmark in pricing and application due to their varied properties. Factors influencing aluminum prices include global demand, energy costs, and regional trade policies.

Platforms focusing on commodity trade in the Middle East, such as Aritral, enable seamless connections between verified buyers and suppliers, fostering transparency and efficient transactions. Moreover, the aluminum industry dovetails with markets for other metals like copper, zinc, and steel, reflecting the interconnected nature of the region’s metallurgy sector. The future of aluminum in the Middle East is promising, driven by increasing urbanization, infrastructure projects, and its sustainability as a recyclable material. By leveraging market insights and B2B platforms, businesses can capitalize on the growing demand for aluminum and its derivatives, ensuring their foothold in the competitive West Asian market.

-

Brass Trade Dynamics in Middle Eastern Markets

Brass, an alloy of copper and zinc, plays a pivotal role in the trade dynamics of West Asia and the Middle East. This region serves as a vital hub for commodity trade, connecting global markets with local supply chains. Brass, valued for its durability, corrosion resistance, and versatility in applications ranging from construction to electronics, has seen increasing demand across industries. Verified exporters and importers in the Middle East leverage advanced trade platforms to foster efficient trade networks, enabling seamless transactions for brass products. Marketing and trade of brass alloys in Middle Eastern markets are driven by strategic B2B marketplace platforms. These platforms facilitate product listings, trade advertising, and business networking, allowing buyers and sellers to explore global opportunities for brass and its applications. Regional insights on pricing, supply chain solutions, and market trends are crucial for stakeholders aiming to capitalize on this lucrative commodity. The broader metals market in West Asia—including steel, silver, copper, nickel, aluminum, zinc, gold, and platinum—also benefits from such platforms.

For instance, silver’s industrial uses and fluctuating prices are shaped by B2B marketplaces that streamline supply chains. Similarly, copper trade in Middle Eastern and West Asian markets is bolstered by verified networks, ensuring stable supply dynamics. Aritral, an AI-driven B2B platform, supports such international trade by offering tools like AI-powered marketing and global sales assistance, along with direct communication features. By simplifying trade processes, platforms like Aritral enable stakeholders to navigate the complexities of commodity trade and unlock new opportunities in metals markets.

-

Copper Trade Trends in Middle East & West Asia

Copper, one of the most versatile metals, is essential for industries ranging from construction to electronics. The Middle East and West Asia have emerged as critical hubs for copper trade, driven by rising industrial demand and the region"s strategic location as a transit point between Asia, Europe, and Africa. The West Asia Copper Exchange plays a pivotal role in facilitating trade, providing market insights, and connecting verified exporters and importers. As copper prices fluctuate due to global economic shifts, regional B2B marketplaces and trade advertising platforms help businesses navigate complex supply chains and capitalize on opportunities. Copper"s uses are diverse, including electrical wiring, plumbing, and industrial machinery, making it indispensable in modern economies. In addition, recycling copper offers environmental benefits and supports sustainability. Methods such as smelting and electro-refining are used to create copper ingots, which are foundational for manufacturing processes. Copper alloys like brass and bronze further expand its applications in industries like decoration and automotive manufacturing.

Market dynamics in West Asia show increasing demand for copper, correlating with urbanization and industrial growth. Verified exporters on B2B platforms provide reliable supply chain solutions, ensuring consistency in regional product listings. This ecosystem also supports trade in other metals such as steel, silver, aluminum, and zinc, each playing a unique role in the commodity trade landscape. Copper, however, remains a cornerstone, influencing pricing dynamics and fostering economic growth across the Middle East. Aritral, an AI-driven B2B platform, contributes to this thriving industry by simplifying copper trade through product listings, direct communication, and AI-powered marketing tools. By connecting regional stakeholders, Aritral aids in navigating market complexities, ensuring smooth transactions, and unlocking new business opportunities.

-

Exploring the Gold Market and Trade Dynamics in the Middle East

The gold market in the Middle East and West Asia is a cornerstone of the global metals trade, deeply rooted in the region"s history and culture. Gold"s discovery in West Asia dates back thousands of years, and today, the Middle East remains a thriving hub for gold mining, trading, and jewelry manufacturing. Verified exporters and importers leverage regional trade platforms to facilitate the flow of gold, ensuring transparency and reliability in supply chains. In recent years, B2B marketplaces in Asia have emerged as pivotal players, offering regional product listings and connecting Middle Eastern gold traders with global buyers. These platforms provide market insights, helping businesses navigate fluctuating prices influenced by currency stability, geopolitical factors, and demand in industries like jewelry, electronics, and investments. For instance, the price of gold is closely tied to global economic conditions and is expected to remain volatile in the coming year. Gold"s applications in the region extend beyond jewelry, including its use in electronics and as a financial asset. Jewelry manufacturing wages in the Middle East vary significantly, influenced by craftsmanship and market demand.

Buyers are advised to distinguish between new and second-hand gold jewelry by examining hallmarks and wear patterns. Middle Eastern traders emphasize transparency and quality assurance, making the region a premier destination for gold transactions. Aritral, an AI-driven B2B platform, supports the gold and metals market by simplifying trade processes. Through verified profiles, AI-powered marketing, and direct communication tools, Aritral helps connect regional stakeholders with global opportunities, enhancing supply chain efficiency for commodities like gold, silver, and other metals. "

-

Nickel Trade and Market Insights in Middle East & West Asia

Nickel, a vital industrial and strategic metal, plays a significant role in global commodity trade, particularly across the Middle East and West Asia. Known for its corrosion resistance and high melting point, nickel is essential in stainless steel production, battery technology, and various alloys such as brass. In West Asia, nickel trade dynamics are shaped by regional demand in infrastructure, automotive, renewable energy, and electronics industries. Verified exporters and importers leverage platforms like Aritral to explore opportunities, streamline supply chains, and analyze market trends. The Middle East"s B2B marketplace fosters connections among nickel suppliers and buyers, facilitating trade advertising and networking. Nickel"s industrial importance aligns with broader metals trade, including steel, copper, aluminum, and zinc. Supply chain solutions offered by these platforms connect regional businesses and enhance transparency in pricing, demand forecasting, and verified transactions. Nickel"s global significance is further underscored by its role in emerging technologies such as electric vehicle batteries, influencing trade agreements and regional market strategies.

Market insights reveal significant growth opportunities for nickel in the Middle East, particularly as urbanization and industrialization fuel demand for stainless steel and nickel-based alloys. Trade platforms are instrumental in connecting regional product listings, providing market insights, and facilitating connections between suppliers and buyers in the rapidly evolving commodities landscape. The integration of AI-driven tools, such as those offered by Aritral, simplifies global trade dynamics and promotes efficient communication and refined advertising strategies. In addition, nickel’s supply chain is impacted by trends in other metals like silver, copper, and gold, which share overlapping markets and applications. By exploring verified B2B networks, businesses can tap into regional nickel markets while addressing logistical challenges and identifying new growth avenues. Such platforms are reshaping trade dynamics in West Asia and the Middle East, paving the way for enhanced cooperation and sustainable practices in the metals industry. "

-

Exploring Platinum Trade Dynamics in Middle East & West Asia

Platinum, a critical component in industrial applications, is gaining increased attention across the Middle East and West Asia due to its unique properties and diverse uses. As a high-value metal, platinum is integral to automotive catalysts, jewelry, and electronic applications, making its trade dynamics pivotal in the region. The Middle East’s strategic location as a global trade hub enables seamless import and export activities, supported by emerging B2B marketplaces that connect verified buyers and sellers. These platforms are transforming the commodity trade landscape by streamlining transactions, enhancing transparency, and providing market insights. Platinum demand in West Asia is driven by industrial growth and increasing investments in high-tech sectors. Supply chain solutions offered by regional trade platforms enable businesses to navigate logistical challenges, ensuring timely delivery of this precious metal. Verified exporters and importers listed on these marketplaces further boost confidence in transactions, while detailed product listings provide vital insights into pricing trends and quality specifications. In addition to platinum, metals like steel, silver, copper, aluminum, and zinc also play critical roles in the region"s commodity trade.

For instance, copper’s role in electrical infrastructure and silver’s application in solar energy technologies highlight the growing emphasis on sustainability-driven markets. Meanwhile, the gold trade remains a cornerstone of the Middle Eastern economy, with B2B platforms facilitating connections between local suppliers and global buyers. Exploring the platinum market through such platforms unveils opportunities to tap into emerging trends, such as green technology and clean energy initiatives. Businesses leveraging these trade networks gain access to invaluable market insights, fostering growth and competitiveness. Aritral, an AI-powered B2B platform, simplifies international trade by offering services like product listing, marketing, and global sales assistance, making it a trusted partner in the region’s metals and commodities trade ecosystem. "

-

Exploring Silver Trade Dynamics in West Asia

Silver plays a pivotal role in the West Asian trade landscape, driven by its diverse industrial applications and cultural significance. As a key commodity in the Middle East"s robust import-export ecosystem, silver enjoys steady demand, bolstered by its uses in electronics, jewelry, and renewable energy technologies. Verified exporters and importers leverage B2B platforms to navigate the region"s silver market, ensuring transparency and efficiency in supply chains. The West Asian Silver Market is influenced by factors such as global economic trends, regional mining outputs, and fluctuations in demand for industrial uses, particularly in solar energy and electronics. Silver pricing in the Middle East is shaped by global market forces, currency valuations, and the availability of local mines. The region’s historical silver mines, while not as abundant as those in Latin America or Asia-Pacific, contribute to a steady supply chain and regional self-reliance. Trade platforms such as Aritral are instrumental in connecting verified buyers and sellers, showcasing regional product listings and facilitating market insights that support business networking. Furthermore, the Middle East"s silver trade is interconnected with other metals like gold, copper, and zinc, highlighting the region"s role as a hub for multi-metal trade.

Trends point toward growing demand for silver paste production, which has emerged as a key innovation in the region. Future supply and demand forecasts indicate an upward trajectory, driven by expanding industrial applications and the rising prominence of B2B marketplaces that streamline trade operations. The strategic integration of silver into West Asia’s commodity trade underscores its importance as a tradable asset. Platforms like Aritral ensure seamless transactions and deliver AI-powered market insights, fostering confidence in a dynamic trade environment.

-

Steel and Metals Trade Dynamics in Middle East and West Asia

Steel and metals like copper, aluminum, silver, and zinc represent the backbone of industrialization and economic growth across the globe, with the Middle East and West Asia emerging as critical regional hubs for these industries. Steel, in particular, is indispensable to infrastructure development, automotive manufacturing, and construction industries. In West Asia, steel products like rebars, beams, channels, and galvanized wires are heavily traded, with prices influenced by factors such as market demand, raw material costs, and energy prices. Verified exporters and importers on B2B marketplaces ensure smoother trade of these commodities. The Asia Iron and Steel Market is a dynamic and evolving sector, supported by supply chain solutions and regional trade platforms that connect buyers and sellers. For example, girder and beam production factories in the Middle East are increasingly leveraging technology and trade advertising platforms to streamline operations and expand their reach. Hot-rolled sheets and cold-rolled sheets dominate demand due to their varied applications, while galvanized wires and steel corner profiles represent niche yet vital segments. Beyond steel, metals such as silver, zinc, gold, and copper hold immense potential in West Asia’s trade economy.

Silver’s price is affected by global supply and demand trends, with its applications ranging from electronics to jewelry. Zinc, abundant in the earth"s crust, remains integral to industrial applications like galvanization and biological processes. Gold continues to be a cornerstone of the Middle Eastern economy, with traders focusing on its price volatility and investment opportunities. Copper and aluminum markets are also pivotal, with aluminum shaping supply chains due to its lightweight and versatile properties. Platforms like Aritral simplify international trade by offering AI-driven tools for product listing, direct communication, and market insights. These innovations empower businesses to navigate complexities in the Middle East’s commodity trade landscape efficiently, making it easier to connect with verified suppliers and optimize trade networks. "

-

Zinc Trade Insights in West Asia & Middle East Metals Market

Zinc plays a pivotal role in the industrial and trade ecosystem of West Asia and the Middle East. As one of the most versatile metals, it is abundant in the earth"s crust, with significant applications ranging from galvanization in steel to manufacturing alloys like brass and nickel. The Middle East and West Asia are key players in the zinc market, supported by robust supply chain networks and verified exporters facilitating regional and international trade. Zinc ingots, categorized under HS codes such as 790111 and 790120, are highly sought after due to their durability and corrosion resistance. Leading manufacturers in West Asia are recognized for producing high-quality zinc ingots, with some of the most modern facilities located in the UAE and Saudi Arabia. Demand for zinc is driven by construction, automotive, and health industries, where it is used in galvanizing steel, producing batteries, and serving as an essential trace element for human health. B2B marketplaces in Asia, such as Aritral, enable seamless communication between buyers and suppliers and provide real-time market insights, fostering transparency in commodity trade. Verified exporters and detailed product listings ensure that businesses can confidently explore zinc ingot sourcing options and evaluate pricing trends.

In the broader metals market, zinc competes with copper, aluminum, and silver, each finding unique niches in Middle Eastern supply chains. Trade platforms influence these dynamics by offering market insights and connecting regional manufacturers to global buyers. Looking ahead, the zinc industry in West Asia is expected to grow due to increased demand for sustainable and durable materials, with prices forecasted to remain stable amidst fluctuating energy costs. For buyers, understanding market trends and leveraging B2B trade platforms is crucial in navigating this competitive landscape effectively. "

-

What is Metal?

Metals are a class of chemical elements characterized by high electrical and thermal conductivity, malleability, ductility, and luster. Typically solid at room temperature, except for mercury, metals possess a crystalline structure that facilitates electron movement, contributing to their conductivity. They exhibit metallic bonds, sharing electrons within a lattice. Metals vary in reactivity; noble metals like gold and platinum resist corrosion, while others, such as iron and aluminum, are prone to oxidation. Their strength and durability make them suitable for diverse applications across construction, manufacturing, transportation, and electronics. Metals can form alloys, enhancing their properties. They are primarily silvery, high-density solids, with some exhibiting unique characteristics like low densities or high melting points. Metals are excellent conductors of electricity and heat, attributed to their free electrons.

Malleability allows them to be shaped without breaking, while ductility enables stretching into wires. The periodic table categorizes metals into groups, including alkali, alkaline earth, transition, and precious metals. Understanding these properties is crucial for industries relying on metal trade, especially in regions like the Middle East and West Asia, where commodities like aluminum, steel, and gold are pivotal.

-

Properties of Metals

Metals are characterized by their excellent electrical and thermal conductivity due to the presence of free electrons. They exhibit malleability and ductility, allowing them to be shaped into various forms without breaking. Most metals are solid at room temperature, with a crystalline structure that contributes to their strength and stability. While some metals, like gold and platinum, are resistant to corrosion, others, such as iron and aluminum, are more reactive and prone to oxidation. Metals are typically dense, shiny, and have high melting points, making them suitable for a wide range of applications in industries such as construction, manufacturing, and electronics. Their versatility is further enhanced by their ability to alloy with other metals, leading to materials with tailored properties for specific uses. The unique combination of these characteristics makes metals indispensable in modern technology and infrastructure.

-

Egyptian Metals

Egypt"s metal industry has deep historical roots, particularly in gold mining, with the Sukari Gold Mine being a notable site. The country also possesses significant iron ore deposits, primarily located in the Eastern Desert and Sinai Peninsula. Bauxite is another key resource, supporting aluminum production at the Egyptian Aluminium Company (Egyptalum). The steel sector plays a vital role in Egypt"s economy, providing essential materials for construction and manufacturing. Additionally, Egypt has a growing copper industry, with deposits in the Sinai Peninsula and Eastern Desert, contributing to electrical and construction sectors. The country also processes non-ferrous metals like zinc and lead, which are crucial for various industries. Despite its resources, Egypt primarily imports metals to meet its industrial demands, relying on international suppliers for essential commodities. The government is working to enhance the competitiveness of the metal sector through infrastructure development and investment incentives.

Challenges such as energy costs and regulatory reforms remain, but ongoing investments aim to bolster the industry. Egypt"s strategic location facilitates international trade, allowing for efficient metal imports and limited exports of refined products. The focus is on value-added production rather than raw metal exports, with a vibrant metal fabrication sector supporting local and international markets."

-

Metal mine reserves in West Asia (Middle East)

West Asia"s geological diversity has led to the formation of significant metal deposits, influenced by tectonic and volcanic activity. The region is rich in resources such as gold, copper, aluminum, and iron, found in various geological formations. Countries like Saudi Arabia, Iran, and Turkey are key players in metal production, with notable mines like Mahd adh Dhahab and Sarcheshmeh. The strategic location of West Asia has historically facilitated trade, making it a vital hub for metal mining and commerce. The region"s ancient civilizations utilized metals extensively, driving further exploration and extraction. The combination of geological richness and historical demand positions West Asia as a crucial area for commodity trade, particularly in metals like zinc, nickel, and manganese, which are essential for various industries.

-

Metals of Iran

Iran is strategically located between significant mountain ranges, contributing to its rich mineral reserves. The country boasts 62 types of minerals, with proven metal reserves estimated at 6 billion tons and potential reserves exceeding 5 billion tons. Key metals include copper, iron ore, zinc, aluminum, lead, and gold, with Iran being a top global producer in several categories. Notable copper deposits are found in Kerman, Sistan and Baluchestan, and East Azerbaijan, while high-quality iron ore is primarily sourced from the Chadormalu and Gol Gohar mines. Zinc production is concentrated in Yazd, Zanjan, and East Azerbaijan, supporting various industrial applications. The aluminum sector is bolstered by significant bauxite deposits, particularly in Jajarm and North Hormozgan. Gold mining, especially in the eastern regions, plays a crucial role in the economy, supporting jewelry and investment sectors. Iran"s steel industry is well-established, producing a wide range of products essential for construction and manufacturing.

Despite facing challenges from economic sanctions and geopolitical factors, Iran aims to enhance its metal industry through government initiatives and foreign investment. The country is focused on maximizing domestic consumption and exploring export opportunities, leveraging its vast mineral wealth."

-

Metals Trade in West Asia (Middle East)

West Asia"s economy has been significantly shaped by its rich metal resources and the oil industry. Countries like Saudi Arabia, Iran, and the UAE have heavily invested in steel and aluminum production, essential for infrastructure and industrial growth. The region"s historical trade routes facilitated the exchange of metals, including gold and silver, and modern free trade zones have attracted international traders. Despite a comparative advantage in basic metals, the region"s investment in mining has been low, with recent efforts focusing on leveraging information networks to enhance the mining sector. The demand for metals is rising due to industrialization and diversification beyond oil, with cities like Dubai and Istanbul emerging as key trading hubs. West Asia exports a variety of metals while also importing raw materials to meet domestic needs. The future of metal reserves is uncertain, with predictions of depletion in several key minerals, leading to increased competition and prices in the global market. As the region continues to develop downstream industries, it aims to transform into a significant mineral hub internationally."

-

Moroccan Metals

Morocco is a significant player in the global metals market, particularly known for its vast phosphate reserves, which are crucial for fertilizer production. The country ranks among the world"s largest producers and exporters of phosphates, primarily sourced from the Khouribga and Youssoufia regions. Additionally, Morocco has notable lead and zinc deposits located in the High Atlas and Anti-Atlas Mountains, which are vital for various industries, including construction and automotive. The copper industry, though smaller in scale, is also present, with deposits in the Anti-Atlas Mountains and Draa Valley. Silver mining complements the metal sector, with resources often found alongside lead and zinc. Morocco"s iron ore, primarily located in Western Sahara, supports a growing steel industry, producing a range of products from rebar to structural steel. The emerging aluminum sector, fueled by bauxite deposits, is represented by the Jorf Lasfar Aluminum Complex, which caters to multiple industries. Overall, Morocco"s diverse mineral resources and growing metal fabrication sector contribute significantly to its economy, accounting for a notable percentage of GDP and exports."

-

Saudi Arabia's Metals

Saudi Arabia"s mining sector is pivotal for its economic diversification, with significant reserves of metals such as gold, aluminum, copper, and zinc. The Arabian Shield region is particularly rich in gold, with the Mahd adh-Dhahab mine being one of the largest. The country is also a key player in the aluminum market, boasting the Ras Al Khair smelter, one of the largest integrated aluminum complexes globally. Copper production is concentrated in the Jabal Sayid region, while zinc is extracted primarily in Al Amar, supporting the construction and industrial sectors. The presence of other metals like nickel and cobalt indicates potential for future growth. The government actively encourages foreign investment and industrialization in the mining sector, aiming to enhance the value chain and promote sustainable practices. With over 4,500 mines, including substantial iron ore deposits, Saudi Arabia is positioned as a leader in the Persian Gulf"s metal industry. The steel sector, supported by iron ore production, plays a crucial role in infrastructure development. Overall, Saudi Arabia"s commitment to developing its mining and metal industries reflects its strategy to diversify the economy and attract investment."

-

Algerian Metals

Algeria is rich in various mineral resources, particularly metals such as iron ore, zinc, lead, copper, silver, and gold. These resources are crucial for Algeria"s industrial production and economic growth, attracting both domestic and foreign investments in the mining sector. Historically dominated by the public sector, recent reforms, including the 1991 mining law, have encouraged private sector participation and foreign investment. This law established a framework for exploration and exploitation, promoting job creation and revenue generation. Algeria"s iron ore reserves, primarily located in the Tindouf region, are estimated at 2.5 billion metric tons, while significant zinc and lead deposits are found near Tébessa. The Hoggar region holds potential for copper deposits, and gold exploration is ongoing in the southern part of the country. The government is actively promoting the mining sector through incentives such as tax benefits and improved infrastructure, aiming to boost production and diversify the economy. These developments indicate a shift towards sustainable and responsible mineral resource exploitation, enhancing Algeria"s position in the global commodity trade."

-

History of Metals

Metals have been integral to human civilization since the Stone Age, serving as tools for warfare and logistics. The history of metals includes significant milestones such as the use of copper around 8000 BCE, the development of bronze during the Bronze Age, and the transition to iron in the Iron Age. The Greeks and Romans advanced metallurgy through techniques like casting and forging. The medieval period saw the emergence of steel production, enhancing weaponry and tools. The Industrial Revolution revolutionized metal production with innovations like the Bessemer process, leading to mass production and the steel industry’s rise. In the 20th century, advancements in metallurgy included high-strength alloys and non-ferrous metals, which are now crucial in various industries including construction, transportation, and electronics. Metals are essential for sustainable energy sources, with copper, aluminum, and silver playing key roles in electrical infrastructure. Lightweight metals enhance fuel efficiency in transportation, while metals like steel are vital for construction.

Advanced manufacturing techniques, such as 3D printing, utilize metal powders for customized components. The electronics industry relies on metals for wiring and semiconductors, while healthcare applications benefit from metals like titanium and stainless steel. Recycling metals is increasingly important for sustainability, and innovations in nanotechnology are opening new avenues for metal applications.