Egypt is a country located in the northeast of the African continent and borders the Mediterranean Sea to the north, Israel and the Gulf of Aqaba to the east, Sudan to the south, and Libya to the west. The capital of Egypt is Cairo. The currency of this country is the Egyptian pound (EGP). The official language of Egypt is Arabic and most of the people of this country also speak Arabic. The majority of Egyptians have Islamic beliefs. Egypt is a large and diverse market and has an advanced economy in the region. The main sectors of the Egyptian economy include services, industry, agriculture, economic foundations and tourism. Egypt has rich natural resources including oil, natural gas, granite, kaolin, phosphate and iron. The products that Egyptian businessmen import and export to other countries include machinery, electronic devices, chemical products, clothing and food products, agricultural products, steel products, and textile products. On the other hand, Egypt exports oil and gas products, agricultural products including food products, auto parts, textile products and wooden products to other countries. Egypt`s biggest trading partners are mainly China, Italy, America, India and Turkey. Also, Egypt has strong trade relations with Arab, European and African countries. The biggest sources of Egypt`s income are tourism, oil and gas, remittances from Egyptians living abroad, and the export of agricultural and industrial products.

-

Al-Ahjar Al-Karima 3 months ago

Al-Ahjar Al-Karima 3 months ago Egypt

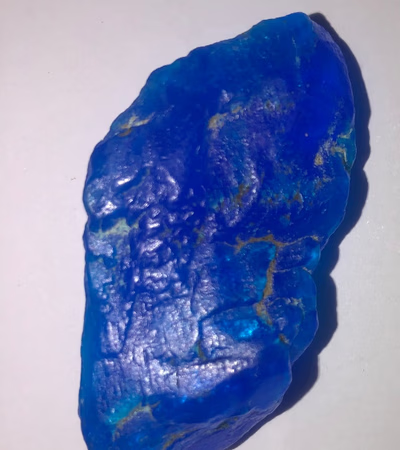

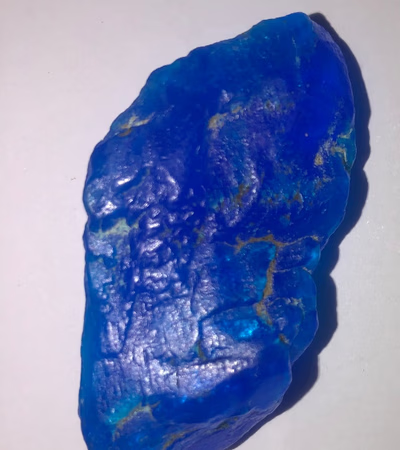

Precious stones

Egypt

Precious stones

Precious stones in all their types and crafts, and meteoritesDetails

-

Sami Hussein Eissa 2 weeks ago

Sami Hussein Eissa 2 weeks ago Egypt

Trader in Precious Stones and Agricultural Products

Egypt

Trader in Precious Stones and Agricultural Products

Exporting Agricultural ProductsDetails

-

Fathisayed 4 months ago

Fathisayed 4 months ago Egypt

Precious Stones

Egypt

Precious Stones

Transparent StoneDetails

-

Awlad Danqal 2 weeks ago

Awlad Danqal 2 weeks ago Egypt

Legumes

Egypt

Legumes

All kinds of legumes, rice, fresh vegetables, dried fruits, nuts, seeds, livestock, stallions, camels, Barqi sheep, goats, deer, ostriches, peacocks, ...Details

-

Tarek Alshahat 2 weeks ago

Tarek Alshahat 2 weeks ago Egypt

Fruit

Egypt

Fruit

We work in the field of exporting fruits such as oranges, lemons, grapefruits, grapes, mangoes, and all vegetables.Details

-

Ahmed Wagih 6 months ago

Ahmed Wagih 6 months ago Egypt

Herbs and spices

Egypt

Herbs and spices

We specialize in offering a wide range of Herbs, Spices, Grains, and Legumes products including [Basil, Anise, Bay leaves, Chilli, Chamomile, Calendul...Details

-

Mehran Moheni 2 weeks ago

Mehran Moheni 2 weeks ago Egypt

Precious Stones

Egypt

Precious Stones

Precious stones have more energyDetails

-

Marwa Mohamed Melisa 2 weeks ago

Marwa Mohamed Melisa 2 weeks ago Egypt

Artworks

Egypt

Artworks

An expressive and rare artworkDetails

-

Walaa Elsaaed 2 weeks ago

Walaa Elsaaed 2 weeks ago Egypt

Meteor

Egypt

Meteor

A set of meteorites including the lunar ones, and it contains all the specifications.Details

-

Eng. Lotfy Kamel 4 months ago

Eng. Lotfy Kamel 4 months ago Egypt

Mineral and Industrial Raw Materials

Egypt

Mineral and Industrial Raw Materials

We are a rapidly growing Egyptian company, founded by a group of specialized experts who have great experience in the field of trade, mining, and supp...Details

-

Amr Elhawary 2 weeks ago

Amr Elhawary 2 weeks ago Egypt

Synthetic oils and additives for oils and greases

Egypt

Synthetic oils and additives for oils and greases

I am considering introducing synthetic oils produced in Georgia to Egypt, as Egypt is a large market with many users. This also includes various types...Details

-

Alfan Alislami 2 weeks ago

Alfan Alislami 2 weeks ago Egypt

Islamic Art

Egypt

Islamic Art

The enamel-coated lantern is not just a lighting tool but also an artistic piece that can be displayed as a masterpiece in homes or cultural venues. T...Details

-

Mo Ali 2 weeks ago

Mo Ali 2 weeks ago Egypt

Meteorite

Egypt

Meteorite

Rare meteoriteDetails

-

Ahmed 2 weeks ago

Ahmed 2 weeks ago Egypt

Granite New Halayeb and Halayeb and Jundola Red Aswan Black Aswan Gray

Egypt

Granite New Halayeb and Halayeb and Jundola Red Aswan Black Aswan Gray

Al-Fahd Stone for Marble and Granite for exporting the best types of marble and granite to all Arab countries, African countries, the Gulf, and foreig...Details

-

Nizk Thalji F 2 weeks ago

Nizk Thalji F 2 weeks ago Egypt

Snowy Color Meteor

Egypt

Snowy Color Meteor

Snowy Colored MeteorDetails

-

Kemet Export-Import 2 weeks ago

Kemet Export-Import 2 weeks ago Egypt

Building Materials

Egypt

Building Materials

Kemet Import & Export owns its own factory in Egypt and is an exclusive agent for major cement and iron and steel factoriesDetails

-

Nader 2 weeks ago

Nader 2 weeks ago Egypt

The Miswak and the Prayer Cap

Egypt

The Miswak and the Prayer Cap

Fresh green miswakDetails

Egypt’s strategic location and diversified economy make it a pivotal trade partner for businesses targeting West Asia. In 2023, Egypt's exports of goods and services accounted for 19.1% of its GDP, a significant rise from 10.6% in 2021, although still below the global average of 32.1%. This growth reflects Egypt's increasing integration into global trade networks, particularly in sectors like agriculture and industry. However, challenges such as high inflation (33.9% in 2023 compared to a global average of 8.6%) and a depreciating currency (30.6 LCU per USD in 2023 from 15.6 in 2021) may impact the cost of imports and exports, creating volatility for traders.

On the import side, Egypt's merchandise import value index dropped to 87.0 in 2023 from 128.5 in 2022, signaling reduced import activity, possibly due to economic pressures. Conversely, the export value index also declined to 82.1 in 2023 from 124.1 in 2022, indicating challenges in sustaining export growth. Yet, Egypt’s agriculture sector, contributing 11.6% to GDP in 2023, remains a promising area for trade, especially given its alignment with the global average of 11.3%.

For entrepreneurs, opportunities lie in sectors like industrial goods (32.1% of GDP) and services (51.3% of GDP), which dominate Egypt's economy. Egypt’s domestic credit to the private sector, at 29.3% of GDP in 2023, lags behind the global average of 67.1%, suggesting room for financial partnerships and investments. To mitigate risks, traders should leverage Egypt’s verified exporters and importers through platforms offering supply chain solutions and market insights tailored for the Middle East. By aligning with trusted B2B marketplaces, businesses can navigate economic fluctuations and capitalize on Egypt’s growing trade potential in West Asia.