Chemicals Prices in Egypt

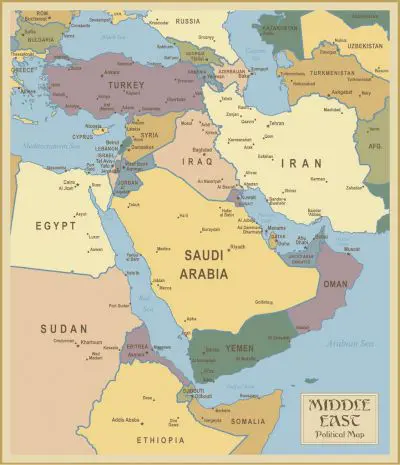

Egypt is one of the northeastern countries of Africa. It borders Libya to the west and Sudan to the south. Chemicals are substances that have a fixed composition and specific properties. Egypt's economic situation grew by 0.26% in 2020. The Middle East, with its vast hydrocarbon and mineral resources, is one of the largest players in this large market in Asia. Suez is unique in Egypt for investment, the city is divided into economic and commercial sectors and is on the list of best cities for investment. Food and pharmaceutical chemicals are specialized categories of chemicals that are specifically used in the food and pharmaceutical industries. Tourism, agriculture, industry, and services sectors each account for almost equally in the country's domestic production. Natural chemical compounds can be solid, liquid, or gaseous

Add your import and export orders to this list

Warning: Undefined variable $formTitle in /home/anbar/domains/anbar.asia/anbar/inc/html/desktop/orderform.php on line 10

Warning: Undefined variable $marketName in /home/anbar/domains/anbar.asia/anbar/inc/html/desktop/orderform.php on line 12

Warning: Undefined variable $location in /home/anbar/domains/anbar.asia/anbar/inc/html/desktop/orderform.php on line 12

If you want to trade in the , please join in Anbar Asia. Your order will be shown here, so the traders of contact you

Egypt's GDP is estimated at more than 32% in the agricultural sector. Egypt produces 688,100 barrels of oil per day. Chemicals themselves are divided into categories of chemical compounds, chemical elements, and ions. Egypt ranks very high in the welfare services sector in the city, transportation and urbanization system. The chemical industry refers to the sector of the economy that is involved in the production, manufacturing, and distribution of chemicals and chemical products. The rate of social security in Egypt is estimated at 40.00 percent, although this rate has been stable from previous years until today. Nanochemistry is a new discipline that combines chemistry with nanoscience. Political situation in Egypt is under control and the financial corruption within the companies has been minimized. Humans probably began to combine these substances before history was recorded

- Egypt Sulfuric Acid Market

- Egypt Phosphoric Acid Market

- Egypt Oxygen Market

- Egypt Chlorine Market

- Egypt Detergent Market

- Egypt Ammonia Market

- Egypt Nitrogen Market

There is no doubt that none of the chemical elements have played a more important role than oxygen in the development of chemistry. This life-giving gas was able to make such a huge breakthrough in chemistry in the late eighteenth century that it had never been possible before.

Read More ...

The main method of commercial production of sulfuric acid is that sulfur dioxide is first prepared from sulfur. Sulfur dioxide is then converted to sulfur trioxide in the process of catalytic oxidation, and then concentrated sulfuric acid is produced by the sulfur trioxide reaction with water.

Read More ...

Egypt is one of the northeastern countries of Africa. It borders Libya to the west and Sudan to the south. Egypt is bordered by the Mediterranean Sea to the north, Israel by land on the Sinai Peninsula, and Palestine on the Gaza Strip. The north of Egypt generally has a pleasant climate due to its proximity to the Mediterranean Sea.

Read More ...Who are the 10 women who made it to the top of the business scene in Egypt according to Forbes?. The petrochemicals giant TCI Sanmar's current investments in Egypt are estimated at USD 1. Egypt is raising the price cap on medicines that cost up to 30 Egyptian pounds ($3. Diamond Egypt Projects provides a successful combination of international expertise with intimate knowledge of local market conditions. Contact us Browse Research Africa Egypt All Categories Heavy Industry Materials & Chemicals Chemicals Region: Chemicals . a broad level market review of Hair Colorants market in Egypt. Industrial Paints & Coatings): Opportunity Analysis and Industry Forecast, 2020–2027 The Egypt paints & coatings market was valued at $2. Euromonitor Home Insecticides in Egypt market report offers a . and Forecast Analytics (updated with COVID-19 Impact) is a broad level market review of Hair Colorants market in Egypt. Opportunity Analysis and Industry Forecast 2020–2027 The Egypt construction chemicals market was valued at $283. and by Country (Saudi Arabia, Qatar, UAE, Egypt, Kuwait, and Rest of Middle East) - Size, Share, Outlook, and Opportunity Analysis, 2019 - 2027 Bio-chemical or bio-based chemicals are manufactured from bio-based renewable materials such . and varnishes in Egypt. Egypt. The package includes country reports from the following countries: Cameroon, Egypt, Ethiopia, Kenya, Madagascar, Malawi, Morocco, Senegal, South Africa, Tanzania The research includes historical data from 2011 to . The package includes country reports from the following countries: Cameroon, Egypt, Ethiopia, Kenya, Madagascar, Malawi, Morocco, Senegal, South Africa, Tanzania The research includes historical data from 2011 to 2017 and forecasts . The "MoP/MoPB – Suez Petrochemical Complex – Egypt - Project Profile" . comprehensive analytical work on Egypt NITROGEN markets. The research work strategically analyzes the Egypt market, assessing the future trends, drivers and challenges across multiple dimensions including growth, demand, pricing, competition, regulatory policies and . The "GAIFZ – Aswan Phosphate Fertilizer Plant – Egypt . The package includes paint and varnish country reports from the following countries: Egypt, Ethiopia, Ghana, . The package includes anti-knock preparation country reports from the following countries: Egypt, Ethiopia, Ghana, Morocco, Senegal, South Africa, Sudan . The package includes printing ink country reports from the following countries: Egypt, Ethiopia, Ghana, Morocco, Nigeria, Senegal, South . The package includes supported catalyst country reports from the following countries: Egypt, Ethiopia, Ghana, Morocco, Senegal, South Africa, Sudan . The "NCIC – Ain Sohkna Fertilizer Complex – Egypt Project Profile" .

Read More ...

Get detailed COVID-19 impact analysis on the Egypt Construction Chemicals Market . The Egypt construction chemicals market was valued at $283. The COVID-19 outbreak has affected the growth of the Egypt construction chemicals market due to the lockdown in country and delay in the construction of residential, commercial, and industrial sectors. The COVID-19 outbreak has affected the growth of the Egypt construction chemicals market due to the lockdown in country and delay in the construction of residential, commercial, and industrial sectors. Construction chemicals belong to the chemical industry's specialty segment. Such chemicals are used to improve impact strength and structural stability in building activities. Some building chemicals help reduce the quantity of raw materials, such as cement and water. Construction chemicals play a crucial role in enhancing concrete performance and increase the life span of the structure. Growth in investment in infrastructure development and residential construction activities across cities is mainly driving the growth of the Egyptian market for construction chemicals. These chemicals are increasingly being used to enhance concrete performance, along with growing industry understanding of the quality of concrete, cement, asphalt, and other building materials. It is anticipated that growing acceptance of ready-mix concrete, especially in the commercial and infrastructure sectors, would further boost the demand for building chemicals in the market. The Egypt construction chemicals market is segmented on the basis of product type and application. By product type, the market is classified into concrete admixtures, waterproofing & roofing chemicals, protective coatings, adhesives & sealants, industrial flooring, asphalt additives, repair & and others. The key players operating in the Egypt construction chemicals market are BASF SE, CMB – Chemicals for Modern Building, EAMIC Ltd, Hemts Construction Chemicals, NCC X-Calibur, Innova Priority Solution, Polymar-EG, Prokem specialty chemicals, Sika Egypt for Construction Chemicals, and United Paints and Chemicals Drymix S. By product type, the concrete admixtures segment held a significant share in the Egypt construction chemicals market in 2019. Egypt Construction Chemicals Market By Product Type Your browser does not support the canvas element. By application, the residential segment held a significant share in the Egypt construction chemicals market in 2019. Egypt Construction Chemicals Market By Application Your browser does not support the canvas element. Impact Of Covid-19 On The Egypt Construction Chemicals Market . New investment law and focus on transportation and energy boost Egypt’s construction sector3. Criss-cross analysis of construction chemicals product type vs Trade outlook of construction chemicals . CHAPTER 4:EGYPT CONSTRUCTION CHEMICALS MARKET, BY PRODUCT TYPE . Waterproofing and roofing chemicals . CHAPTER 5:EGYPT CONSTRUCTION CHEMICALS MARKET, BY APPLICATION . CMB – CHEMICALS FOR MODERN BUILDING . HEMTS CONSTRUCTION CHEMICALS . PROKEM SPECIALTY CHEMICALS . SIKA EGYPT FOR CONSTRUCTION CHEMICALS . UNITED PAINTS AND CHEMICALS DRYMIX S. EGYPT CONSTRUCTION CHEMICALS MARKET, BY PRODUCT TYPE, (TONS)TABLE 02. EGYPT CONSTRUCTION CHEMICALS MARKET, BY PRODUCT TYPE, 03. EGYPT CONSTRUCTION CHEMICALS MARKET, BY APPLICATION, (TONS)TABLE 04. EGYPT CONSTRUCTION CHEMICALS MARKET, BY APPLICATION, 05. SIKA EGYPT: COMPANY 28. SIKA EGYPT: PRODUCT 29. SIKA EGYPT: KEY STRATEGIC MOVES AND 30. UNITED PAINTS AND CHEMICALS DRYMIX S. UNITED PAINTS AND CHEMICALS DRYMIX S. EGYPT CONSTRUCTION CHEMICALS MARKET 09. PRICING ANALYSIS: EGYPT CONSTRUCTION CHEMICALS MARKETFIGURE 10. PRICING ANALYSIS: EGYPT CONCRETE ADMIXTURE PRICING ANALYSIS, BY 11. PRICING ANALYSIS: EGYPT CONSTRUCTION CHEMICALS MARKET, BY SUPPLIER (USD)FIGURE 12. EGYPT CONSTRUCTION CHEMICALS PROFITABILITY RATIONFIGURE 15. EGYPT CONSTRUCTION CHEMICALS MARKET, BY PRODUCT TYPE, 16. EGYPT CONSTRUCTION CHEMICALS MARKET FOR CONCRETE ADMIXTURES, 2019-2027 17. EGYPT CONSTRUCTION CHEMICALS MARKET FOR WATERPROOFING AND ROOFING CHEMICALS, 2019-2027 18. EGYPT CONSTRUCTION CHEMICALS MARKET FOR PROTECTIVE COATINGS, 2019-2027 19. EGYPT CONSTRUCTION CHEMICALS MARKET FOR ADHESIVES AND SEALANTS, 2019-2027 20. EGYPT CONSTRUCTION CHEMICALS MARKET FOR INDUSTRIAL FLOORING, 2019-2027 21. EGYPT CONSTRUCTION CHEMICALS MARKET FOR ASPHALT ADDITIVES, 2019-2027 22. EGYPT CONSTRUCTION CHEMICALS MARKET FOR REPAIR AND 2019-2027 23. EGYPT CONSTRUCTION CHEMICALS MARKET FOR OTHERS, 2019-2027 24. EGYPT CONSTRUCTION CHEMICALS MARKET, BY APPLICATION, 25. EGYPT CONSTRUCTION CHEMICALS MARKET FOR RESIDENTIAL, 2019-2027 26. EGYPT CONSTRUCTION CHEMICALS MARKET FOR INDUSTRIAL AND COMMERCIAL, 2019-2027 27. EGYPT CONSTRUCTION CHEMICALS MARKET FOR 2019-2027 28. According to the CXOs of the leading companies, the growth of Egypt construction market is progressive, and this trend is expected to continue during the forecast period with surge in urbanization and increase in large-scale infrastructure projects across several economies. Additionally, The El Dabaa Nuclear Power Plant (NPP), the first nuclear power plant in Egypt, is scheduled to be installed on the Mediterranean coast in the Matrouh Governorate, 250 km west of Alexandria. Furthermore, increased investment in growth is expected to lead to higher which in turn would drive the demand for building chemicals. The market value of Egypt construction chemicals in the forecast period is anticipated to be $444. Major players in the market are CMB – Chemicals for Modern Building, EAMIC Ltd, Prokem specialty chemicals, Sika Egypt for Constrcution Chemicals, NCC X-Calibur, BASF SE, and Polymar-EG among others. Residential application is projected to increase the demand for Egypt construction chemicals market . By product type concrete admixtures accounted for the largest Egypt construction chemicals market share . New infrastructure growth and major investments in new housing projects & renovation of buildings are expected to drive the Egypt construction chemicals market during the forecast period . Residential application expected to drive the adoption of Egypt construction chemicals market.

Read More ...

The agrochemicals market in Egypt is estimated to grow at a CAGR of 2. Egypt Agrochemicals Market Dynamics. Egypt is one of the major agriculture producing countries in the African continent; more than half of the population is involved in the agriculture sector. The availability of land for agricultural usages is very much constricted in Egypt. So the need of improving the efficiency through the usage of agrochemicals has been driving the market demand. Further, with the economic improvement in some African countries, farmers have become more aware of the necessity of agrochemicals application in the land. The high cost of agrochemicals is not always affordable for the poor farmers of Africa. Along with that, there is a need to strengthen the government involvement in popularizing consumption of agrochemicals for better productivity of agricultural lands. Egypt Agrochemicals Market Segmentation. Cereal crops like maize, rice and wheat account for the majority of agrochemicals usage. Other important crops consuming agrochemicals are soya bean, cotton, sugar cane, sugar beet and fruits like grapes, orange and vegetables like potato etc. Key Players in Egypt’s Agrochemicals Market. The fragmented market of Egyptian fertilizer industry is dominated by a lot of foreign players as these players try to get hold of this highly underdeveloped market. 21 Israel Chemicals Ltd.

Read More ...

Chemical sector is boosting the Egyptian manufacturing industry. The prospects for the chemical industry in Egypt are favorable. Due to the healthy population growth of around 2%, expanding natural gas production and rising exports by Egyptian companies, the general market conditions are encouraging. Agriculture, which is growing at a constant rate of 3% a year, requires agricultural chemicals, and the robust construction sector ensures a sustained demand for paints and varnishes. Planned improvements in health care for nearly 100 million Egyptians and export opportunities are encouraging pharmaceutical manufacturers to invest. According to the latest figures from the CAPMAS statistics office, the chemical and fertilizer industries are key growth drivers for the Egyptian industrial output. The Export Council for Chemicals and Fertilizers estimates an increase of exports of 22% in 2018 against the previous year. Expansion of petrochemicals to meet rising domestic demand. Both oil and gas production and consumption are increasing in Egypt. According to the Internet portal Egypt Oil & Gas, the new target is now 7. With the growing supply of natural gas, Egypt’s opportunities for petrochemical refining are also increasing. In April 2019, the head of the Chemicals and Fertilizers Export Council, Khaled Abo Al Makarem, estimated that by 2023, Egypt could cover half of its plastics requirements itself. The ministry is focusing on further expanding the downstream sector and increasing Egypt’s in fuels. According to the Daily News Egypt, the state-owned Egyptian Petroleum Corporation purchases oil products primarily from Saudi Aramco, Kuwait Petroleum Corporation, and Iraqi Sumo. Egyptian General Petroleum Corporation (EGPC) plans to increase the capacity of its eight refineries from 38 million to 41 million tons for US$ 12. Thus, the Egyptian production of crude oil and condensates reached about 660,000 barrels daily at the turn of the year. The Indian polymer film manufacturer Flex Films announced in early 2019 that it would invest US$ 200 million in Egypt. The local subsidiary Flex P Films Egypt plans to set up a second production facility. Agrochemicals benefit from steady growth in agriculture. Between 2017 and 2022, the market research company Mordor International expects average annual demand growth of agrochemicals of 2. An important driver of demand for agrochemicals is the scarcity of agricultural land. At the same time, the population is growing and Egypt is increasingly successful in exporting fruit and vegetables to Europe, for example. Agrochemicals are mainly used in the cultivation of corn, rice, and wheat. Egypt has to purchase about 75% of the pesticides it needs from abroad. According to Mordor Intelligence, the fragmented Egyptian market for agrochemicals is dominated by foreign companies. The local supplier El Nasr Company for Intermediate Chemicals (NCIC) is planning a new fertilizer complex in Ain Sokhna on the Gulf of Suez. Population growth, low per capita health expenditure, and a high dependence on imports of make Egypt an attractive healthcare market. Pharmaceutical companies in Egypt are investing in new capacities on various scales. The Egyptian government is aiming to build a factory for plasma derivatives for the treatment of hepatitis B, C, and HIV. EIPICO plans to build a factory for biosimilar drugs in the 10th of Ramadan City near Cairo. According to Al Mal, Egypt imports 25,000 tons of medical salts per year to date. The Egyptian Ministry of Health is interested in foreign companies to invest in the production of dialysis fluid and peritoneal dialysis solution. In spring 2019, the company also negotiated with five medium-sized Egyptian pharmaceutical manufacturers to examine possible takeovers. Gilead Sciences has selected its Egyptian partner EvaPharma to develop the African market. As a distribution and production center, Egypt will form a basis for expansion on the continent. Egypt is both the largest producer and consumer of paints and varnishes in North Africa. Egypt: Selected early-stage investment projects in the chemical industry . The aim of the government’s Petrochemicals Master Plan 2002 to 2022 is to expand local production. For the Egyptian Ministry of Petroleum, production is becoming increasingly important. According to the Daily News Egypt, reduced energy consumption in the refineries and other plants already saves around EUR 18 million annually. Egypt wants to become part of the World Bank’s “Zero Routine Flaring” initiative. Egyptian companies active in plastics, rubber, and fertilizers. With 4,921 companies, plastics, rubber, and petrochemicals represented about half of the members. The diversified chemicals and fertilizers sector had 1,779 companies. In the 2000s, an extensive expansion of petrochemical capacities began in Egypt. According to the Egyptian Ministry of Investment, public companies Delta Company for Fertilizers, Semadco and KIMA produce nitrogenous fertilizers. The private companies Abu Qir Fertilizers, Alexandria Fertilizers, EBIC, Helwan Fertilizers, Liquifert, MOPCO Fertilizers, Suez Fertilizers, and The Egyptian Fertilizers Company are also active in this sector. Egypt: Main companies in the chemical sector. The Egyptian market for chemical products is characterized by extensive government regulation. The Egyptian Organization for & Quality (http://www. The regulatory authority for is the Egyptian Drug Authority, which belongs to the Ministry of Health. A large number of goods are only released for the Egyptian market after a successful initial inspection by CAPA.

Read More ...

https://www.marketresearch.com/seek/Chemicals-Egypt/212/1166/1.html

https://www.egypt-business.com/ticker/details/1611-2021-waterproofing-chemicals---global-market-research-report/31487