How does the Middle East shape global gold trade through B2B platforms?

The gold market in the Middle East and West Asia is a cornerstone of the global metals trade, deeply rooted in the region"s history and culture. Gold"s discovery in West Asia dates back thousands of years, and today, the Middle East remains a thriving hub for gold mining, trading, and jewelry manufacturing. Verified exporters and importers leverage regional trade platforms to facilitate the flow of gold, ensuring transparency and reliability in supply chains. In recent years, B2B marketplaces in Asia have emerged as pivotal players, offering regional product listings and connecting Middle Eastern gold traders with global buyers. These platforms provide market insights, helping businesses navigate fluctuating prices influenced by currency stability, geopolitical factors, and demand in industries like jewelry, electronics, and investments. For instance, the price of gold is closely tied to global economic conditions and is expected to remain volatile in the coming year. Gold"s applications in the region extend beyond jewelry, including its use in electronics and as a financial asset. Jewelry manufacturing wages in the Middle East vary significantly, influenced by craftsmanship and market demand.

Buyers are advised to distinguish between new and second-hand gold jewelry by examining hallmarks and wear patterns. Middle Eastern traders emphasize transparency and quality assurance, making the region a premier destination for gold transactions. Aritral, an AI-driven B2B platform, supports the gold and metals market by simplifying trade processes. Through verified profiles, AI-powered marketing, and direct communication tools, Aritral helps connect regional stakeholders with global opportunities, enhancing supply chain efficiency for commodities like gold, silver, and other metals. "

-

Mohammad Javad Baqeri 1 months ago

Mohammad Javad Baqeri 1 months ago Iran

Aluminum, iron and steel, pickles, dried fruits and groceries, saffron and spices, metal waste, gold, tar, dairy products, jam and honey, copper, silv

Iran

Aluminum, iron and steel, pickles, dried fruits and groceries, saffron and spices, metal waste, gold, tar, dairy products, jam and honey, copper, silv

I\m directly in contact with all those suppliers from Iran`Details

-

Calvaire Gold Mining Limited 2 months ago

Calvaire Gold Mining Limited 2 months ago Kenya

Gold

Kenya

Gold

Calvaire Gold Mining Limited is a premier gold mining company dedicated to extracting and supplying high-quality gold. With sustainable mining practic...Details

-

Ahjar Karima Wa Niyazk 3 months ago

Ahjar Karima Wa Niyazk 3 months ago United Arab Emirates

Stones and Meteorites

United Arab Emirates

Stones and Meteorites

Precious and semi-precious stones, rare and common, meteorites, and volcanic rocksDetails

-

Ahmet Ebu Halıl 3 months ago

Ahmet Ebu Halıl 3 months ago Turkey

Existing

Turkey

Existing

Iron raw materialDetails

-

Farshid 4 months ago

Farshid 4 months ago Iran

Unique and Special Metal

Iran

Unique and Special Metal

If you are a buyer of this special metal, contact me. Sales are only conducted at my place, and nowhere else.Details

-

Farshid 3 days ago

Farshid 3 days ago Iran

Metals

Iran

Metals

Gold and silverDetails

-

M Ayaz Khogyany 6 months ago

M Ayaz Khogyany 6 months ago Afghanistan

Meteorite Seller

Afghanistan

Meteorite Seller

I'm a seller of meteoritesDetails

-

Nile Delta Minerals Ltd 6 months ago

Nile Delta Minerals Ltd 6 months ago Uganda

Director

Uganda

Director

Gold(Au) purity is 97.6% price is 48000/kg Origin: Uganda and DR. CongoDetails

-

Sandy 7 months ago

Sandy 7 months ago India

Antic Stones With Mixture of many metals

India

Antic Stones With Mixture of many metals

It is a very antique piece of stone which has a blend of various metals like gold, silver, zinc and etc.Details

-

Gulha Trading Import & Export 7 months ago

Gulha Trading Import & Export 7 months ago Qatar

Gold

Qatar

Gold

Gold Trading From Nairobi Kenya \nTotal - 800 KGSDetails

-

Safa Abdulredha Abdulmahdi Al-Shams 3 days ago

Safa Abdulredha Abdulmahdi Al-Shams 3 days ago Iraq

Gold and Diamonds

Iraq

Gold and Diamonds

30 tons of 24-carat gold are available in the Central Bank's treasuryDetails

-

Aladelsteel 15 months ago

Aladelsteel 15 months ago Egypt

Iron Materials

Egypt

Iron Materials

Billet and Reinforcement IronDetails

-

Shree Fire Services Today

Shree Fire Services Today India

Shree Fire Services

India

Shree Fire Services

Shree Fire Services constitute the business in 2008 and is an eminent, prominent manufacturer and trader of Fire Fighting Equipment and Accessories.We...Details

-

Exploring Aluminum Trade and Industry in West Asia and the Middle East

Aluminum, known for its versatility, lightweight nature, and corrosion resistance, has emerged as one of the most widely used metals after iron. In the Middle East, aluminum plays a key role in trade and industrialization, with West Asia serving as a vital hub for its production, export, and import. The aluminum industry in the region is supported by robust supply chain solutions, verified exporters and importers, and growing demand from various sectors such as construction, transportation, and packaging. West Asia’s aluminum industry thrives due to its access to abundant raw materials like bauxite and cost-effective energy resources. Aluminum products in the market include ingots, slabs, wires, and foils, each catering to distinct industries. For instance, aluminum foil finds widespread applications in packaging and insulation, while ribbed aluminum foil is highly valued in architectural design. Aluminum ingots, classified by alloy series such as 1000, 3000, and 5000, serve as a benchmark in pricing and application due to their varied properties. Factors influencing aluminum prices include global demand, energy costs, and regional trade policies.

Platforms focusing on commodity trade in the Middle East, such as Aritral, enable seamless connections between verified buyers and suppliers, fostering transparency and efficient transactions. Moreover, the aluminum industry dovetails with markets for other metals like copper, zinc, and steel, reflecting the interconnected nature of the region’s metallurgy sector. The future of aluminum in the Middle East is promising, driven by increasing urbanization, infrastructure projects, and its sustainability as a recyclable material. By leveraging market insights and B2B platforms, businesses can capitalize on the growing demand for aluminum and its derivatives, ensuring their foothold in the competitive West Asian market.

-

Brass Trade Dynamics in Middle Eastern Markets

Brass, an alloy of copper and zinc, plays a pivotal role in the trade dynamics of West Asia and the Middle East. This region serves as a vital hub for commodity trade, connecting global markets with local supply chains. Brass, valued for its durability, corrosion resistance, and versatility in applications ranging from construction to electronics, has seen increasing demand across industries. Verified exporters and importers in the Middle East leverage advanced trade platforms to foster efficient trade networks, enabling seamless transactions for brass products. Marketing and trade of brass alloys in Middle Eastern markets are driven by strategic B2B marketplace platforms. These platforms facilitate product listings, trade advertising, and business networking, allowing buyers and sellers to explore global opportunities for brass and its applications. Regional insights on pricing, supply chain solutions, and market trends are crucial for stakeholders aiming to capitalize on this lucrative commodity. The broader metals market in West Asia—including steel, silver, copper, nickel, aluminum, zinc, gold, and platinum—also benefits from such platforms.

For instance, silver’s industrial uses and fluctuating prices are shaped by B2B marketplaces that streamline supply chains. Similarly, copper trade in Middle Eastern and West Asian markets is bolstered by verified networks, ensuring stable supply dynamics. Aritral, an AI-driven B2B platform, supports such international trade by offering tools like AI-powered marketing and global sales assistance, along with direct communication features. By simplifying trade processes, platforms like Aritral enable stakeholders to navigate the complexities of commodity trade and unlock new opportunities in metals markets.

-

Copper Trade Trends in Middle East & West Asia

Copper, one of the most versatile metals, is essential for industries ranging from construction to electronics. The Middle East and West Asia have emerged as critical hubs for copper trade, driven by rising industrial demand and the region"s strategic location as a transit point between Asia, Europe, and Africa. The West Asia Copper Exchange plays a pivotal role in facilitating trade, providing market insights, and connecting verified exporters and importers. As copper prices fluctuate due to global economic shifts, regional B2B marketplaces and trade advertising platforms help businesses navigate complex supply chains and capitalize on opportunities. Copper"s uses are diverse, including electrical wiring, plumbing, and industrial machinery, making it indispensable in modern economies. In addition, recycling copper offers environmental benefits and supports sustainability. Methods such as smelting and electro-refining are used to create copper ingots, which are foundational for manufacturing processes. Copper alloys like brass and bronze further expand its applications in industries like decoration and automotive manufacturing.

Market dynamics in West Asia show increasing demand for copper, correlating with urbanization and industrial growth. Verified exporters on B2B platforms provide reliable supply chain solutions, ensuring consistency in regional product listings. This ecosystem also supports trade in other metals such as steel, silver, aluminum, and zinc, each playing a unique role in the commodity trade landscape. Copper, however, remains a cornerstone, influencing pricing dynamics and fostering economic growth across the Middle East. Aritral, an AI-driven B2B platform, contributes to this thriving industry by simplifying copper trade through product listings, direct communication, and AI-powered marketing tools. By connecting regional stakeholders, Aritral aids in navigating market complexities, ensuring smooth transactions, and unlocking new business opportunities.

-

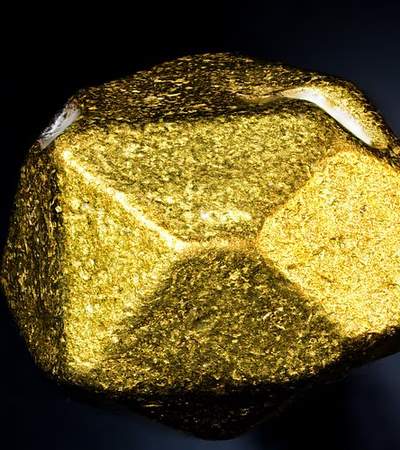

Exploring the Gold Market and Trade Dynamics in the Middle East

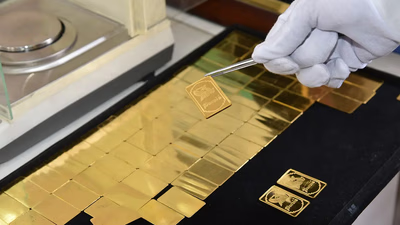

The gold market in the Middle East and West Asia is a cornerstone of the global metals trade, deeply rooted in the region"s history and culture. Gold"s discovery in West Asia dates back thousands of years, and today, the Middle East remains a thriving hub for gold mining, trading, and jewelry manufacturing. Verified exporters and importers leverage regional trade platforms to facilitate the flow of gold, ensuring transparency and reliability in supply chains. In recent years, B2B marketplaces in Asia have emerged as pivotal players, offering regional product listings and connecting Middle Eastern gold traders with global buyers. These platforms provide market insights, helping businesses navigate fluctuating prices influenced by currency stability, geopolitical factors, and demand in industries like jewelry, electronics, and investments. For instance, the price of gold is closely tied to global economic conditions and is expected to remain volatile in the coming year. Gold"s applications in the region extend beyond jewelry, including its use in electronics and as a financial asset. Jewelry manufacturing wages in the Middle East vary significantly, influenced by craftsmanship and market demand.

Buyers are advised to distinguish between new and second-hand gold jewelry by examining hallmarks and wear patterns. Middle Eastern traders emphasize transparency and quality assurance, making the region a premier destination for gold transactions. Aritral, an AI-driven B2B platform, supports the gold and metals market by simplifying trade processes. Through verified profiles, AI-powered marketing, and direct communication tools, Aritral helps connect regional stakeholders with global opportunities, enhancing supply chain efficiency for commodities like gold, silver, and other metals. "

-

Nickel Trade and Market Insights in Middle East & West Asia

Nickel, a vital industrial and strategic metal, plays a significant role in global commodity trade, particularly across the Middle East and West Asia. Known for its corrosion resistance and high melting point, nickel is essential in stainless steel production, battery technology, and various alloys such as brass. In West Asia, nickel trade dynamics are shaped by regional demand in infrastructure, automotive, renewable energy, and electronics industries. Verified exporters and importers leverage platforms like Aritral to explore opportunities, streamline supply chains, and analyze market trends. The Middle East"s B2B marketplace fosters connections among nickel suppliers and buyers, facilitating trade advertising and networking. Nickel"s industrial importance aligns with broader metals trade, including steel, copper, aluminum, and zinc. Supply chain solutions offered by these platforms connect regional businesses and enhance transparency in pricing, demand forecasting, and verified transactions. Nickel"s global significance is further underscored by its role in emerging technologies such as electric vehicle batteries, influencing trade agreements and regional market strategies.

Market insights reveal significant growth opportunities for nickel in the Middle East, particularly as urbanization and industrialization fuel demand for stainless steel and nickel-based alloys. Trade platforms are instrumental in connecting regional product listings, providing market insights, and facilitating connections between suppliers and buyers in the rapidly evolving commodities landscape. The integration of AI-driven tools, such as those offered by Aritral, simplifies global trade dynamics and promotes efficient communication and refined advertising strategies. In addition, nickel’s supply chain is impacted by trends in other metals like silver, copper, and gold, which share overlapping markets and applications. By exploring verified B2B networks, businesses can tap into regional nickel markets while addressing logistical challenges and identifying new growth avenues. Such platforms are reshaping trade dynamics in West Asia and the Middle East, paving the way for enhanced cooperation and sustainable practices in the metals industry. "

-

Exploring Platinum Trade Dynamics in Middle East & West Asia

Platinum, a critical component in industrial applications, is gaining increased attention across the Middle East and West Asia due to its unique properties and diverse uses. As a high-value metal, platinum is integral to automotive catalysts, jewelry, and electronic applications, making its trade dynamics pivotal in the region. The Middle East’s strategic location as a global trade hub enables seamless import and export activities, supported by emerging B2B marketplaces that connect verified buyers and sellers. These platforms are transforming the commodity trade landscape by streamlining transactions, enhancing transparency, and providing market insights. Platinum demand in West Asia is driven by industrial growth and increasing investments in high-tech sectors. Supply chain solutions offered by regional trade platforms enable businesses to navigate logistical challenges, ensuring timely delivery of this precious metal. Verified exporters and importers listed on these marketplaces further boost confidence in transactions, while detailed product listings provide vital insights into pricing trends and quality specifications. In addition to platinum, metals like steel, silver, copper, aluminum, and zinc also play critical roles in the region"s commodity trade.

For instance, copper’s role in electrical infrastructure and silver’s application in solar energy technologies highlight the growing emphasis on sustainability-driven markets. Meanwhile, the gold trade remains a cornerstone of the Middle Eastern economy, with B2B platforms facilitating connections between local suppliers and global buyers. Exploring the platinum market through such platforms unveils opportunities to tap into emerging trends, such as green technology and clean energy initiatives. Businesses leveraging these trade networks gain access to invaluable market insights, fostering growth and competitiveness. Aritral, an AI-powered B2B platform, simplifies international trade by offering services like product listing, marketing, and global sales assistance, making it a trusted partner in the region’s metals and commodities trade ecosystem. "

-

Exploring Silver Trade Dynamics in West Asia

Silver plays a pivotal role in the West Asian trade landscape, driven by its diverse industrial applications and cultural significance. As a key commodity in the Middle East"s robust import-export ecosystem, silver enjoys steady demand, bolstered by its uses in electronics, jewelry, and renewable energy technologies. Verified exporters and importers leverage B2B platforms to navigate the region"s silver market, ensuring transparency and efficiency in supply chains. The West Asian Silver Market is influenced by factors such as global economic trends, regional mining outputs, and fluctuations in demand for industrial uses, particularly in solar energy and electronics. Silver pricing in the Middle East is shaped by global market forces, currency valuations, and the availability of local mines. The region’s historical silver mines, while not as abundant as those in Latin America or Asia-Pacific, contribute to a steady supply chain and regional self-reliance. Trade platforms such as Aritral are instrumental in connecting verified buyers and sellers, showcasing regional product listings and facilitating market insights that support business networking. Furthermore, the Middle East"s silver trade is interconnected with other metals like gold, copper, and zinc, highlighting the region"s role as a hub for multi-metal trade.

Trends point toward growing demand for silver paste production, which has emerged as a key innovation in the region. Future supply and demand forecasts indicate an upward trajectory, driven by expanding industrial applications and the rising prominence of B2B marketplaces that streamline trade operations. The strategic integration of silver into West Asia’s commodity trade underscores its importance as a tradable asset. Platforms like Aritral ensure seamless transactions and deliver AI-powered market insights, fostering confidence in a dynamic trade environment.

-

Steel and Metals Trade Dynamics in Middle East and West Asia

Steel and metals like copper, aluminum, silver, and zinc represent the backbone of industrialization and economic growth across the globe, with the Middle East and West Asia emerging as critical regional hubs for these industries. Steel, in particular, is indispensable to infrastructure development, automotive manufacturing, and construction industries. In West Asia, steel products like rebars, beams, channels, and galvanized wires are heavily traded, with prices influenced by factors such as market demand, raw material costs, and energy prices. Verified exporters and importers on B2B marketplaces ensure smoother trade of these commodities. The Asia Iron and Steel Market is a dynamic and evolving sector, supported by supply chain solutions and regional trade platforms that connect buyers and sellers. For example, girder and beam production factories in the Middle East are increasingly leveraging technology and trade advertising platforms to streamline operations and expand their reach. Hot-rolled sheets and cold-rolled sheets dominate demand due to their varied applications, while galvanized wires and steel corner profiles represent niche yet vital segments. Beyond steel, metals such as silver, zinc, gold, and copper hold immense potential in West Asia’s trade economy.

Silver’s price is affected by global supply and demand trends, with its applications ranging from electronics to jewelry. Zinc, abundant in the earth"s crust, remains integral to industrial applications like galvanization and biological processes. Gold continues to be a cornerstone of the Middle Eastern economy, with traders focusing on its price volatility and investment opportunities. Copper and aluminum markets are also pivotal, with aluminum shaping supply chains due to its lightweight and versatile properties. Platforms like Aritral simplify international trade by offering AI-driven tools for product listing, direct communication, and market insights. These innovations empower businesses to navigate complexities in the Middle East’s commodity trade landscape efficiently, making it easier to connect with verified suppliers and optimize trade networks. "

-

Zinc Trade Insights in West Asia & Middle East Metals Market

Zinc plays a pivotal role in the industrial and trade ecosystem of West Asia and the Middle East. As one of the most versatile metals, it is abundant in the earth"s crust, with significant applications ranging from galvanization in steel to manufacturing alloys like brass and nickel. The Middle East and West Asia are key players in the zinc market, supported by robust supply chain networks and verified exporters facilitating regional and international trade. Zinc ingots, categorized under HS codes such as 790111 and 790120, are highly sought after due to their durability and corrosion resistance. Leading manufacturers in West Asia are recognized for producing high-quality zinc ingots, with some of the most modern facilities located in the UAE and Saudi Arabia. Demand for zinc is driven by construction, automotive, and health industries, where it is used in galvanizing steel, producing batteries, and serving as an essential trace element for human health. B2B marketplaces in Asia, such as Aritral, enable seamless communication between buyers and suppliers and provide real-time market insights, fostering transparency in commodity trade. Verified exporters and detailed product listings ensure that businesses can confidently explore zinc ingot sourcing options and evaluate pricing trends.

In the broader metals market, zinc competes with copper, aluminum, and silver, each finding unique niches in Middle Eastern supply chains. Trade platforms influence these dynamics by offering market insights and connecting regional manufacturers to global buyers. Looking ahead, the zinc industry in West Asia is expected to grow due to increased demand for sustainable and durable materials, with prices forecasted to remain stable amidst fluctuating energy costs. For buyers, understanding market trends and leveraging B2B trade platforms is crucial in navigating this competitive landscape effectively. "

-

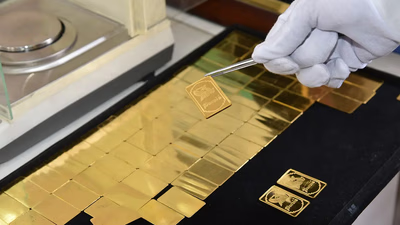

Important points in buying and selling jewelry and gold

Understanding the intricacies of buying and selling jewelry and gold is crucial for successful transactions. Key factors include recognizing different types of jewelry, such as fine, fashion, and antique pieces, as well as understanding gold"s purity, weight, craftsmanship, and market trends. Authenticity verification is essential; look for hallmarks indicating metal purity and request certificates for gemstones from reputable labs. Assess the condition of items carefully, considering aspects like damage and overall craftsmanship. Negotiation skills are vital; clearly communicate expectations and document transaction details to prevent disputes. Security during transactions should not be overlooked—conduct them in reputable locations and consider secure payment methods. Familiarity with legal regulations regarding jewelry sales in your area is also important. In the Middle East, 18-carat gold is preferred due to its balance of quality and value.

Buyers should be aware of the emotional significance of jewelry while also staying informed about market prices to ensure fair transactions. Engaging with trustworthy sellers or buyers can enhance the experience and lead to better deals. "

-

How much is jewelry making wages in Western Asia (Middle East) ?

Western Asia"s jewelry making is characterized by a blend of traditional craftsmanship and modern techniques. Each region showcases unique styles, with methods like filigree and engraving being prevalent. Jewelry serves not only as adornment but also reflects cultural identity and social status, playing a vital role in weddings and religious ceremonies. Major cities such as Istanbul and Dubai are key players in the jewelry trade, with Dubai being a significant hub for gold and diamond transactions. Wages for jewelry makers vary across the region; in the UAE, they range from AED 2,000 to AED 6,000 monthly, while in Saudi Arabia, they range from SAR 3,000 to SAR 7,000. Turkey"s wages fall between TRY 2,000 to TRY 5,000. The complexity of designs influences wages significantly; handcrafted pieces command higher prices compared to machine-made items. The global demand for unique jewelry continues to rise, with Western Asia exporting significant quantities of gold and diamond pieces that highlight its rich craftsmanship. The influence of Islamic art is evident in many designs, incorporating geometric patterns and calligraphy that reflect cultural heritage.

-

What will happen to the price of gold in the next year?

Factors influencing gold prices include global economic conditions, interest rates, inflation, currency fluctuations, and geopolitical tensions. Historical data analysis reveals patterns that can inform future price movements, although past performance is not a guarantee. Technical analysis of price charts and indicators aids in identifying trends and potential targets. Broader macroeconomic factors such as economic growth rates and trade dynamics also play a role in shaping investor sentiment towards gold as a safe-haven asset. Recent trends show a positive outlook for gold, with analysts predicting prices may reach $1,800 soon but face challenges ahead. Research firm Murenbeeld & Co forecasts average prices of $1,806 in Q2 2021 and $1,900 by Q1 2022. However, uncertainties surrounding the economic recovery and inflation persist. The rise of Bitcoin poses competition for gold"s market value, with analysts noting a 2.

5% reduction in gold"s value due to Bitcoin"s increase. Understanding supply-demand dynamics is crucial; factors like production levels and investment demand significantly impact pricing. Staying informed through expert opinions and market forecasts is essential for navigating the complexities of gold pricing. "

-

What is the best way to buy jewelry in West Asian (Middle East) countries?

Jewelry trading in West Asia offers various avenues, including established jewelry stores, traditional gold souks, and private sales through personal networks. Reputable stores provide a wide selection of high-quality pieces and knowledgeable staff to assist buyers. Gold souks, like Dubai"s famous Gold Souk, offer extensive options but require caution to ensure authenticity. Networking plays a crucial role in accessing exclusive pieces through private sales. Trade shows and exhibitions are valuable for discovering new designers and establishing industry connections. Buyers should prioritize reputable sources to avoid issues with gemstone quality and pricing discrepancies. The sale of gold differs from jewelry, with specific pricing structures based on daily rates and seller profits. E-commerce platforms have gained popularity for jewelry purchases, but buyers must research sellers thoroughly to ensure secure transactions.

Auction houses also present opportunities for acquiring unique pieces but require knowledge of the auction process. "

-

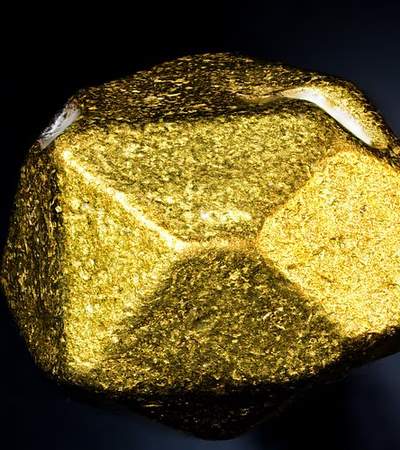

History of Gold Metal Discovery In West Asia (Middle East)

West Asia has a rich history of gold discovery and trade, dating back to ancient civilizations like Mesopotamia, where artifacts from around 3000 BCE were found. Ancient Egypt also played a significant role, mining gold from the Nubian and Eastern Deserts for jewelry and trade. The Persian Empire further contributed to gold accumulation, with kings using it to finance military campaigns. The rise of the Arab Caliphates in the 7th century CE established key trade routes that facilitated gold exchange across Asia, Africa, and Europe, with Baghdad emerging as a center for gold craftsmanship. Gold"s allure continued through history, being used in various important objects and maintaining its status as a precious metal. In modern times, China has become the largest producer of gold, while countries like Saudi Arabia and the UAE have significant reserves. Dubai has evolved into a major trading hub for gold, showcasing its ongoing importance in global markets. "

-

Applications of gold metal in various industries

Gold has been a valuable medium of exchange for over 6,000 years due to its rarity and durability. While its use as currency has diminished, gold remains integral in various industries, particularly electronics. It is a key component in devices like smartphones and computers, where it serves as a reliable conductor that resists corrosion. The demand for gold in electronics is significant, with billions of mobile phones produced annually, each containing small amounts of gold. Additionally, gold"s applications extend to dentistry and medicine, where it is used for fillings and certain treatments. In aerospace, gold"s unique properties make it essential for spacecraft components, reflecting infrared radiation and acting as a lubricant in vacuum conditions. The increasing need for advanced materials suggests that the demand for gold will continue to rise, further solidifying its value in the global market.

-

How to distinguish second-hand gold jewelry from new?

Identifying second-hand gold jewelry involves examining its physical condition and markings. Look for signs of wear such as scratches, dents, or tarnish, particularly on areas prone to damage like clasps and ring backs. A patina may indicate age, but some prefer this aesthetic. Repairs can also signal pre-ownership; check for solder marks or resized bands. Hallmarks provide insight into purity and age, but be cautious of forgeries. The gold"s carat indicates its purity level, with 24 carat being pure gold, while lower carats contain other metals for durability. Different regions have varying standards for gold grades; for instance, 18 carat is common in Iran while Arab countries often use between 20 and 24 carats. New jewelry typically comes with packaging and documentation that may be absent in second-hand pieces.

Pricing can also be a clue; second-hand items are generally less expensive than new ones. Always consider the source when purchasing to ensure authenticity. "

-

About West Asian (Middle East) Gold Market

West Asia has long been a pivotal center for gold trading, leveraging its strategic location to facilitate trade between Europe, Asia, and Africa. Historical empires like the Persian Empire and the Ottoman Empire significantly influenced the development of this market. Gold is culturally significant in West Asian societies, symbolizing wealth and status, often exchanged during weddings and celebrations. Major trading hubs include Dubai, Istanbul, and Manama, which attract global buyers and sellers. The region boasts a robust financial infrastructure supporting gold investments through bullion banks and gold ETFs. Middle Eastern central banks maintain substantial gold reserves to diversify their holdings and stabilize currencies. Countries like the UAE, Saudi Arabia, and Turkey are notable for their significant reserves. Gold"s unique properties—its resistance to corrosion and tarnishing—make it a preferred choice for jewelry, particularly wedding bands.

The demand for gold surges during festive seasons such as Eid and Diwali, reflecting its status as a store of value. Additionally, West Asia is celebrated for its exquisite gold craftsmanship, with skilled artisans creating intricate designs that enhance the allure of gold jewelry. "