Chemicals Prices in Yemen

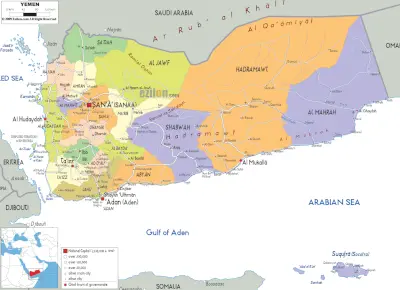

Yemen is located in southwest Asia and south of the Arabian Peninsula, the capital of which is the beautiful city of Sanaa. Chemicals are substances that have a fixed composition and specific properties. Trade balances in Yemen are about 14% higher than before, and growth in this area is considered acceptable. The Middle East, with its vast hydrocarbon and mineral resources, is one of the largest players in this large market in Asia. Britain conquered Yemen in 1943 but gained independence in 1967. The present-day Republic of Yemen was established in 1990 in Yemen. Food and pharmaceutical chemicals are specialized categories of chemicals that are specifically used in the food and pharmaceutical industries

Add your import and export orders to this list

Warning: Undefined variable $formTitle in /home/anbar/domains/anbar.asia/anbar/inc/html/desktop/orderform.php on line 10

Warning: Undefined variable $marketName in /home/anbar/domains/anbar.asia/anbar/inc/html/desktop/orderform.php on line 12

Warning: Undefined variable $location in /home/anbar/domains/anbar.asia/anbar/inc/html/desktop/orderform.php on line 12

If you want to trade in the , please join in Anbar Asia. Your order will be shown here, so the traders of contact you

Estimates show that the revenue situation in Yemen in 2019 grew by about 12 percent. Chemicals themselves are divided into categories of chemical compounds, chemical elements, and ions. Sanaa is one of the most important cities in Yemen, which has grown a lot in terms of work as beautiful city in the field of tourism. The chemical industry refers to the sector of the economy that is involved in the production, manufacturing, and distribution of chemicals and chemical products. The people of Yemen have no interest in extravagance, and this can be seen in all the cities of Yemen. The flag of Yemen is tied to the history of this country. Nanochemistry is a new discipline that combines chemistry with nanoscience

- Yemen Sulfuric Acid Market

- Yemen Phosphoric Acid Market

- Yemen Detergent Market

- Yemen Oxygen Market

- Yemen Chlorine Market

- Yemen Nitrogen Market

- Yemen Ammonia Market

There is no doubt that none of the chemical elements have played a more important role than oxygen in the development of chemistry. This life-giving gas was able to make such a huge breakthrough in chemistry in the late eighteenth century that it had never been possible before.

Read More ...

The main method of commercial production of sulfuric acid is that sulfur dioxide is first prepared from sulfur. Sulfur dioxide is then converted to sulfur trioxide in the process of catalytic oxidation, and then concentrated sulfuric acid is produced by the sulfur trioxide reaction with water.

Read More ...

Yemen has several climates. Western Yemen benefits from monsoon rains, which fall mainly in late spring and at the end of summer. Most of the rain falls in the mountains, with an annual maximum of a 1,000 millimetres in the southern mountains, decreasing gradually to an average of 400 millimetres in the northern mountains.

Read More ...Promising signs for Yemen's oil industry, but civil war rages. London — Nearly five years into a devastating civil war that has spiraled into a humanitarian crisis, Yemen continues to pump a trickle of oil. A tenuous peace deal between the competing Yemeni factions that are part of a Saudi-led coalition fighting the Iranian-backed Houthi rebels has raised hopes. "Overall the security risk remains high in Yemen and for many companies it is still premature to place the country on their radar screen, especially at a time when there are many more lucrative opportunities and safer bets elsewhere," said Carole Nakhle, an energy economist who heads the consultancy Crystol Energy. Underdeveloped Yemen has never been a massive oil producer, particularly relative to its Arab neighbors, but it contains significant proved hydrocarbon reserves of some 3 billion barrels of crude and 16. The oil industry is vital to Yemen's finances, contributing some 63% of government revenues before the fighting broke out, according to the International Monetary Fund, and will play a central role in rebuilding the Middle East's poorest country, should peace one day return. The landmark accord signed in November between Yemen's UN-recognized government and southern separatists was a positive first step that helped end infighting that had threatened to further splinter the country. Most of Yemen's oil resources and ports on the Gulf of Aden are in territory controlled by the government. A suspected Houthi missile attack on Yemeni government forces Saturday reportedly killed 116. "To get Yemen to a place where IOCs can return in strength. State-owned companies PetroMasila and Safer produce the bulk of Yemen's crude, with Austria-based OMV and Indonesia's Medco the only two international companies still operating in Yemen. "Please understand that we cannot comment further nor can we make future predictions based on the volatile situation in Yemen," the company said in an email. As for the Yemen LNG project on the southern coast, French major Total, which holds a 39. Yemen's oil reserves are largely concentrated in the inland Masila Basin in the center of the country, and the Marib and Shabwa basins further west. Current production is trucked to a pipeline running 200 km south to the Bir Ali terminal on the Gulf of Aden coast, though the Yemeni government has planned for a new 80 km pipeline that would connect the Marib fields to the Bir Ali pipeline and is scheduled to be operational as soon as this month. "An upward revision for Yemen would be unsurprising, but jihadists, Houthis, and tribal violence pose persistent risks," it said in a recent note. Tiny independent Petsec Energy, which holds two leases in Yemen but has yet to start production, remains bullish on the country, CEO Terrence Fern told Platts.

Read More ...

There are thousands of different chemicals extensively used in the different industries for the production of huge variety of products across the globe. The chemical distribution services helps the chemical producers in the distribution of chemicals in various new and developing markets, and helps to reduce the cost of distribution. The consumption of commodity chemicals is rising exponentially in several end use industries such as consumer goods, electronics, construction, and automotive. Asia Pacific is the leading consumer of the chemicals and hence the largest chemical distribution market across the globe. Moreover, countries like China and India are the manufacturing hub and has huge demand for the chemicals. Further, rising consumption of chemicals in various end use industries is propelling the market growth. Further rising awareness regarding the negative impacts of chemicals on health and environment may hamper the consumption of various chemicals in food and beverage and consumer goods industries that may hamper the chemical distribution market to a certain level. Challenges - Stringent government regulations on the usage of various specialty chemicals in the food and beverages and other industries is a major challenge faced by the chemical industry participants. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Read More ...

Get detailed COVID-19 impact analysis on the Specialty Chemicals Market . The global specialty chemicals market was valued at $711. Specialty chemicals are particular chemical products that help in providing variety of effects to various industries that they cater to such as textile, ink additives, construction, oil & gas, cosmetics, and food. Specialty chemicals can be formulations or entities whose composition greatly influences the performance of the customers’ product. These chemicals are used on the basis of their function and performance. Whereas, variations in raw material cost and stringent regulations by the government are estimated to hamper the growth of the global specialty chemicals market. The global specialty chemicals market is segmented on the basis of type and region. Depending on type, the market is divided into agrochemicals, flavor ingredients, fragrances ingredients, dyes & pigments, personal care active ingredients, water treatment chemicals, construction chemicals, surfactants, textile chemicals, bio-based chemicals, polymer additives, oil field chemicals, paper & pulp chemicals, electronic chemicals, specialty polymers, pharmaceutical ingredients, and others. Region wise, the specialty chemicals market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The key players operating in the global specialty chemicals market are BASF SE, Dow, Inc. Other companies in accordance with specialty chemicals market are Henkel Ag & Co. Specialty Chemicals Market By Type Your browser does not support the canvas element. By type, the pharmaceutical ingredients accounted for the largest specialty chemicals market share in 2019, and is anticipated to continue this trend during the forecast period. Increase in population base along with rise in demand for food is further demanding agrochemicals for the better crop production and protection, which further drives the growth of the specialty chemicals market during the forecast period. Furthermore, growing awareness among farmers toward the use of agrochemicals in farming fuels the growth of the market. With increase in urbanization and there is decrease in agriculture land, which leads to growth in demand for agrochemicals to increase the crop yield per acre of land; thereby, driving the growth of the specialty chemicals market during the forecast period. Specialty Chemicals Market By Region 2026Asia Pacific North America Europe Lamea Asia Pacific holds a dominant position in 2019 and would continue to maintain the lead over the forecast period. This is attributed to the presence of key developing economies such as China, India, and Japan in this region, which registered the highest market share in the specialty chemicals market in 2017. Specialty chemicals are used in the Asia-Pacific region in various applications such as paints & coatings, water treatment, personal care ingredients & cosmetics, electronics, agriculture, and others. In 2019, China was the largest market of specialty chemicals in Asia, accounting for around 38. The Indian specialty chemicals industry is highly fragmented and comprises mainly small- to medium-scale companies. Moreover, the unprecedented increase in the use of water treatment chemicals has fueled the growth of the specialty chemicals industry in India. Moreover, rise in urbanization and in the countries such as China, India, and Japan drives the demand for paints & coatings, which further fuels the demand for construction chemicals, which in turn drives the specialty chemicals market during the forecast period. In addition, the demand for water treatment chemicals in Asia-Pacific region, especially in China and India, owing to rise in need for potable water in domestic and industrial applications due to increasing population is expected to fuel the demand for specialty chemicals market. Key forces shaping specialty chemicals market3. Growth in awareness among end-users regarding the benefits of Environmental and health concerns related to the use of Continuous development and production of novel eco-friendly specialty chemicals3. and of the specialty chemicals market . Impact of key regulation on the global specialty chemicals market . Regulation on chemicals . Impact of CORONA (COVID-19) outbreak on the global specialty chemicals market . CHAPTER 4: GLOBAL SPECIALTY CHEMICALS MARKET, BY TYPE . Agrochemicals . Water treatment chemicals . Construction chemicals . Textile chemicals . Coating & Sizing Chemicals4. Finishing Chemicals4. Bio-based chemicals . Oil field chemicals . Cementing Chemicals4. Acidizing Chemicals4. Fracturing Chemicals4. Oil Production Chemicals 4. Paper & pulp chemicals . Bleaching & Recycled Fiber (RCF) Chemicals4. Process Chemicals4. Functional Chemicals4. Coating Chemicals4. Electronic chemicals . Photoresist Chemicals4. Wet Chemicals4. CHAPTER 5: SPECIALTY CHEMICALS MARKET, BY REGION . GLOBAL SPECIALTY CHEMICALS MARKET REVENUE, BY TYPE ($MILLION) (2019-2027) 97TABLE 02. GLOBAL SPECIALTY CHEMICALS MARKET, BY TYPE, ($MILLION), 2017-2027 98TABLE 03. GLOBAL SPECIALTY CHEMICALS MARKET FOR AGROCHEMICALS, BY TYPE ($MILLION) 103TABLE 04. GLOBAL SPECIALTY CHEMICALS MARKET FOR AGROCHEMICALS, BY REGION ($MILLION) 105TABLE 05. GLOBAL SPECIALTY CHEMICALS MARKET FOR FLAVOR INGREDIENTS, BY TYPE ($MILLION) 111TABLE 06. GLOBAL SPECIALTY CHEMICALS MARKET FOR FLAVOR INGREDIENTS, BY REGION ($MILLION) 112TABLE 07. GLOBAL SPECIALTY CHEMICALS MARKET FOR FRAGRANCES INGREDIENTS, BY TYPE ($MILLION) 117TABLE 08. GLOBAL SPECIALTY CHEMICALS MARKET FOR FRAGRANCES INGREDIENTS, BY REGION ($MILLION) 118TABLE 09. GLOBAL SPECIALTY CHEMICALS MARKET FOR DYES & PIGMENTS, BY REGION ($MILLION) 123TABLE 10. GLOBAL SPECIALTY CHEMICALS MARKET FOR PERSONAL CARE ACTIVE INGREDIENTS, BY REGION ($MILLION) 127TABLE 11. GLOBAL SPECIALTY CHEMICALS MARKET FOR WATER TREATMENT CHEMICALS, BY TYPE ($MILLION) 131TABLE 12. GLOBAL SPECIALTY CHEMICALS MARKET FOR WATER TREATMENT CHEMICALS, BY REGION ($MILLION) 133TABLE 13. GLOBAL SPECIALTY CHEMICALS MARKET FOR CONSTRUCTION CHEMICALS, BY TYPE ($MILLION) 138TABLE 14. GLOBAL SPECIALTY CHEMICALS MARKET FOR CONSTRUCTION CHEMICALS, BY REGION ($MILLION) 140TABLE 15. GLOBAL SPECIALTY CHEMICALS MARKET FOR SURFACTANTS, BY TYPE ($MILLION) 145TABLE 16. GLOBAL SPECIALTY CHEMICALS MARKET FOR SURFACTANTS, BY REGION ($MILLION) 147TABLE 17. GLOBAL SPECIALTY CHEMICALS MARKET FOR TEXTILE CHEMICALS, BY REGION ($MILLION) 152TABLE 18. GLOBAL SPECIALTY CHEMICALS MARKET FOR TEXTILE CHEMICALS, BY TYPE ($MILLION) 154TABLE 19. GLOBAL SPECIALTY CHEMICALS MARKET FOR BIO-BASED CHEMICALS, BY TYPE ($MILLION) 160TABLE 20. GLOBAL SPECIALTY CHEMICALS MARKET FOR BIO-BASED CHEMICALS, BY REGION ($MILLION) 162TABLE 21. GLOBAL SPECIALTY CHEMICALS MARKET FOR POLYMER ADDITIVES, BY REGION ($MILLION) 167TABLE 22. GLOBAL SPECIALTY CHEMICALS MARKET FOR OIL FIELD CHEMICALS, BY TYPE ($MILLION) 170TABLE 23. GLOBAL SPECIALTY CHEMICALS MARKET FOR OIL FIELD CHEMICALS, BY REGION ($MILLION) 172TABLE 24. GLOBAL SPECIALTY CHEMICALS MARKET FOR PAPER & PULP CHEMICALS, BY TYPE ($MILLION) 177TABLE 25. GLOBAL SPECIALTY CHEMICALS MARKET FOR PAPER & PULP CHEMICALS, BY REGION ($MILLION) 179TABLE 26. GLOBAL SPECIALTY CHEMICALS MARKET FOR ELECTRONIC CHEMICALS, BY TYPE ($MILLION) 184TABLE 27. GLOBAL SPECIALTY CHEMICALS MARKET FOR ELECTRONIC CHEMICALS, BY REGION ($MILLION) 186TABLE 28. GLOBAL SPECIALTY CHEMICALS MARKET FOR SPECIALTY POLYMERS, BY REGION ($MILLION) 192TABLE 29. GLOBAL SPECIALTY CHEMICALS MARKET FOR PHARMACEUTICAL INGRIDENTS, BY TYPE ($MILLION) 196TABLE 30. GLOBAL SPECIALTY CHEMICALS MARKET FOR PHARMACEUTICAL INGREDIENTS, BY REGION ($MILLION) 196TABLE 31. GLOBAL SPECIALTY CHEMICALS MARKET FOR OTHERS, BY REGION ($MILLION) 201TABLE 32. GLOBAL SPECIALTY CHEMICALS MARKET, BY REGION, ($MILLION) 205TABLE 33. NORTH AMERICA SPECIALTY CHEMICALS MARKET, BY TYPE, ($MILLION), 209TABLE 34. NORTH AMERICA SPECIALTY CHEMICALS MARKET, BY COUNTRY, ($MILLION) 212TABLE 35. SPECIALTY CHEMICALS MARKET, BY TYPE ($MILLION) 215TABLE 36. CANADA SPECIALTY CHEMICALS MARKET, BY TYPE ($MILLION) 220TABLE 37. MEXICO SPECIALTY CHEMICALS MARKET, BY TYPE ($MILLION) 225TABLE 38. EUROPE SPECIALTY CHEMICALS MARKET, BY TYPE, ($MILLION), 231TABLE 39. EUROPE SPECIALTY CHEMICALS MARKET, BY COUNTRY, ($MILLION) 234TABLE 40. GERMANY SPECIALTY CHEMICALS MARKET, BY TYPE ($MILLION) 238TABLE 41. FRANCE SPECIALTY CHEMICALS MARKET, BY TYPE ($MILLION) 243TABLE 42. UK SPECIALTY CHEMICALS MARKET, BY TYPE ($MILLION) 248TABLE 43. SPAIN SPECIALTY CHEMICALS MARKET, BY TYPE ($MILLION) 252TABLE 44. ITALY SPECIALTY CHEMICALS MARKET, BY TYPE ($MILLION) 256TABLE 45. REST OF EUROPE SPECIALTY CHEMICALS MARKET, BY TYPE ($MILLION) 260TABLE 46. ASIA-PACIFIC SPECIALTY CHEMICALS MARKET, BY TYPE, ($MILLION), 266TABLE 47. ASIA-PACIFIC SPECIALTY CHEMICALS MARKET, BY COUNTRY, ($MILLION) 269TABLE 48. CHINA SPECIALTY CHEMICALS MARKET, BY TYPE ($MILLION) 273TABLE 49. INDIA SPECIALTY CHEMICALS MARKET, BY TYPE ($MILLION) 278TABLE 50. JAPAN SPECIALTY CHEMICALS MARKET, BY TYPE ($MILLION) 283TABLE 51. AUSTRALIA SPECIALTY CHEMICALS MARKET, BY TYPE ($MILLION) 287TABLE 52. SOUTH KOREA SPECIALTY CHEMICALS MARKET, BY TYPE ($MILLION) 291TABLE 53. REST OF ASIA-PACIFIC SPECIALTY CHEMICALS MARKET, BY TYPE ($MILLION) 295TABLE 54. LAMEA SPECIALTY CHEMICALS MARKET, BY TYPE, ($MILLION), 301TABLE 55. LAMEA SPECIALTY CHEMICALS MARKET, BY COUNTRY, ($MILLION) 305TABLE 56. BRAZIL SPECIALTY CHEMICALS MARKET, BY TYPE ($MILLION) 308TABLE 57. SAUDI ARABIA SPECIALTY CHEMICALS MARKET, BY TYPE ($MILLION) 312TABLE 58. SOUTH AFRICA SPECIALTY CHEMICALS MARKET, BY TYPE ($MILLION) 316TABLE 59. REST OF LAMEA SPECIALTY CHEMICALS MARKET, BY TYPE ($MILLION) 320TABLE 60. SPECIALTY CHEMICALS MARKET DYNAMICS 67FIGURE 12. COMPARATIVE ANALYSIS OF SPECIALTY CHEMICALS MARKET FOR AGROCHEMICALS, BY COUNTRY, 2019 & 2027 ($MILLION) 109FIGURE 13. COMPARATIVE ANALYSIS OF SPECIALTY CHEMICALS MARKET FOR FLAVOR INGREDIENTS, BY COUNTRY, 2019 & 2027 ($MILLION) 115FIGURE 14. COMPARATIVE ANALYSIS OF SPECIALTY CHEMICALS MARKET FOR FRAGRANCES INGREDIENTS, BY COUNTRY, 2019 & 2027 ($MILLION) 121FIGURE 15. COMPARATIVE ANALYSIS OF SPECIALTY CHEMICALS MARKET FOR DYES & PIGMENTS, BY COUNTRY, 2019 & 2027 ($MILLION) 125FIGURE 16. COMPARATIVE ANALYSIS OF SPECIALTY CHEMICALS MARKET FOR PERSONAL CARE ACTIVE INGREDIENTS, BY COUNTRY, 2019 & 2027 ($MILLION) 129FIGURE 17. COMPARATIVE ANALYSIS OF SPECIALTY CHEMICALS MARKET FOR WATER TREATMENT CHEMICALS, BY COUNTRY, 2019 & 2027 ($MILLION) 136FIGURE 18. COMPARATIVE ANALYSIS OF SPECIALTY CHEMICALS MARKET FOR CONSTRUCTION CHEMICALS, BY COUNTRY, 2019 & 2027 ($MILLION) 143FIGURE 19. COMPARATIVE ANALYSIS OF SPECIALTY CHEMICALS MARKET FOR SURFACTANTS, BY COUNTRY, 2019 & 2027 ($MILLION) 150FIGURE 20. COMPARATIVE ANALYSIS OF SPECIALTY CHEMICALS MARKET FOR TEXTILE CHEMICALS, BY COUNTRY, 2019 & 2027 ($MILLION) 158FIGURE 21. COMPARATIVE ANALYSIS OF SPECIALTY CHEMICALS MARKET FOR BIO-BASED CHEMICALS, BY COUNTRY, 2019 & 2027 ($MILLION) 165FIGURE 22. COMPARATIVE ANALYSIS OF SPECIALTY CHEMICALS MARKET FOR POLYMER ADDITIVES, BY COUNTRY, 2019 & 2027 ($MILLION) 168FIGURE 23. COMPARATIVE ANALYSIS OF SPECIALTY CHEMICALS MARKET FOR OILFIELD CHEMICALS, BY COUNTRY, 2019 & 2027 ($MILLION) 175FIGURE 24. COMPARATIVE ANALYSIS OF SPECIALTY CHEMICALS MARKET FOR PAPER & PULP CHEMICALS, BY COUNTRY, 2019 & 2027 ($MILLION) 182FIGURE 25. COMPARATIVE ANALYSIS OF SPECIALTY CHEMICALS MARKET FOR ELECTRONIC CHEMICALS, BY COUNTRY, 2019 & 2027 ($MILLION) 190FIGURE 26. COMPARATIVE ANALYSIS OF SPECIALTY CHEMICALS MARKET FOR SPECIALTY POLYMERS, BY COUNTRY, 2019 & 2027 ($MILLION) 194FIGURE 27. COMPARATIVE ANALYSIS OF SPECIALTY CHEMICALS MARKET FOR PHARMACEUTICAL INGREDIENTS, BY COUNTRY, 2019 & 2027 ($MILLION) 199FIGURE 28. COMPARATIVE ANALYSIS OF SPECIALTY CHEMICALS MARKET FOR OTHERS, BY COUNTRY, 2019 & 2027 ($MILLION) 203FIGURE 29. SPECIALTY CHEMICALS MARKET REVENUE (2019-2027) ($MILLION) 214FIGURE 30. CANADA SPECIALTY CHEMICALS MARKET REVENUE (2019-2027) ($MILLION) 219FIGURE 31. MEXICO SPECIALTY CHEMICALS MARKET REVENUE (2019-2027) ($MILLION) 224FIGURE 32. GERMANY SPECIALTY CHEMICALS MARKET REVENUE (2019-2027) ($MILLION) 237FIGURE 33. FRANCE SPECIALTY CHEMICALS MARKET REVENUE (2019-2027) ($MILLION) 242FIGURE 34. UK SPECIALTY CHEMICALS MARKET REVENUE (2019-2027) ($MILLION) 247FIGURE 35. SPAIN SPECIALTY CHEMICALS MARKET REVENUE (2019-2027) ($MILLION) 251FIGURE 36. ITALY SPECIALTY CHEMICALS MARKET REVENUE (2019-2027) ($MILLION) 255FIGURE 37. REST OF EUROPE SPECIALTY CHEMICALS MARKET REVENUE (2019-2027) ($MILLION) 259FIGURE 38. CHINA SPECIALTY CHEMICALS MARKET REVENUE (2019-2027) ($MILLION) 272FIGURE 39. INDIA SPECIALTY CHEMICALS MARKET REVENUE (2019-2027) ($MILLION) 277FIGURE 40. JAPAN SPECIALTY CHEMICALS MARKET REVENUE (2019-2027) ($MILLION) 281FIGURE 41. AUSTRALIA SPECIALTY CHEMICALS MARKET REVENUE (2019-2027) ($MILLION) 286FIGURE 42. SOUTH KOREA SPECIALTY CHEMICALS MARKET REVENUE (2019-2027) ($MILLION) 290FIGURE 43. REST OF ASIA-PACIFIC SPECIALTY CHEMICALS MARKET REVENUE (2019-2027) ($MILLION) 294FIGURE 44. BRAZIL SPECIALTY CHEMICALS MARKET REVENUE (2019-2027) ($MILLION) 307FIGURE 45. SAUDI ARABIA SPECIALTY CHEMICALS MARKET REVENUE (2019-2027) ($MILLION) 311FIGURE 46. SOUTH AFRICA SPECIALTY CHEMICALS MARKET REVENUE (2019-2027) ($MILLION) 315FIGURE 47. REST OF LAMEA SPECIALTY CHEMICALS MARKET REVENUE (2019-2027) ($MILLION) 319FIGURE 48. The Asia-Pacific region provides lucrative opportunities to leading global chemical manufacturers, owing to its huge potential to set up manufacturing plants and growing demand for specialty chemicals. Increase in demand for specialty chemicals in the Asia-Pacific region and rise in purchasing power are the major factors driving the adoption of specialty chemicals for various applications, such as textiles, paints, and construction. For instance, increase in the demand for bio-based chemicals from various industries driving the growth of specialty chemicals market during the forecast period. Moreover, stringent government regulations for proper efficient utilization of water has enforced industries and municipal corporations to adopt water treatment solutions, which in turn drives the demand for water treatment chemicals. Moreover, construction chemicals, personal care active ingredients, textile chemicals, and oilfield chemicals among others are expected to witness dynamic growth due to the low cost of raw materials for manufacturing specialty chemicals. all over the world increases the demand for electronic chemicals and paper, oilfield chemicals, which is expected to drive the growth of the specialty chemicals market during the forecast period . The global Specialty chemicals market anticipated to grow at CAGR of 5. Some of the key trends observed in the global Specialty chemicals market are growing focus towards pharmaceutical grade Specialty chemicals due to increaed emphasis on healthcare activities owing to COVID epidemic . North America and Asia Pacific regions expected to provide lucrative growth opportunities to the global Specialty chemicals market. Pharmaceutical ingridents is the largest segment in the global Specialty chemicals market. Major customer of the Specialty chemicals are from pharmaceutical manufacturers, fertilizer manufactuers, oilfield industry, personal care manufactuers, and industrial sector are the key potential consumers in the Specialty chemicals market.

Read More ...

https://www.globenewswire.com/news-release/2021/10/28/2323297/0/en/Chemical-Distribution-Market-Size-to-Reach-US-412-4-Bn-by-2030.html

https://www.spglobal.com/platts/en/market-insights/latest-news/natural-gas/012320-promising-signs-for-yemens-oil-industry-but-civil-war-rages