Explore banking laws in Pakistan and their impact on trade.

The central bank of Pakistan is the State Bank of Pakistan (SBP). It is responsible for formulating and implementing monetary policy, regulating and supervising banks, and promoting the stability and integrity of the banking system. Pakistan has foreign exchange regulations that govern the movement of money and capital across borders. These regulations are primarily administered by the SBP. They aim to facilitate legitimate transactions, prevent money laundering, and maintain stability in the foreign exchange market.

Banks in Pakistan that are authorized by the SBP to deal in foreign exchange are known as Authorized Dealers (ADs). They are responsible for facilitating foreign exchange transactions, including money transfers and capital movements. To transfer money within Pakistan or abroad, individuals and businesses can utilize various banking channels. These include wire transfers, electronic funds transfers (EFT), online banking, and other payment systems offered by banks. The process typically involves providing details of the recipient's account, the amount to be transferred, and complying with any documentation requirements specified by the bank.

Pakistani banking laws also include provisions related to anti-money laundering and counter financing of terrorism. Banks are required to implement measures to detect and report suspicious transactions, conduct customer due diligence, and comply with regulations aimed at combating financial crimes. Responsible for Pakistan's monetary policy is the Ministry of Finance and the Central and State Banks. All kinds of investment banks and financial development institutions and all kinds of investment funds are responsible for transferring money and capital flows in the country.

In the field of money transfer, since 1994, Pakistan has set new principles for currency conversion. In other words, importers do not need prior authorization to withdraw foreign currency and make their payments through FEBC foreign exchange remittances, which can be purchased in Pakistani currency (rupee) and can be easily converted into foreign currency. Of course, opening a credit account for the transfer of remittances requires various assessments such as the quality and type of imported products. Export-dependent currencies must be stored at the Central Bank of Pakistan and received in exchange for currency. To convert currency, the Central Bank of Pakistan calculates the exchange rate of rupees to various currencies in US dollars and adjusts it based on the following.

- Relative changes in the currencies of Pakistan's main foreign trade partners against the dollar

- The extent of Pakistan's inflation gap with these foreign partners

Taxes in the Government of Pakistan are collected following the laws of the central government from all sources of direct taxes and consumption and sales taxes, including customs duties, consumption and sales. However, state governments levy land taxes, agricultural income taxes, real estate taxes, and other sharp local taxes. Direct taxes usually include wages, real estate income, business income, capital gains, and other sources of income. Pakistan's tax year ends on June 30 every year for 12 months.

But the central government also considers December 31 of each year as the end of the fiscal year. The taxpayer includes a natural or legal person. Pakistan's total imports of goods in 2017 were $ 55.6 billion, making it the 47th largest exporter in the world. The article "Exports to Pakistan" contains complete information about the top imports of Pakistan, exporting countries to Pakistan, the largest source of imports from the continents to Pakistan, along with practical diagrams and. Pakistan's total exports in 2017 were $ 24.8 billion, making it the 68th largest exporter in the world.

Capital movements refer to the transfer of funds for investment purposes, such as foreign direct investment (FDI), portfolio investments, or loans. Pakistan has regulations governing capital movements, which include reporting requirements and prior approvals for certain types of transactions. Investors interested in bringing capital into Pakistan or taking it out should consult the SBP and adhere to the applicable regulations. Banks in Pakistan follow Know Your Customer (KYC) guidelines to verify the identity of their customers and mitigate the risk of money laundering and terrorist financing. Customers are usually required to provide identification documents, proof of address, and other relevant information when opening bank accounts or engaging in significant financial transactions.

-

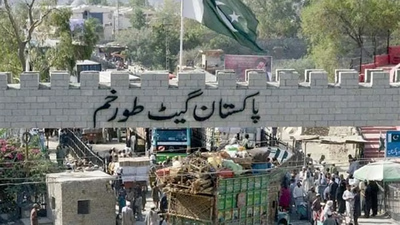

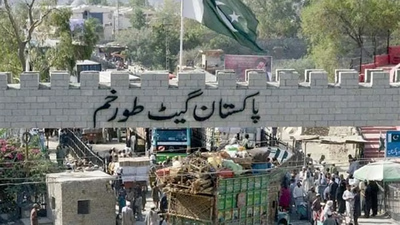

The Pakistan Customs Authority, under the Federal Board of Revenue, enforces customs laws and regulations, imposing duties on imported goods based on their classification and applicable trade agreements. Importers and exporters must adhere to specific clearance procedures, including filing documentation like the Import General Manifest (IGM) or Export General Manifest (EGM) and paying relevant taxes. Tariff rates have significantly decreased since 1994, with current rates set at 25% for consumer goods, 10% for intermediate goods, and 5% for raw materials. The government retains the authority to restrict or prohibit certain imports and exports under exceptional circumstances. Additionally, measures are in place to protect intellectual property rights by collaborating with rights holders to combat counterfeit goods. The adoption of electronic systems like WeBOC has streamlined customs processes, enhancing efficiency. While there are no restrictions on exports to Pakistan, exporters must register with the Pakistan Export Promotion Office. Customs value is determined based on transaction value adjusted per WTO guidelines. Certain goods face import/export prohibitions due to national security or health concerns, necessitating permits for compliance.

-

The State Bank of Pakistan (SBP) oversees the country"s banking regulations, focusing on foreign exchange and capital movement. Authorized Dealers (ADs) facilitate money transfers, both domestically and internationally, through various banking channels like wire transfers and online banking. The SBP"s regulations aim to prevent money laundering while ensuring stability in the foreign exchange market. Since 1994, importers can withdraw foreign currency without prior authorization for payments through FEBC remittances. The central bank also manages currency conversion rates based on economic factors such as inflation and trade partner currencies. Pakistan"s tax system includes direct taxes collected by the central government, while local governments impose additional taxes. In 2017, Pakistan"s imports totaled $55. 6 billion, ranking it as the 47th largest exporter globally, with exports at $24.

8 billion. Capital movements are regulated by the SBP, requiring reporting and approvals for certain transactions. Investors must comply with these regulations when transferring funds for investment purposes. Banks enforce Know Your Customer (KYC) guidelines to combat financial crimes by verifying customer identities during significant transactions.

-

Pakistan"s transportation sector is crucial for its economic development, with a focus on enhancing trade through its ports and railways. The Karachi Port Trust (KPT) and Port Qasim are key players in handling cargo, with KPT managing 30. 8 million tons in 2006-07 and showing a rise in activity in the current fiscal year. Port Qasim, catering to 40% of national shipping needs, recorded a growth of 10% in cargo handling during the same period. Gwadar Port holds significant potential for regional trade, aiming to connect Pakistan with Central Asia and beyond, while also promoting local economic growth. The government emphasizes infrastructure investment to support sustainable economic growth and improve supply chain solutions across the region. Railways are highlighted as an efficient alternative for long-haul transport, contributing to both passenger and freight movement while being environmentally friendly. Overall, the transportation landscape in Pakistan is evolving to meet the demands of international trade and regional connectivity. "

-

Recent economic changes in Pakistan have led to significant growth, particularly in manufacturing and financial services. The country has improved its foreign exchange position and reduced foreign debt, aided by the International Monetary Fund and U. S. debt forgiveness. GDP growth rates have steadily increased, reaching approximately 8. 4% by mid-2005, with the service sector now contributing about 53% to GDP. Despite these advancements, challenges such as inflation and lower reserves persist. The Karachi Stock Exchange has seen peaks alongside other emerging markets, attracting substantial foreign investment across various industries including telecommunications, textiles, and aerospace.

Sialkot has emerged as a key industrial hub, generating billions in exports from sectors like sports equipment and auto parts. The potential for growth in aerospace capabilities could further enhance economic development, with ongoing research into missile technology linked to the space program. Overall, while Pakistan"s economy shows promise through diversification and investment opportunities, it must navigate existing economic pressures to sustain its upward trajectory. "

-

Pakistan, officially the Islamic Republic of Pakistan, is located in South Asia and shares borders with India, Afghanistan, Iran, and China. It has a diverse geography that includes mountains, fertile plains, and deserts. The country has a population of over 228 million people and is the second-largest Muslim nation globally. Its capital is Islamabad, while Karachi is its largest city. Pakistan"s economy is a mix of agriculture, industry, and services, with textiles and agriculture being significant export sectors. The nation has a rich cultural heritage influenced by various ethnic groups and is known for its traditional music, dance forms, and sports like cricket. Despite facing political and economic challenges since its independence in 1947, Pakistan has experienced periods of growth. The country also offers numerous tourist attractions ranging from historical sites to natural beauty. "