Analyzing gold price trends in Middle East trade markets.

Stay informed about the factors that influence the price of gold. These include global economic conditions, interest rates, inflation rates, currency fluctuations, geopolitical tensions, central bank policies, and investor sentiment. Monitor news and reports related to these factors to assess their potential impact on gold prices. Examine historical price data for gold to identify patterns, trends, and cycles. Look for any consistent factors or correlations that have influenced gold prices in the past. This analysis can provide insights into potential price movements in the future, although it's important to note that past performance does not guarantee future results.

Utilize technical analysis to study price charts, patterns, and indicators. Technical analysis involves examining historical price and volume data to identify trends, support and resistance levels, and potential price targets. Various technical indicators and chart patterns can help you make informed decisions about potential price movements. However, it's important to remember that technical analysis is not foolproof and should be used in conjunction with other factors. Evaluate broader macroeconomic factors that could impact gold prices. Factors such as economic growth rates, monetary policies, fiscal policies, trade dynamics, and other market indicators can influence investor sentiment and the overall demand for gold as a safe-haven asset or hedge against inflation.

Over the past few weeks, gold has once again been able to regain its strength and experience a significant increase. This has led analysts to look positively at the future of gold. In an interview with Kitco News, gold market analyst Shantel Sheen said he expects gold prices to reach $ 1,800 in the coming months but will not reach $ 1,900 by the end of the year. He believes that gold will continue to rise in the long run, but it faces many challenges that could change its price.

Consulting with financial advisors, economists, or professionals with expertise in the precious metals market can provide valuable insights and guidance. They can help analyze market factors, interpret trends, and provide more accurate and personalized estimates based on your specific situation and goals. Research firm Murenbeeld & Co said in its latest forecast that it expects the average price of gold in the second quarter of 2021 to be $ 1806, in the third quarter to $ 1827 and in the fourth quarter to $ 1865. The company expects the price of an ounce of gold to reach $ 1,900 in the first quarter of 2022 and its highest level in the second quarter of 2022.

"He is currently neutral on the price of gold because the central banks have put a lot of stimulus into the economy and it is not yet clear whether the economic recovery will be sustainable or not," said Shantel Shion, head of the company's research team. According to Shivan, there is still a lot of uncertainty about the Corona virus epidemic, and the current pace of economic recovery will not be sustainable.

Another issue that currently exists is rising inflation. According to Shivan, investors cannot be sure of the stability or instability of inflation until the end of the year. However, Sheen believes that given the high volume of financial and monetary stimulus to the economy, high inflation is unlikely. Also, the price of Bitcoin can have a big impact on the gold market, and the yellow metal will have tough competition with these cryptocurrencies. According to Sheen, the increase in the price of Bitcoin has so far reduced the value of the gold market by 2.5%.

Evaluate the supply and demand dynamics of gold. Factors such as gold production levels, mining costs, jewelry demand, industrial demand, investment demand (including ETFs and central bank purchases), and recycling rates can impact the price of gold. Analyze these aspects to gain an understanding of the potential supply-demand balance in the coming year. Stay updated on market forecasts and expert opinions from reputable sources such as financial institutions, research organizations, and industry experts. Consider a range of viewpoints and opinions to gain a comprehensive understanding of the expectations for gold prices in the next year. However, be aware that forecasts can vary widely, and no prediction is guaranteed.

-

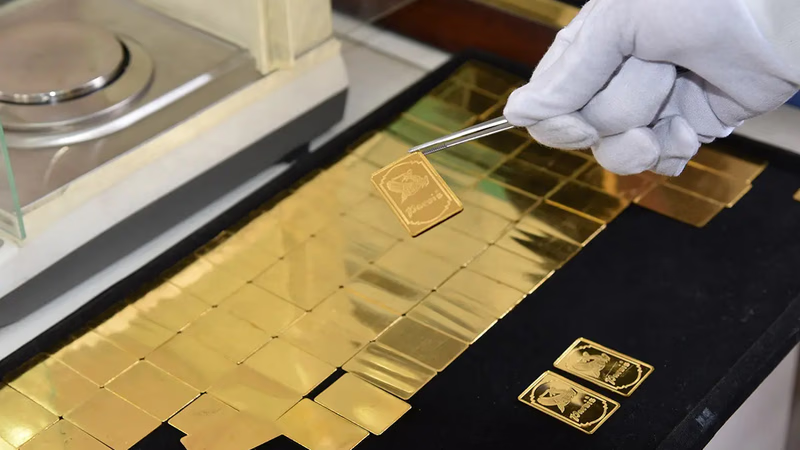

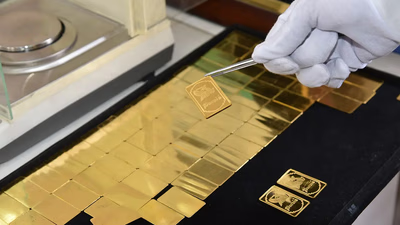

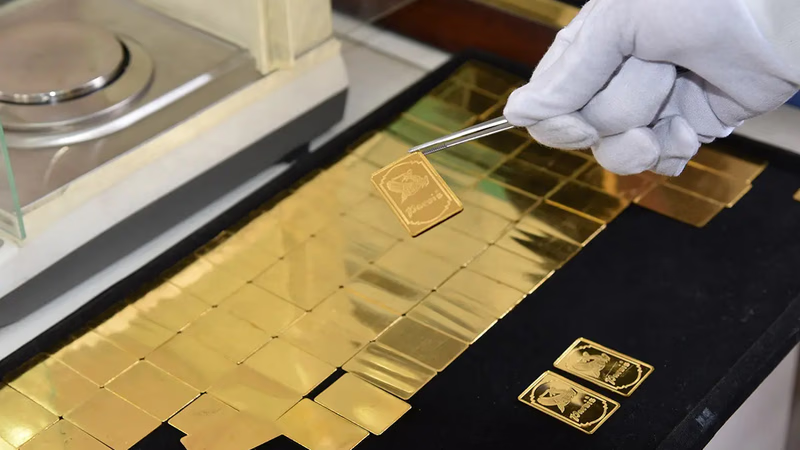

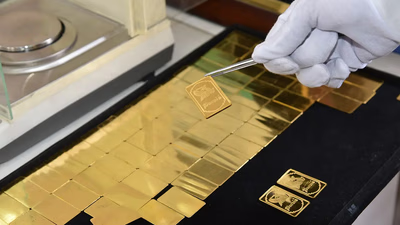

Understanding the intricacies of buying and selling jewelry and gold is crucial for successful transactions. Key factors include recognizing different types of jewelry, such as fine, fashion, and antique pieces, as well as understanding gold"s purity, weight, craftsmanship, and market trends. Authenticity verification is essential; look for hallmarks indicating metal purity and request certificates for gemstones from reputable labs. Assess the condition of items carefully, considering aspects like damage and overall craftsmanship. Negotiation skills are vital; clearly communicate expectations and document transaction details to prevent disputes. Security during transactions should not be overlooked—conduct them in reputable locations and consider secure payment methods. Familiarity with legal regulations regarding jewelry sales in your area is also important. In the Middle East, 18-carat gold is preferred due to its balance of quality and value.

Buyers should be aware of the emotional significance of jewelry while also staying informed about market prices to ensure fair transactions. Engaging with trustworthy sellers or buyers can enhance the experience and lead to better deals. "

-

Western Asia"s jewelry making is characterized by a blend of traditional craftsmanship and modern techniques. Each region showcases unique styles, with methods like filigree and engraving being prevalent. Jewelry serves not only as adornment but also reflects cultural identity and social status, playing a vital role in weddings and religious ceremonies. Major cities such as Istanbul and Dubai are key players in the jewelry trade, with Dubai being a significant hub for gold and diamond transactions. Wages for jewelry makers vary across the region; in the UAE, they range from AED 2,000 to AED 6,000 monthly, while in Saudi Arabia, they range from SAR 3,000 to SAR 7,000. Turkey"s wages fall between TRY 2,000 to TRY 5,000. The complexity of designs influences wages significantly; handcrafted pieces command higher prices compared to machine-made items. The global demand for unique jewelry continues to rise, with Western Asia exporting significant quantities of gold and diamond pieces that highlight its rich craftsmanship. The influence of Islamic art is evident in many designs, incorporating geometric patterns and calligraphy that reflect cultural heritage.

-

Factors influencing gold prices include global economic conditions, interest rates, inflation, currency fluctuations, and geopolitical tensions. Historical data analysis reveals patterns that can inform future price movements, although past performance is not a guarantee. Technical analysis of price charts and indicators aids in identifying trends and potential targets. Broader macroeconomic factors such as economic growth rates and trade dynamics also play a role in shaping investor sentiment towards gold as a safe-haven asset. Recent trends show a positive outlook for gold, with analysts predicting prices may reach $1,800 soon but face challenges ahead. Research firm Murenbeeld & Co forecasts average prices of $1,806 in Q2 2021 and $1,900 by Q1 2022. However, uncertainties surrounding the economic recovery and inflation persist. The rise of Bitcoin poses competition for gold"s market value, with analysts noting a 2.

5% reduction in gold"s value due to Bitcoin"s increase. Understanding supply-demand dynamics is crucial; factors like production levels and investment demand significantly impact pricing. Staying informed through expert opinions and market forecasts is essential for navigating the complexities of gold pricing. "

-

Jewelry trading in West Asia offers various avenues, including established jewelry stores, traditional gold souks, and private sales through personal networks. Reputable stores provide a wide selection of high-quality pieces and knowledgeable staff to assist buyers. Gold souks, like Dubai"s famous Gold Souk, offer extensive options but require caution to ensure authenticity. Networking plays a crucial role in accessing exclusive pieces through private sales. Trade shows and exhibitions are valuable for discovering new designers and establishing industry connections. Buyers should prioritize reputable sources to avoid issues with gemstone quality and pricing discrepancies. The sale of gold differs from jewelry, with specific pricing structures based on daily rates and seller profits. E-commerce platforms have gained popularity for jewelry purchases, but buyers must research sellers thoroughly to ensure secure transactions.

Auction houses also present opportunities for acquiring unique pieces but require knowledge of the auction process. "

-

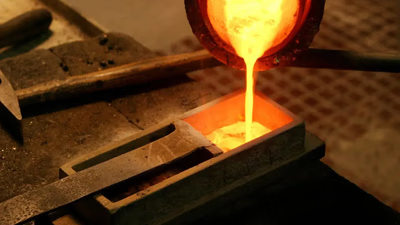

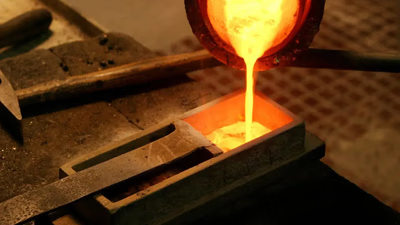

Gold has been a valuable medium of exchange for over 6,000 years due to its rarity and durability. While its use as currency has diminished, gold remains integral in various industries, particularly electronics. It is a key component in devices like smartphones and computers, where it serves as a reliable conductor that resists corrosion. The demand for gold in electronics is significant, with billions of mobile phones produced annually, each containing small amounts of gold. Additionally, gold"s applications extend to dentistry and medicine, where it is used for fillings and certain treatments. In aerospace, gold"s unique properties make it essential for spacecraft components, reflecting infrared radiation and acting as a lubricant in vacuum conditions. The increasing need for advanced materials suggests that the demand for gold will continue to rise, further solidifying its value in the global market.

-

Identifying second-hand gold jewelry involves examining its physical condition and markings. Look for signs of wear such as scratches, dents, or tarnish, particularly on areas prone to damage like clasps and ring backs. A patina may indicate age, but some prefer this aesthetic. Repairs can also signal pre-ownership; check for solder marks or resized bands. Hallmarks provide insight into purity and age, but be cautious of forgeries. The gold"s carat indicates its purity level, with 24 carat being pure gold, while lower carats contain other metals for durability. Different regions have varying standards for gold grades; for instance, 18 carat is common in Iran while Arab countries often use between 20 and 24 carats. New jewelry typically comes with packaging and documentation that may be absent in second-hand pieces.

Pricing can also be a clue; second-hand items are generally less expensive than new ones. Always consider the source when purchasing to ensure authenticity. "

-

West Asia has a rich history of gold discovery and trade, dating back to ancient civilizations like Mesopotamia, where artifacts from around 3000 BCE were found. Ancient Egypt also played a significant role, mining gold from the Nubian and Eastern Deserts for jewelry and trade. The Persian Empire further contributed to gold accumulation, with kings using it to finance military campaigns. The rise of the Arab Caliphates in the 7th century CE established key trade routes that facilitated gold exchange across Asia, Africa, and Europe, with Baghdad emerging as a center for gold craftsmanship. Gold"s allure continued through history, being used in various important objects and maintaining its status as a precious metal. In modern times, China has become the largest producer of gold, while countries like Saudi Arabia and the UAE have significant reserves. Dubai has evolved into a major trading hub for gold, showcasing its ongoing importance in global markets. "

-

West Asia has long been a pivotal center for gold trading, leveraging its strategic location to facilitate trade between Europe, Asia, and Africa. Historical empires like the Persian Empire and the Ottoman Empire significantly influenced the development of this market. Gold is culturally significant in West Asian societies, symbolizing wealth and status, often exchanged during weddings and celebrations. Major trading hubs include Dubai, Istanbul, and Manama, which attract global buyers and sellers. The region boasts a robust financial infrastructure supporting gold investments through bullion banks and gold ETFs. Middle Eastern central banks maintain substantial gold reserves to diversify their holdings and stabilize currencies. Countries like the UAE, Saudi Arabia, and Turkey are notable for their significant reserves. Gold"s unique properties—its resistance to corrosion and tarnishing—make it a preferred choice for jewelry, particularly wedding bands.

The demand for gold surges during festive seasons such as Eid and Diwali, reflecting its status as a store of value. Additionally, West Asia is celebrated for its exquisite gold craftsmanship, with skilled artisans creating intricate designs that enhance the allure of gold jewelry. "