Construction Materials Prices in Saudi Arabia

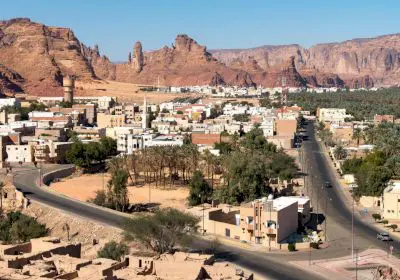

Saudi Arabia is the largest country in West Asia and is one of the largest producers and exporters of crude Oil in the world. Building materials are used in the construction and production of various structures. Road transportation is the most common and widely used mode of transport in Saudi Arabia. Fine sand is usually easily found on the beach and in the river. The customs inspector places the consignment (passenger) on the inspection device and all Saudi lines are responsible for keeping the cargo in storage. Plaster is a soft, white powder obtained from gypsum

Add your import and export orders to this list

Warning: Undefined variable $formTitle in /home/anbar/domains/anbar.asia/anbar/inc/html/desktop/orderform.php on line 10

Warning: Undefined variable $marketName in /home/anbar/domains/anbar.asia/anbar/inc/html/desktop/orderform.php on line 12

Warning: Undefined variable $location in /home/anbar/domains/anbar.asia/anbar/inc/html/desktop/orderform.php on line 12

If you want to trade in the , please join in Anbar Asia. Your order will be shown here, so the traders of contact you

Saudi Arabia is rich in natural resources such as gold and copper, crude Oil, natural gas, and iron. The construction industry is one of the most prosperous industries and businesses in the Middle East. Saudi Arabia is the 18th largest economy in the world and the largest economy in the Middle East and North Africa. Soil is a combination of excellent minerals and minerals created by weathering and rock destruction. Saudi Arabia has specific regulations regarding the import and export of goods, and there are certain items that are considered forbidden or restricted in the country. Cement is produced in a very soft powder and is provided to the consumer in bulk or in packages

- Saudi Arabia Sand Market

- Saudi Arabia Concrete blocks Market

- Saudi Arabia Brick Market

- Saudi Arabia paint Market

- Saudi Arabia Glass Market

- Saudi Arabia Cement Market

- Saudi Arabia Plaster Market

- Saudi Arabia Ceramic Tile Market

- Saudi Arabia wood and timber Market

- Saudi Arabia Clay Market

- Saudi Arabia lime Market

Gravel smaller than sand is called fine sand. Fine sand is usually easily found on the beach and in the river. In civil engineering, according to the classification, ASTM called fine sand for gravels smaller than 4.75 mm and coarser than 0.075 mm of.

Read More ...

Clay is one of the types of sticky soils that is used in construction. This soil is the result of erosion of metamorphic and igneous rocks and because of its very fine grains, it is also called colloid. The important point in using this material is to choose a quality sample of it. Clay is the best material that can be used to control the temperature of the building.

Read More ...

Whitewash plaster: The price of whitewash plaster is very reasonable. This plaster is used to cover the surface and whitewash the walls, and its color is completely white.

Read More ...

The combination of cement with water creates a hard material called concrete, which plays an important role in strengthening various structures.

Read More ...

Industry of Saudi ArabiaSaudi Arabia has increased its share of crude Oil revenues in the development of industrial projects. Saudi Arabia's industrialization program focuses on building Oil and gas refineries. At the end of 2005, Saudi Arabia estimated its proven gas reserves at 1.2 trillion cubic meters, ranking fourth in the world.

Read More ...

Sand is produced by crushing rocks. Coarse stones are produced from the crushing and separation of natural stones, and finer sands, in addition to stones, also contain shells and corals. In civil engineering, aggregates smaller than 75 mm and coarser than 4.75 are called sand. Sands are divided into two categories according to the source and type of grains used in construction.

Read More ...

Clay soil is a term that refers to sedimentary rocks containing a significant amount of clay minerals, such as rock. Iran is one of the special regions of the world that has many resources; The export capacity of clay from the waters of Chabahar port to Pakistan shows that Iran has the richest resources.

Read More ... Prefabricated construction materials can be classified into two types – concrete-based and metal prefabricated products. The Saudi Arabia construction and development industry is expected to be the vibrant sector during the forecast period, considering the assured development projects. Saudi Arabia Prefabricated Buildings Market Analysis, by Structure Type. Saudi Arabia Prefabricated Buildings Market Analysis, by Material Type . Saudi Arabia Prefabricated Buildings Market Analysis, by Unit Size. Saudi Arabia Prefabricated Buildings Market Analysis, by Application. Saudi Arabia Prefabricated Buildings Industry. Saudi Arabia Prefabricated Buildings Market, by Structure Type. Saudi Arabia Prefabricated Buildings Market, by Material Type. Saudi Arabia Prefabricated Buildings Market, by Unit Size. Saudi Arabia Prefabricated Buildings Market, by Application.

Read More ...

The Saudi Arabia Construction Market is segmented by Construction Type into, Commercial Constructions, Residential Constructions, Industrial Constructions, Infrastructure and Energy and Utility Constructions. The report offers market size and forecasts for Saudi Arabia construction market in volume (thousand metric tons) and value (USD billion) for all the above segments. The Saudi Arabian construction market was valued at around USD 37 billion in 2020 and is expected to register a CAGR of 5. Prior to the Covid-19 outbreak, it was reported that the infrastructure and construction industry in Saudi Arabia was amongst the largest in the Gulf Cooperation Council (GCC) region, with more than USD 825 billion worth of planned and unawarded projects. The total value of construction contracts awarded in Saudi Arabia during the third quarter (Q3) of 2020 collapsed by 84% on figures for the same period in 2019 as the economic impact of the COVID-19 pandemic continued to spread. The Saudi Arabian construction market is expected to witness significant growth and offer lucrative potential, due to its Vision 2030, NTP 2020, and several ongoing reforms to diversify away from oil. According to the industry sources, more than 5,200 construction projects are currently ongoing in Saudi Arabia at a value of USD 819 billion. Saudi Arabia’s Vision 2030, along with a significant investment in housing and infrastructure development promoted across the country by local authorities, are revitalizing the construction industry and generating interest in a growing number of international players. Some of the major urban construction projects in Saudi Arabia include the King Abdullah Security Compounds (Phase 5), and the Grand Mosque (Holy Haram Mosque expansion), each valued at USD 21. The Saudi Arabian construction market report covers a complete analysis of the industry, including current economic and market scenario, market size estimation for key segments, emerging trends in the market segments, market dynamics, and key comparisons among Saudi Arabia and other GCC member countries. The significance of construction in Saudi Arabia is underscored by its suite of giga projects; transport and mobility schemes, such as Riyadh Metro; social infrastructure developments, such as the Ministry of Sakani program; and energy megaprojects, such as the state-owned Aramco’s Berri and Marjan oil fields. Saudi Arabia’s top construction projects of 2019. Neom, the Red Sea Project, Qiddiya entertainment city, Amaala, Jean Nouvel’s Sharaan resort in Al-Ula, Makkah Grand Mosque – Third Expansion, Jeddah Tower, Ministry of Sakani homes, Jabal Omar, Al Widyan, Riyadh Metro, Riyadh Rapid Bus Transit System, King Fahd Medical City Expansion, King Abdullah Bin Abdulaziz Medical Complexes, King Salman Energy Park (Spark), Saudi Aramco’s Berri and Marjan, Hanergy Solar Park, Dumat Al Jandal Wind Power Plant, Saudi PIB factory, Pan-Asia bottling facility. The flight to Neom was followed by the approval of Neom Bay’s masterplan approval by the Neom Founding Board, chaired by Saudi Arabia's Crown Prince HRH Prince Mohammed bin Salman bin Abdulaziz. Another one of Saudi Arabia’s gig projects has also made progress in 2019. The Saudi market is highly competitive, with the presence of major international players. The Saudi market presents opportunities for growth during the forecast period, which is expected to further drive the market competition. With a few players holding a significant market share, the Saudi market has an observable level of consolidation. 5 Review and Commentary on the Extent of Saudi Arabia's Economy 6 Comparison of Key Industry Metrics of Saudi Arabia with Other GCC Member Countries (Analyst View). 7 Comparison of Construction Cost Metrics of Saudi Arabia with Other GCC Member Countries (Analyst View). FUTURE OF CONSTRUCTION SECTOR IN SAUDI ARABIA. The Saudi Arabia Construction Market market is studied from 2017 - 2026. The Saudi Arabia Construction Market is growing at a CAGR of 5. , Samsung C&T Engineering & Construction are the major companies operating in Saudi Arabia Construction Market.

Read More ...

Get detailed COVID-19 impact analysis on the Saudi Arabia Construction Chemicals Market . The Saudi Arabia construction chemicals market size was valued at $741. The COVID-19 outbreak has affected the growth of the Saudi Arabia construction chemicals market due to the lockdown in country and delay in the construction of residential, commercial, and industrial sectors. The COVID-19 outbreak has affected the growth of the Saudi Arabia construction chemicals market due to the lockdown in country and delay in the construction of residential, commercial, and industrial sectors. The rapid growth in the infrastructure sector, along with the requirements for repair of older buildings in countries, has led to an increase in the use of advanced technologies in construction activities, which is a major factor in supporting the growth of the chemical market for construction in Saudi Arabia. Additionally, government initiatives to increase diversified investment patterns across sectors such as retail, and others to reduce reliance on the oil sector also serve as a major growth driver for the chemical construction market in Saudi Arabia. In addition, there are many pipeline projects such as airports, metro networks, ports, highways, bridges, hotels, and others that also lead to creating high demand for Saudi Arabia's constriction chemicals during the forecast period. However, because of the reaction between chemicals and environmental gases that are harmful to living beings, problems associated with adverse effects on the environment serve as the key restraining factor for the growth of the chemical market for construction in Saudi Arabia. The Saudi Arabia construction chemicals market is segmented on the basis of product type and application. The major key players operating in the Saudi Arabia Construction Chemicals Market include Arkema S. Saudi Arabia Construction Chemicals Market By Product Type Your browser does not support the canvas element. By application, the residential of construction chemicals segment held the largest Saudi Arabia Construction Chemicals Market share in the year 2019. The demand for construction chemicals is booming in the real estate sector of Saudi Arabia on account of development of individual housing units and commercial complexes. Saudi Arabia Construction Chemicals Market By Application Your browser does not support the canvas element. Impact Of Covid-19 On The Saudi Arabia Construction Chemicals Market . CHAPTER 4:SAUDI ARABIA CONSTRUCTION CHEMICALS MARKET, BY PRODUCT TYPE . CHAPTER 5:SAUDI ARABIA CONSTRUCTION CHEMICALS MARKET, BY APPLICATION . SAUDI ARABIA CONSTRUCTION CHEMICALS MARKET, BY PRODUCT TYPE, (TONS)TABLE 02. SAUDI ARABIA CONSTRUCTION CHEMICALS MARKET, BY PRODUCT TYPE, 03. SAUDI ARABIA CONSTRUCTION CHEMICALS MARKET, BY APPLICATION, (TONS)TABLE 04. SAUDI ARABIA CONSTRUCTION CHEMICALS MARKET, BY APPLICATION, 05. SAUDI ARABIA CONSTRUCTION CHEMICALS MARKET 09. PRICING ANALYSIS: SAUDI ARABIA CONSTRUCTION CHEMICALS MARKETFIGURE 10. PRICING ANALYSIS: SAUDI ARABIA CONCRETE ADMIXTURE PRICING ANALYSIS, BY 11. PRICING ANALYSIS: SAUDI ARABIA CONSTRUCTION CHEMICALS MARKET, BY SUPPLIER (USD)FIGURE 12. SAUDI ARABIA CONSTRUCTION CHEMICALS PROBITABILITY RATIONFIGURE 15. SAUDI ARABIA CONSTRUCTION CHEMICALS MARKET, BY PRODUCT TYPE, 16. SAUDI ARABIA CONSTRUCTION CHEMICALS MARKET FOR CONCRETE ADMIXTURES, 2019-2027 17. SAUDI ARABIA CONSTRUCTION CHEMICALS MARKET FOR WATERPROOFING AND ROOFING CHEMICALS, 18. SAUDI ARABIA CONSTRUCTION CHEMICALS MARKET FOR PROTECTIVE COATINGS, 2019-2027 19. SAUDI ARABIA CONSTRUCTION CHEMICALS MARKET FOR ADHESIVES AND SEALANTS, 2019-2027 20. SAUDI ARABIA CONSTRUCTION CHEMICALS MARKET FOR INDUSTRIAL FLOORING, 2019-2027 21. SAUDI ARABIA CONSTRUCTION CHEMICALS MARKET FOR ASPHALT ADDITIVES, 2019-2027 22. SAUDI ARABIA CONSTRUCTION CHEMICALS MARKET FOR REPAIR AND 2019-2027 23. SAUDI ARABIA CONSTRUCTION CHEMICALS MARKET FOR OTHERS, 2019-2027 24. SAUDI ARABIA CONSTRUCTION CHEMICALS MARKET, BY APPLICATION, 25. SAUDI ARABIA CONSTRUCTION CHEMICALS MARKET FOR RESIDENTIAL, 2019-2027 26. SAUDI ARABIA CONSTRUCTION CHEMICALS MARKET FOR INDUSTRIAL AND COMMERCIAL, 2019-2027 27. SAUDI ARABIA CONSTRUCTION CHEMICALS MARKET FOR 2019-2027 28. According to the CXOs of the leading companies, growth in the demand for construction chemicals in Saudi Arabia is expected to be driven by growing urbanization and in major developing countries, the introduction of stringent government policies and increased investment in the construction sector. Additionally, one of Saudi Arabia's main strategies for fueling economic growth is investment in large-scale infrastructure projects. For examples, the Kingdom of Saudi Arabia has signed a deal with South Korean and Chinese companies under a USD100 billion project to construct 1. Additionally, the government is concentrating extensively on the development of deals as part of the Saudi Arabia Vision 2030 program. Construction chemicals have been used in various applications including residential, industrial & commercial, infrastructure and others are expected to drive the growth of the Saudi Arabia construction chemicals market. The Saudi Arabia construction chemicals market anticipated to grow at CAGR of 6. Some of the key trend observed in the Saudi Arabia construction chemicals market is increasing residential and infrastructure application to dominate the market. , Polywed Construction Chemicals, and The Dow Chemical Company are the leading players in Saudi Arabia construction chemicals market. Residential sector is the largest segment in the Saudi Arabia construction chemicals market. Major customer of the construction chemicals are from residential, industrial & commercial, and infrastructure are the key potential consumers in the Saudi Arabia construction chemicals market.

Read More ...

Saudi Arabia construction market stood over $ 34 billion in 2019 and is exhibiting a CAGR of over 5% during the forecast period, on account of significant investments in infrastructure and housing development projects. Under Vision 2030, Saudi Arabia is increasing investments in technology and infrastructure development for economic which is expected to have a positive impact on the country’s construction market during forecast period. Saudi Arabia construction market is segmented by industry type, and by region. Regionally, Saudi Arabia construction market has been segmented into west, east, central and Rest of Saudi. Construction projects such as Al Faisaliya City, Dahiyat Al Fursan, Al Ruwaid Redevelopment are among some of the large-scale construction projects in Saudi Arabia. Saudi Binladin Group is the leading player in Saudi Arabia construction market. Initially, TechSci Research sourced a list of leading construction companies across Saudi Arabia. TechSci Research analyzed the industries served and presence of all major players operating in Saudi Arabia construction market . TechSci Research calculated Saudi Arabia construction market size by using a top-down approach, wherein data for various industry type recorded and forecast for the future years. In this report, Saudi Arabia construction been segmented into following categories, in addition to the industry trends which have also been detailed below: . Company Profiles: Detailed analysis of the major companies present in Saudi Arabia construction market. Impact of COVID-19 on Saudi Arabia Construction Market . Saudi Arabia Construction Market Outlook . Saudi Arabia Industrial Construction M arket Outlook . Saudi Arabia Infrastructure Construction M arket Outlook . Saudi Arabia Commercial Construction M arket Outlook . Saudi Arabia Residential Construction M arket Outlook . Saudi Arabia Economic Profile . Freyssinet Saudi Arabia . Figure 1: Saudi Arabia Construction Market Size, By Value (USD Million), 2016–2026F . Figure 2: Saudi Arabia Construction Market Share, By Industry Type, By Value, 2016-2026F . Figure 3: Saudi Arabia Construction Market Share, By Region, By Value, 2020 & 2026F . Figure 4: Saudi Arabia Construction Market Share, By Company, By Value, 2021E-2026F . Figure 5: Saudi Arabia Construction Market Attractiveness Index, By Industry Type, By Value, 2021E-2026F . Figure 6: Saudi Arabia Industrial Construction Market Size, By Value (USD Million), 2016-2026F . Figure 7: Saudi Arabia Industrial Construction Market Share, By Region, By Value, 2020 & 2026F . Figure 8: Saudi Arabia Infrastructure Construction Market Size, By Value (USD Million), 2016-2026F . Figure 9: Saudi Arabia Infrastructure Construction Market Share, By Region, By Value, 2020 & 2026F . Figure 10: Saudi Arabia Commercial Construction Market Size, By Value (USD Million), 2016-2026F . Figure 11: Saudi Arabia Commercial Construction Market Share, By Region, By Value, 2020 & 2026F . Figure 12: Saudi Arabia Residential Construction Market Size, By Value (USD Million), 2016-2026F . Figure 13: Saudi Arabia Residential Construction Market Share, By Region, By Value, 2020 & 2026F . Table 1: Saudi Arabia GDP, 2020 . Table 2: Population of Saudi Arabia . Saudi Arabia Construction Market to Surpass $ 43 Billion by 2024. Increasing spending on large-scale infrastructure development and housing projects to drive construction market in Saudi Arabia during the forecast period.

Read More ...

The real estate service provider Knight Frank expects that population growth and support measures by the Saudi Arabian government will drive the housing market in the long term. In Riyadh, project developers are concentrating on creating affordable housing under the auspices of government programs. According to JLL, the housing supply in Riyadh remained virtually unchanged in the second quarter of 2018, at 1. As a result, the supply of housing in Riyadh has increased for managers, foreign workers and their families as well as for short-term residents. In early 2018, Saudi Arabia presented a US$ 32 billion housing program running until 2030. The vacancy rate in the second quarter of 2018 was 8% in Riyadh (Q2 2017: 16%), 21% in Jeddah (Q2 2017: 16%) and a staggering 30% in the first half of 2018 in the metropolitan region of Dammam. In Riyadh, office space was expected to increase by 151,000 m² m² to a total of 4 million m² in the second half of 2018, while only 51,000 m² were completed in the first half of the year. The Riyadh Metro is scheduled for completion in 2019. Saudi Arabia once again has been issuing tourism visas since April 2018. Millions of religious pilgrims visit Saudi Arabia every year. The Qiddiyah entertainment district, including a Six Flags theme park, is being constructed just outside Riyadh. International companies usually serve the Saudi Arabian market from their sales offices outside the country, mainly the UAE. According to JLL, the number of hotel rooms available in Riyadh at the end of June 2018 was 12,300 (12,000 at the end of December 2017). Saudi Arabia is already the most important market in the Gulf region for most retailers because of its population size. Retail space has been steadily expanded in recent years, especially in Riyadh and Jeddah. JLL expects retail space in shopping centers in Riyadh to increase from 2. The Saudi Arabian Mining Company (Maaden), together with Mosaic and Sabic, are planning a large phosphate project costing US$ 550 million in the petrochemical complex Wa’ad Al Shamal Minerals Industrial City. According to official figures, the population of Saudi Arabia is 32. Three projects were cancelled in the first three quarters of 2018, including the first phase of Military Medical City in Riyadh (US$ 3. 4 billion each, one in Jeddah and one in Riyadh. Saudi Arabia wants to invest more in education. According to the USGBC, more than 303 projects were aiming for LEED certification in Saudi Arabia by the end of September. Riyadh’s King Abdullah Financial District (KAFD) alone intends to achieve certification for around 50 projects but faces an uncertain future. Although there are no concrete commitments yet, according to reports Saudi Arabia is looking for a major investor to act as a driving force. In 2018 four packages were awarded to Saudi Arabian companies for the construction of royal palaces in Neom. Saudi Arabia: Cement production and domestic sales by manufacturer (in 1,000 tons). Saudi Arabia’s strategy seeks to expand the building materials and supply products industries. Saudi Arabia is the largest producer and consumer of steel in the GCC region. Saudi Arabia seeks to expand its downstream industry. The Saudi Arabian Amiantit Company in Dammam produces GRP pipes (glass fiber reinforced plastic pipes). Saudi Arabia is also becoming an increasingly important exporter of polystyrene. Saudi Arabia’s polystyrene output has increased further with the commissioning of Saudi Polymers (annual capacity: 200,000 metric tons). Cables and wires are manufactured by Saudi Cable, Middle East Specialized Cables Company, Bahra Cables Company, Rescab, Energya Cables, Riyadh Cables and Alfanar. Saudi Rockwool Factory, located in an industrial area south of Riyadh, produces mineral wool for thermal and acoustic insulation and fire protection. Most of the raw materials required are available in Saudi Arabia. Saudi Arabia: Incoming orders in the construction industry (US$ millions*). Additionally, the market has collapsed not only in Saudi Arabia but in almost all Gulf countries. Saudi Arabia: Leading construction companies (selection). Leading international construction companies in Saudi Arabia include Saipem (Italy), Hyundai Engineering & Construction (South Korea), JGS Corporation (Japan), GS Engineering & Construction (South Korea), Larsen & Toubro (India), Tecnicas Reunidas (Spain), Samsung Engineering (South Korea), Daelim Industrial (South Korea), Bechtel (USA), ABV Rock Group (Sweden), Consolidated Contractors Group (Greece), Fluor Corporation (USA), SK Engineering & Construction (South Korea) and Habtoor Leighton Group (UAE). In contrast, the legal hurdles to establish a presence in Saudi Arabia are comparatively low. Foreign architects, engineers and other construction service providers are able to establish professional partnerships with Saudi Arabian partners. The Ministry of Commerce and Investment (MCI) handles registration for this, and the Saudi Arabian General Investment Authority (SAGIA) is not involved. The next edition of “Saudi Build” will take place in Riyadh from 7-10 October 2019.

Read More ...

https://www.mordorintelligence.com/industry-reports/saudi-arabia-construction-market

https://www.mordorintelligence.com/industry-reports/saudi-arabia-prefabricated-buildings-industry-study-market