How do coal trade dynamics shape the economy of West Asia and the Middle East?

Coal remains a cornerstone of global energy markets, playing a pivotal role in industrial development. In West Asia and the Middle East, coal trade dynamics are influenced by a growing demand for reliable energy sources and industrial raw materials. West Asian coal traders and suppliers engage actively in regional export-import activities, leveraging B2B marketplaces that emphasize verified exporters and importers to ensure trust and quality in transactions. This region"s coal trade is characterized by strong supply chain solutions and market insights, allowing businesses to navigate fluctuating demand and regulatory complexities efficiently. Coal producers and consumers across Asia have developed robust networks to meet energy and industrial needs, with high demand markets in East Asia driving exports. Target markets for coal exports from West Asia include countries like India and China, which consume substantial quantities for electricity generation and steel production. These trade flows are facilitated by platforms offering detailed regional product listings, enabling buyers to locate verified suppliers efficiently. The coal trade also intersects with other mineral trading activities in West Asia, including bauxite, chromite, chalcopyrite, hematite, galena, cassiterite, and sphalerite.

Each mineral contributes uniquely to the regional economy, with bauxite supporting aluminum production, chromite essential in steelmaking, and sphalerite critical for zinc supply chains. B2B marketplaces in this region, such as Aritral, simplify these transactions through AI-powered marketing and profile management tools, ensuring businesses connect seamlessly. Market trends indicate that coal consumption in West Asia is expanding due to industrial growth, while exports remain robust to meet global energy demand. Verified exporters and importers play a crucial role in maintaining the integrity of these trade relationships, underscoring the importance of advanced trade advertising platforms for business networking. Coal’s significance in energy security and industrial development ensures sustained economic impact in West Asia and the Middle East. "

-

Rahmani 3 months ago

Rahmani 3 months ago Oman

meteorite

Oman

meteorite

meteorite with certificate around 3500grDetails

-

Nooradeen Abdalylyy 3 months ago

Nooradeen Abdalylyy 3 months ago Yemen

Meteor

Yemen

Meteor

We have a meteorite for sale, size 300 grams, lunar meteorite, location Yemen, AdenDetails

-

Kamal Go 1 months ago

Kamal Go 1 months ago Morocco

Meteorites

Morocco

Meteorites

Meteorites are stones that fall from the skyDetails

-

Ahjar Karima Wa Niyazk 1 months ago

Ahjar Karima Wa Niyazk 1 months ago United Arab Emirates

Stones and Meteorites

United Arab Emirates

Stones and Meteorites

Precious and semi-precious stones, rare and common, meteorites, and volcanic rocksDetails

-

Ahjar Raye 2 months ago

Ahjar Raye 2 months ago Iraq

Meteorite

Iraq

Meteorite

MeteoriteDetails

-

Hasan 1 months ago

Hasan 1 months ago Iran

Meteorite

Iran

Meteorite

Two pieces of 200 kg meteoriteDetails

-

Fathisayed 4 months ago

Fathisayed 4 months ago Egypt

Precious Stones

Egypt

Precious Stones

Transparent StoneDetails

-

Frederic Gizenga 4 months ago

Frederic Gizenga 4 months ago Kenya

Gold, Diamond, Used Rails, Copper Cathodes, Tantalite, Cashew Nuts

Kenya

Gold, Diamond, Used Rails, Copper Cathodes, Tantalite, Cashew Nuts

Merchandise Available!!! Product: Gold Nuggets Weight: 23 Karat Purity: 97% Quantity:4500kgs Price: $ 60,000 Per Kg Commission: $ 3000 Per Kg ...Details

-

Eng. Lotfy Kamel 4 months ago

Eng. Lotfy Kamel 4 months ago Egypt

Mineral and Industrial Raw Materials

Egypt

Mineral and Industrial Raw Materials

We are a rapidly growing Egyptian company, founded by a group of specialized experts who have great experience in the field of trade, mining, and supp...Details

-

Nadeem Zain 1 months ago

Nadeem Zain 1 months ago Lebanon

Meteorite Stone Weighing 150 Grams

Lebanon

Meteorite Stone Weighing 150 Grams

There are several types of precious stones available, in addition to meteorite stones.Details

-

Salem Bahdi Alawlaqi 1 months ago

Salem Bahdi Alawlaqi 1 months ago Yemen

Lunar Meteorite for Sale

Yemen

Lunar Meteorite for Sale

Lunar meteorite for sale with the certificate from the testing laboratory. Serious buyers can contact me via WhatsApp or call.Details

-

Elkadaoui 1 months ago

Elkadaoui 1 months ago Morocco

A stone, I don't know its type

Morocco

A stone, I don't know its type

I don't know the type of this stoneDetails

-

Ali Asghar Parimi 2 months ago

Ali Asghar Parimi 2 months ago Iran

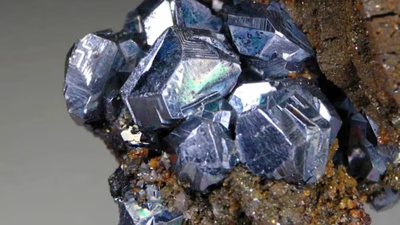

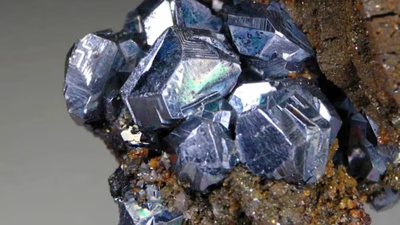

Chromite. Meteorite

Iran

Chromite. Meteorite

Celestine and chromite ores, coal, and various mineral and semi-precious stones, as well as meteorites and collectionsDetails

-

Nasser Sanousi 1 months ago

Nasser Sanousi 1 months ago Algeria

Meteorite

Algeria

Meteorite

MeteoriteDetails

-

Bakir 1 months ago

Bakir 1 months ago Syria

Meteorite Stone

Syria

Meteorite Stone

Peace, mercy, and blessings of Allah be upon you. May you be well. I have a meteorite stone in Damascus, Syria.Details

-

Naif N 1 months ago

Naif N 1 months ago Saudi Arabia

Iron Meteorite: The outer crust of the meteorite indicates that it is recently fallen

Saudi Arabia

Iron Meteorite: The outer crust of the meteorite indicates that it is recently fallen

For sale: Iron meteorite, magnetic attraction, weight (338 grams), and the outer crust of the meteorite indicates that it is recently fallen and not o...Details

-

Salah Beik 1 months ago

Salah Beik 1 months ago Saudi Arabia

Precious Stones and Meteorites

Saudi Arabia

Precious Stones and Meteorites

Distinctive StonesDetails

-

Mohammad Ali Bahri Alzaidi 1 months ago

Mohammad Ali Bahri Alzaidi 1 months ago Yemen

Meteorites

Yemen

Meteorites

I have iron meteoritesDetails

-

Abdel Moutalib 6 months ago

Abdel Moutalib 6 months ago Mauritania

Abdel Moutalib

Mauritania

Abdel Moutalib

I have some meteorites.Details

-

Arj Savahel 1 months ago

Arj Savahel 1 months ago Oman

Arj Savahel

Oman

Arj Savahel

Arj Savahel is adorned with silver and precious stones for sale Coastal sweat of rare stonesDetails

-

نيزك 2 months ago

نيزك 2 months ago Algeria

نيازك

Algeria

نيازك

نيزكDetails

-

Abo Taem 1 months ago

Abo Taem 1 months ago Syria

Meteorite Stone

Syria

Meteorite Stone

Meteorite CutterDetails

-

Ilgin Naz Menteş 1 months ago

Ilgin Naz Menteş 1 months ago Turkey

Meteorit

Turkey

Meteorit

They are laboratory confirmed meteorites, I have about 44 kg of them, these are just a sampleDetails

-

دولار 1 months ago

دولار 1 months ago Iraq

Fossil Fish

Iraq

Fossil Fish

A fossil trait found underground at a depth exceeding twenty metersDetails

-

تركي 1 months ago

تركي 1 months ago Saudi Arabia

Meteor

Saudi Arabia

Meteor

For sale, only serious buyers, and the sale is very fastDetails

-

Meteorites 2 months ago

Meteorites 2 months ago Algeria

Meteorites

Algeria

Meteorites

MeteoritesDetails

-

Cassiterite Trade Dynamics in West Asia and Middle East

Cassiterite, a mineral essential for tin extraction, holds significant value in global trade, especially within West Asia and the Middle East. This region"s mineral trade platforms, including tin ore, have emerged as pivotal hubs for connecting verified exporters and importers, fostering robust B2B marketplace dynamics. Cassiterite"s importance is underscored by its applications in electronics, construction, and industrial manufacturing, with significant demand from international markets driving local economies. Tin ore traders in the Middle East operate within a sophisticated supply chain powered by regional insights and AI-driven tools like Aritral, which facilitate product listings and direct communication between stakeholders. The supply and demand dynamics of cassiterite in West Asia are influenced by resource availability, regional mining capabilities, and global market trends. The mineral contributes to economic diversification, reducing dependence on oil exports by fostering mineral-based industries. Verified exporters and importers play a critical role in ensuring quality control and international compliance, enhancing the credibility of the regional cassiterite trade. Beyond cassiterite, other minerals such as bauxite, chalcopyrite, chromite, hematite, galena, sphalerite, and coal are integral to West Asia"s economy.

For instance, bauxite trade supports aluminum production, while chalcopyrite and sphalerite bolster copper and zinc markets, respectively. Chromite, crucial for steel production, and hematite, a primary iron ore, further strengthen the region"s economic framework. These minerals collectively shape the region’s supply chain dynamics and international trade relations, aided by innovative trade platforms offering advertising and networking solutions. Aritral simplifies the trading process by enabling profile management, AI-powered marketing, and global sales assistance, bridging gaps between suppliers and consumers in the mineral industry. As West Asia continues to develop its mineral trade capabilities, cassiterite remains a cornerstone, driving economic growth and fostering international collaboration.

-

Chalcopyrite Trade Dynamics in the Middle East and West Asia

Chalcopyrite, a vital copper sulphide mineral, plays an essential role in the global trade landscape, particularly within the Middle East and West Asia. The region"s rich mineral reserves have positioned it as a critical hub for copper ore trade, connecting suppliers and traders to international markets. Chalcopyrite is widely sought after by industries producing electrical wire, construction materials, and advanced electronics, making it a high-demand commodity for importers and exporters. In West Asia, chalcopyrite mining operations contribute significantly to the copper supply chain, supporting regional economies while feeding global demand for copper products. Verified exporters and importers on B2B marketplaces in Asia are leveraging platforms to streamline their operations, ensuring secure transactions and efficient logistics solutions. Middle Eastern traders, enriched by market insights and trade advertising platforms, are increasingly penetrating international markets by promoting regional product listings of chalcopyrite and other minerals such as chromite, hematite, bauxite, galena, sphalerite, coal, and cassiterite. The Middle Eastern chalcopyrite market benefits from its proximity to major shipping routes and robust business networking opportunities. West Asian suppliers are particularly pivotal in bridging the gap between consumers and sellers of copper metal ore, fostering collaboration across supply chains.

As demand grows, businesses in the region are investing in advanced extraction technologies and trade solutions, enhancing their competitiveness. Aritral, an AI-driven B2B platform, provides a streamlined avenue for chalcopyrite traders in Asia and the Middle East to connect with verified partners and expand their market reach. Its tools for product listing, communication, and AI-powered marketing are tailored to meet the dynamic challenges of the commodity trade sector. "

-

Chromite Trade Dynamics in West Asia and the Middle East

Chromite, a vital mineral for stainless steel production and other industrial applications, holds significant importance in the global commodity trade. West Asia, particularly the Middle East, has emerged as a critical hub for chromite trading, leveraging its strategic location and expansive trade networks. This region"s chromite market is characterized by strong demand from Asian merchants of chrome metal ore, connecting verified exporters and importers through platforms that facilitate seamless transactions. Chromite deposits in West Asia, though smaller compared to global leaders like South Africa and Kazakhstan, are pivotal for regional supply chains. These deposits often serve as intermediate sources for Asian markets, ensuring consistent availability for industrial needs. The Middle East"s trade platform ecosystem actively supports chromite marketing and trading by offering regional product listings, market insights, and business networking opportunities. Verified exporters and importers utilize these platforms to streamline supply chain operations, ensuring reliability and trust in transactions. Platforms advertising trade opportunities for chromite ore often integrate AI-driven tools to enhance visibility and efficiency.

In addition to chromite, West Asia excels in trading minerals like hematite, bauxite, galena, sphalerite, coal, cassiterite, and chalcopyrite. Iron ore suppliers in Asia capitalize on the hematite trading market, driven by demand for steelmaking. Similarly, bauxite trade flourishes due to its importance in aluminum production, while galena and sphalerite cater to lead and zinc industries, respectively. Coal remains indispensable for energy, and cassiterite supports tin production. Chalcopyrite, a primary copper ore, shapes the region"s economic landscape through its critical role in global mineral exports. Platforms like Aritral simplify international trade in these commodities by offering product listings, AI-powered marketing, and profile management. As West Asia continues to grow its mineral trade portfolio, its role in shaping global supply chains becomes increasingly prominent. "

-

Coal Trade Dynamics in West Asia and Middle East

Coal remains a cornerstone of global energy markets, playing a pivotal role in industrial development. In West Asia and the Middle East, coal trade dynamics are influenced by a growing demand for reliable energy sources and industrial raw materials. West Asian coal traders and suppliers engage actively in regional export-import activities, leveraging B2B marketplaces that emphasize verified exporters and importers to ensure trust and quality in transactions. This region"s coal trade is characterized by strong supply chain solutions and market insights, allowing businesses to navigate fluctuating demand and regulatory complexities efficiently. Coal producers and consumers across Asia have developed robust networks to meet energy and industrial needs, with high demand markets in East Asia driving exports. Target markets for coal exports from West Asia include countries like India and China, which consume substantial quantities for electricity generation and steel production. These trade flows are facilitated by platforms offering detailed regional product listings, enabling buyers to locate verified suppliers efficiently. The coal trade also intersects with other mineral trading activities in West Asia, including bauxite, chromite, chalcopyrite, hematite, galena, cassiterite, and sphalerite.

Each mineral contributes uniquely to the regional economy, with bauxite supporting aluminum production, chromite essential in steelmaking, and sphalerite critical for zinc supply chains. B2B marketplaces in this region, such as Aritral, simplify these transactions through AI-powered marketing and profile management tools, ensuring businesses connect seamlessly. Market trends indicate that coal consumption in West Asia is expanding due to industrial growth, while exports remain robust to meet global energy demand. Verified exporters and importers play a crucial role in maintaining the integrity of these trade relationships, underscoring the importance of advanced trade advertising platforms for business networking. Coal’s significance in energy security and industrial development ensures sustained economic impact in West Asia and the Middle East. "

-

Galena and Mineral Trade in the Middle East: Trends and Insights

Galena, a natural lead sulfide mineral, is a cornerstone resource in the Middle East and West Asia"s mineral trade. Its prominence in the region stems from abundant reserves and strategic trade platforms that facilitate the import, export, and sale of this key commodity. Verified exporters and importers play a pivotal role in ensuring streamlined supply chain solutions, meeting the demand for lead ore across multiple industries, including batteries, construction, and electronics. Countries like Turkey, Iran, and Saudi Arabia are critical players in the galena trade, leveraging their geographic positioning within crucial trade corridors. The galena market in the Middle East is heavily influenced by global demand, with the Asian galena ore market acting as a significant export destination. West Asia"s reserves, including some of the largest galena mines globally, make it a hub for supply. This mineral trade not only supports local economies but also strengthens the region"s position in global commodity markets. While advancements in mining technology enhance extraction efficiency, platforms like Aritral ensure that trade is transparent, connecting suppliers with verified buyers.

Parallel to the galena market, other minerals such as bauxite, sphalerite, coal, cassiterite, chalcopyrite, chromite, and hematite drive economic activity across the region. For instance, the bauxite trade significantly impacts the aluminum industry, while chromite supports global steel production. Similarly, sphalerite, the primary ore of zinc, and cassiterite, vital for tin production, see robust trade dynamics. These commodities are central to the Middle East"s mineral economy, supported by innovative B2B platforms offering market insights, regional product listings, and trade advertising solutions. Aritral, an AI-driven B2B platform, simplifies the complexities of mineral trade by offering services like product listing, direct communication, and AI-powered marketing, fostering seamless transactions across borders.

-

Hematite Trade and Mineral Economy in West Asia

Hematite, a primary source of iron ore, plays a vital role in the mineral trade ecosystem across West Asia and the Middle East. This region has become a dynamic hub for import and export of raw materials like hematite, bauxite, galena, sphalerite, coal, cassiterite, chalcopyrite, and chromite. The hematite trade market in the Middle East is particularly robust, driven by high demand from industries such as steel production and construction. Verified exporters and importers in West Asia leverage platforms like Aritral to streamline their supply chain solutions and access regional product listings effectively. The supply and demand for hematite in West Asia have been fueled by large-scale mining operations and the strategic location of the Middle East, which acts as a trade bridge between Asia, Europe, and Africa. Iron ore suppliers in Asia capitalize on this regional connectivity to export hematite minerals to markets worldwide. Business networking efforts in West Asia further enhance partnerships between hematite traders and buyers, ensuring seamless trade transactions. Other minerals such as bauxite, galena, and sphalerite also contribute significantly to the commodity trade.

Bauxite, a critical input for aluminum production, has witnessed growing trade volumes in West Asia, driven by increasing industrial activities. Similarly, galena and sphalerite, essential for lead and zinc extraction, are key contributors to the mineral trade economy. Coal, cassiterite, chalcopyrite, and chromite round out the list, with each playing a pivotal role in shaping the economic landscape of the region. Platforms like Aritral support these trading dynamics by offering AI-powered marketing and international sales assistance. By simplifying regional trade processes, they facilitate growth opportunities for mineral businessmen and traders in the Middle East and West Asia.

-

Sphalerite Trade Insights: Middle East and West Asia Zinc Ore Market

Sphalerite, a critical zinc ore mineral, plays a vital role in global trade, particularly in West Asia and the Middle East. As the primary source of zinc, sphalerite fuels industries ranging from construction to electronics. The mineral"s trade dynamics are tightly linked to the region"s economic development, with verified exporters and importers facilitating seamless transactions through modern B2B marketplaces and supply chain solutions. In the Middle East, the sphalerite mineral trade thrives on robust regional product listings and market insights, empowering traders to meet industrial demands efficiently. The demand for zinc ore in Asia is driven by infrastructure development and technological advancements, making West Asia a pivotal hub for sphalerite producers and consumers. Verified exporters ensure quality and compliance, while trade advertising platforms foster business networking opportunities. This enables suppliers to navigate complex supply chain requirements and reach broader markets. The largest sphalerite mines globally often contribute to this regional supply chain, bolstered by cutting-edge trade platforms.

Economic impacts are evident as sphalerite trade strengthens industries, generates employment, and boosts regional GDP. West Asia"s proximity to key global markets further positions it as a strategic node in the commodity trade. Insights into market trends reveal steady growth in zinc ore demand, offering lucrative opportunities for both established and emerging traders. Aritral, an AI-driven B2B platform, simplifies international trade by providing tools for product listings, AI-powered marketing, and direct communication. By connecting verified exporters and importers, platforms like Aritral optimize the sphalerite trade and other mineral markets, enhancing efficiency and growth across West Asia and the Middle East. "

-

Bauxite and Mineral Trade in West Asia and Middle East

Bauxite, the primary source of aluminum, plays a critical role in global trade, particularly in the Middle East and West Asia. As industries in this region grow, demand for bauxite ore has surged, creating opportunities for both regional and international suppliers. West Asia"s bauxite trade market has become increasingly dynamic, with verified exporters from countries like India and Indonesia supplying aluminum ore to meet industrial needs. The Middle Eastern bauxite ore market is expanding due to its strategic location as a hub for global import and export activities, supported by robust supply chain solutions and advanced trade platforms. The economic impact extends beyond bauxite. Minerals like galena (lead ore), sphalerite (zinc ore), coal, cassiterite (tin ore), chalcopyrite (copper ore), chromite, and hematite are shaping the trade dynamics in the region. Verified exporters and importers of galena, for instance, contribute significantly to the lead industry, while sphalerite supports zinc production across Asia. Similarly, coal trade remains essential for energy needs, with West Asian suppliers playing a pivotal role in regional markets.

Cassiterite, chalcopyrite, chromite, and hematite also drive mineral trade, influencing production chains for tin, copper, ferroalloys, and steel, respectively. The bauxite trade is particularly impactful due to its downstream applications in aluminum manufacturing, essential for construction, transportation, and packaging industries. As demand rises, businesses leverage B2B marketplaces, such as Aritral, to streamline trade operations. These platforms offer verified supplier networks, market insights, and AI-driven marketing tools to enhance regional and international trade. By fostering transparency and efficiency, such platforms are instrumental in reshaping the mineral economy of the Middle East and West Asia. The integration of technology and trade expertise ensures that bauxite and other mineral markets continue to thrive in this economically vibrant region. "

-

Coal supply and demand situation in West Asian countries

Coal demand in West Asia is primarily driven by electricity generation, with countries like Saudi Arabia, UAE, Qatar, and Oman increasingly utilizing coal. While some nations have limited coal production, Iraq, Iran, and Turkey are notable producers. Countries with fewer reserves often rely on imports to meet their energy needs. Saudi Arabia and the UAE are significant importers of coal, while Iran and others export to global markets. Various organizations provide insights into the coal market through reports on production and consumption trends. The diversification of energy sources is crucial for reducing dependence on oil; coal serves as a cost-effective alternative that is easier to store and transport. The coal industry also plays a vital role in job creation in regions like Iran. Conversely, Turkey is actively transitioning away from coal towards renewable energy sources such as solar and wind power, implementing strategies to reduce reliance on fossil fuels.

Other Middle Eastern countries are following suit by investing in clean energy technologies. Major global suppliers of coal include Russia, the USA, Australia, and Indonesia, which cater to the import needs of Middle Eastern nations.

-

The largest coal producers in the world

Countries with favorable geological conditions and advanced mining capabilities dominate global coal reserves. Russia, the United States, Australia, China, and India are among the largest holders of coal reserves. These nations benefit from extensive deposits due to their geological history and have developed robust mining industries. Advanced technologies play a crucial role in enhancing coal extraction and processing efficiency. Techniques such as continuous mining, open-pit mining, and surface mining are employed to optimize production while ensuring safety and environmental protection. Russia leads in coal reserves and exports, followed by Australia and Indonesia, which also have significant export volumes. The U. S.

and Canada contribute to the global coal market with reliable production and export capabilities. The interplay of technology, infrastructure, and regulatory frameworks significantly influences the productivity of these countries" coal industries. "

-

Survey of coal consumption in the world

Coal remains a significant energy source globally, despite a decline in usage due to advancements in renewable energy technologies. Countries like China and India continue to rely heavily on coal for electricity generation and industrial processes, particularly in steel production. The coking process converts coal into coke, which is essential for steel and aluminum manufacturing. However, the environmental impact of coal consumption is substantial, contributing to air pollution and climate change through greenhouse gas emissions. Efforts are underway in many nations to transition from coal to cleaner energy sources such as solar and wind power. This shift is driven by the need to mitigate environmental damage and promote sustainable energy practices. Technological advancements and government policies play crucial roles in this transition, with many countries investing in renewable energy infrastructure. The timeline for phasing out coal entirely varies based on regional energy needs and policy frameworks.

-

Target markets for coal exports

Identifying target markets for coal exports requires thorough analysis of global demand and energy needs. Key strategies include attending industry events, networking with international businessmen, and leveraging consultants for market insights. Engaging in exhibitions and conferences allows exporters to connect with potential customers and understand regional requirements. Researching market conditions, competition, and export regulations is crucial before initiating marketing efforts. Digital marketing strategies, including social media and localized content, can enhance outreach in the Middle East. Establishing partnerships with local representatives can facilitate entry into these markets. Major consumers like China and India present significant opportunities due to their reliance on coal for energy production. Japan"s dependence on imported coal further highlights the potential for exporters.

Additionally, neighboring countries such as South Korea, Thailand, and Vietnam are emerging as attractive markets due to increasing energy demands. "