Petrochemicals Prices in Egypt

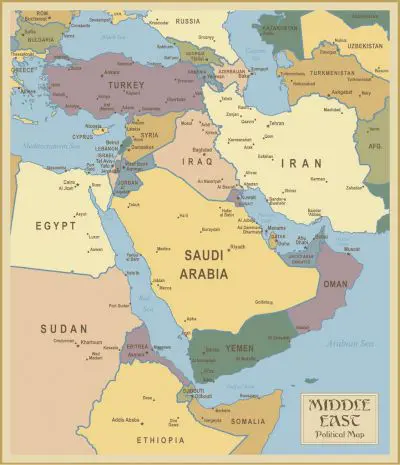

Egypt is one of the northeastern countries of Africa. It borders Libya to the west and Sudan to the south. The Middle East is one of the most important hubs in the petrochemical industry. Egypt's economic situation grew by 0.26% in 2020. production of polymers and granules in our petrochemical is very important

Add your import and export orders to this list

Warning: Undefined variable $formTitle in /home/anbar/domains/anbar.asia/anbar/inc/html/desktop/orderform.php on line 10

Warning: Undefined variable $marketName in /home/anbar/domains/anbar.asia/anbar/inc/html/desktop/orderform.php on line 12

Warning: Undefined variable $location in /home/anbar/domains/anbar.asia/anbar/inc/html/desktop/orderform.php on line 12

If you want to trade in the , please join in Anbar Asia. Your order will be shown here, so the traders of contact you

Egypt's GDP is estimated at more than 32% in the agricultural sector. Egypt produces 688,100 barrels of oil per day. our petrochemical industry has many phases of production of crude oil products. Egypt ranks very high in the welfare services sector in the city, transportation and urbanization system. Petrochemicals are chemical products from the processing of oil and gas

- Egypt resin Market

- Egypt Ethylene Market

- Egypt Nylon Market

- Egypt Styrene Butadiene Rubber Market

- Egypt Polybutadiene Market

- Egypt Acrylonitrile Butadiene Styrene Market

- Egypt Polypropylene Market

Therefore, with a closer look at this issue, it can be understood that the production of polymers and granules in our petrochemical is very important. Currently, the largest imports of petrochemical industries are in the form of granules, because these products are not found naturally and must be produced.

Read More ...

In 1795, ethylene gas was called olefin gas. The first synthesis of ethylene gas compounds (dichlor and ethane) was performed in 1795 by a Dutch chemist. In the middle of the 19th century, because C2H4 had a lower hydrogen than C2H5 ethyl, suffixes (ene) of Greek origin were added to the end of ethyl, and after that olefin gas is called ethylene gas.

Read More ...

The PBR rubber polybutadiene compound is a synthetic rubber. Polybutadiene rubber is a polymeric compound that is formed from the polymerization reaction of units 1 and 3 of butadiene. PBR is the fourth most widely used chemical in the world in 2012.

Read More ...

Polypropylene has been able to replace engineering polymers and even metal parts in industrial applications due to its easy acceptance of high amounts of various fillers and reinforcements, and as a result, a wide market has been opened for it. In addition, alloying with other polymers has diversified the grades and applications of this polymer. polypropylene is used in:

Read More ...

SBR and natural rubber are generally similar. However, some properties of styrene butadiene rubber have made natural rubber perform better than it. Some of these properties include the lower resistance of this polymeric material to tensile, heat accumulation and waste generation.

Read More ...

Egypt is one of the northeastern countries of Africa. It borders Libya to the west and Sudan to the south. Egypt is bordered by the Mediterranean Sea to the north, Israel by land on the Sinai Peninsula, and Palestine on the Gaza Strip. The north of Egypt generally has a pleasant climate due to its proximity to the Mediterranean Sea.

Read More ... Doubts over the ability of the Egyptian petrochemicals industry to pursue an ambitious programme are receding. While Carbon Holdings' Tahrir Petrochemicals Complex is likely to be delayed, we believe its prospects are brightening - although we caution it could be scaled back. Providing expert analysis, independent forecasts and competitive intelligence on the Report includes: Industry View, Industry SWOT Analysis, Industry Forecasts, Petrochemicals Risk Reward Index, Economic Forecasts, Company Profiles and Global, Regional and Country Industry Overviews. The Egypt Petrochemicals Report has been researched at source, and features Fitch Solutions' market assessment and independent forecasts for key petrochemicals sub-sectors. Fitch Petrochemicals industry professionals and strategists, sector analysts, trade associations and regulatory bodies with independent forecasts and competitive intelligence.

Read More ...

The petrochemical industry plays an important role in the Egyptian economy and is one of the most dynamic parts of the oil and gas sector. Recognizing the importance of the industry, the Egyptian government has developed and is implementing a master plan to accelerate its growth, but, despite significant expansion, the industry still faces many obstacles that hinder its ability to achieve its full potential. Egypt’s petrochemical industry will benefit from the country’s resource endowment and domestic market. According to the United Nations Industrial Development Organization (UNIDO), domestic demand for petrochemical products is increasing in Egypt. To meet that demand, Egypt will need to pump additional capital into the refining and manufacturing sector to increase capacity. With population of over 90 million and growing domestic demand, Egypt’s domestic consumption of petrochemical products is expected to increase in the coming years. “Egypt has a potential huge market that can absorb and consume petrochemical products when produced locally. For foreign investors, this can secure a great percentage of their products off take, hence increasing their market shares,” said Sara Mortada, Business Development Department Head at the Egyptian Petrochemicals Holding Company (ECHEM). Moreover, the Egyptian oil and gas sector is aiming to boost the production of petrochemical products to 40 million tons during FY 2017/2018 to meet the growing demand, sources at ECHEM told Amwal Al Ghad. In 2014, Egypt consumed 2. In addition, Egypt supplies petrochemical products to about 50 countries worldwide. “Egypt is gifted with its distinct location, which facilitates product export to global markets, such as Asia, Europe, and Africa,” noted Mortada. Mortada considers this young, competent, and adept workforce one of Egypt’s assets. The Egyptian Ministry of Petroleum and Mineral Resources considers the petrochemical industry a priority and hopes to garner $20 billion worth of investments in it. According to Amr El Shikh, a petrochemical engineer, Egypt has all these prerequisite factors for FDI. Egypt’s petroleum sector includes eight large petrochemicals projects with investments worth almost $7 billion and a total capacity of about 4. He also noted that “Egypt’s strong and trusted banking system is also a main factor in attracting FDI in the petrochemicals industry, as the foreign share of any project is managed by Egypt’s public banks. Echoing this theme, Mortada stated that, “recent reforms of the Egyptian gas market and the issuance of the new gas market regulating law would encourage investments in Egypt as well. [In addition, the] current status of the Egyptian pound highly attracts more foreign investments in Egypt. In August 2016, Egypt’s downstream sector set a new milestone with the inauguration of the petrochemical complex of the Egyptian Ethylene & Derivatives Company (Ethydco). The Tahrir Petrochemicals Complex is set to become Egypt’s largest petrochemical complex. 35 million tons of polyethylene per year, 880,000 million tons of propylene, 250,000 million tons of butadiene, 350,000 million tons of benzene, 150,000 million tons of gas oil and 100,000 million tons of hexene, according to World Refining Association Report about The Future of Egypt’s Refining & Petrochemical Industry. “I believe that the upcoming days hold a bright investment future for the petrochemicals industry in Egypt in the light of the wise governmental reforms, sincere employee dedication, and extensive R&D activities that will place Egypt as a prolific competitor on the regional petrochemicals production map,” stated Mohamed Saafan, ECHEM’s president and chairman of the board, according to ECHEM’s annual report. Egypt’s gas reserves and strategic location close to western European and Mediterranean markets make it an attractive place to invest in new petrochemical capacities. With its assets and technical expertise, Egypt has a unique opportunity to take a leading role in the production of high quality petroleum and petrochemical products, according to Sameh Fahmy, Egypt’s Former Minister of Petroleum and Mineral Resources, in his 2008 interview with Egypt Oil & Gas. Egypt’s comprehensive government support, and the availability of technical expertise in the fields of refining, fertilizers, and petrochemicals also encourage investors to invest in Egypt, Fahmy added. The petroleum sector is pursuing two parallel paths in the development of the petrochemicals industry. Egypt is both developing existing petrochemical projects to increase their competitive capacities and establishing new projects, sources at ECHEM informed Amwal Al Ghad. Development of its petrochemical sector will permit Egypt to optimize the benefits of its natural resources, particularly its new discoveries of large natural gas deposits. These “new gas discoveries will surely boost the contribution of Egypt’s petrochemicals industry, in addition to adding new capacities and maximizing the value added of the industry,” according to an anonymous petrochemical expert. El Shikh, similarly, mentioned that new gas discoveries, such as Zohr, will change Egypt’s petrochemicals industry. Most of Egypt’s petrochemical companies have operated at 50% or less of their total capacity since 2011 because natural-gas scarcity, El Shikh stated. The natural gas feed stock, a primary factor for the petrochemical industry, is expected to be available in Egypt at competitive prices as soon as new gas discoveries come online. Mortada notes that Egypt’s natural gas reserves are attractive to foreign investors in the petrochemical industry because it guarantees a local and dependable supply of feedstock for production purposes. ”Egypt’s natural gas is lean, which means it is mainly composed of methane, and there are various methods for converting methane to olefins, the building blocks of Mortada explained, pointing out that domestic natural gas production will reduce costs by reducing costly imports. This abundance of olefins, Mortada added, would widen the range of petrochemical products produced locally and would increase the opportunity to produce new derivatives, such as the specialty chemicals, which are currently imported and not produced in Egypt. Egypt’s petrochemical master plan presents a three-phase, twenty-year program (2002-2022) for the industry that takes into consideration feedstock availability, global and local market conditions, land availability, financing, and existing projects. ”Egypt’s petrochemicals master plan should be revised, because the market dynamics have changed a lot since 2002, in addition to the shift in over-supply between products, and the invention of totally new petrochemical based products,” a the On the other hand, BMI’s Petrochemicals Risk/Reward Index for the Middle East and Africa region showed that Egypt, with a score of 47. 0 points as a result of improved prospects for the petrochemicals industry and the country as a whole. In 2016, the Egyptian Ministry of Petroleum and Mineral Resources adopted a multifaceted strategy to secure Egypt’s oil and natural gas needs. The goal of this strategy was to expand current petrochemical facilities and thus maximize their ability to add value to products and transform Egypt into a regional energy hub. The petrochemical industry “could support the Egyptian goal of being a regional energy hub if the government diversified the use of the current facilities in order to increase the petrochemical products exports,” according to an anonymous petrochemical expert. Mortada explained that producing exportable downstream products would increase Egypt’s net exports while replacing current imports. This change would strengthen Egypt’s position in the international petrochemical market. Over time, Egypt’s strategic location and access to feedstock sources would contribute to Egypt’s development of trading and export infrastructure and its aspiration of becoming a regional energy hub. The petrochemical industry is well positioned to benefit from current economic reforms and the growth of Egypt’s natural-gas sector and could help drive the Egyptian economy in the future. The current master plan needs to be revised to adapt to rapidly changing market dynamics, drawing upon the opinions and expertise of industrial experts and Egypt’s young and talented workforce, argues one expert. How many blocks are offered in Egypt's 2021 digital bid round?.

Read More ...

Egypt’s petroleum sector is starting a new era of energy The Ministry of Petroleum and Mineral Resources has already announced the first milestone in its ambitious plan by declaring that Egypt will achieve of natural gas before the end of 2018. Although upstream activates drive a great portion of investments in Egypt, looking at the petrochemical industry it is equally essential to reach the goal of transforming the country into a regional energy hub. Furthermore, petrochemicals play an important role in the Egyptian economy and are one of the most dynamic parts of the oil and gas sector. Egypt’s petrochemical industry witnessed changes that rewrote the future of the industry, most notably the reduction of fuel subsidies. In November 2016, Egypt launched a major economic reform program through a number of fiscal policy and monetary policy decisions. The petrochemical industry is well positioned to benefit from those economic reforms in addition to the growth of Egypt’s natural gas sector. The industry could help drive the Egyptian economy in the future in many ways. Some industry experts, however, argue that the subsidies cut has an indirect effect on the petrochemical industry, as the cost of producing petrochemicals is depending on more than one factor. “As petrochemical products are priced according to many factors, including supply and demand trends, substitutes, and feedstock prices, consequently, domestic subsidies cut will not affect the prices of petrochemical products, yet, it might have an impact on their profitability and some products will not be that profitable,” Abeer El Sherbiny, Business Development Engineer, Egyptian Petrochemicals Holding Company (ECHEM) noted. She further explained that if local producers increase prices of their products, then they will not be able to compete with imported less priced petrochemicals products neither in the open Egyptian market, nor in international markets. On the contrary, other industry experts believe that the cost of producing petrochemicals is highly dependent on feedstock, thus there will be a direct effect of reducing energy subsidies. Prices of such goods are currently matching international prices as well as the feedstock, on the other hand petrochemical products like those used as fuel and in industry inputs, representing a big load on governmental budget before subsidies cut will be diminished to fade out after complete subsidies cut, hence these improvements will dramatically affect prices of those goods,” stated an industry expert in who requested anonymity. The natural gas feed stock, a primary factor for the petrochemical industry, is expected to be available in Egypt at competitive prices as gas discoveries have brought online, especially Zohr field. In December 2017, El Molla, announced the start of natural gas production from Egypt’s and the largest offshore field, Zohr, according to an official press release. Zohr’s production is considered a milestone in the history of the natural gas industry and related industries as petrochemical, both globally and in Egypt, especially after adding initial output from Zohr field to the production map in an unprecedented record time, compared to other natural gas discoveries all over the world, El Molla pointed out. The route by which lean gas can be utilized in the petrochemicals sector depends mainly on gas pricing, as some routes cannot be achieved unless a competitive gas price is available,” El Sherbiny explained. “On the positive side, there are a numerous traditional routes for petrochemicals production using lean gas, such as, Methanol and its derivatives (Acetic Acid, and Urea and routes such as olefins production via the Gas To Olefins route (GTO). ] There are nonstop technological efforts to produce chemicals and petrochemicals products directly from lean gas, such as Oxidative Methane Coupling (OCM), however, some of these technologies are not yet El Sherbiny added. The majority of petrochemical plants in Egypt are not planned to use the feed coming from Zohr, it was initially planned to use the western desert gas resources. In order to add more value to Zohr’s gas we have two scenarios to be economically evaluated: either building new petrochemicals plants near Zohr`s gas receiving facilities located near Port Saied and Suez or building other new gas facilities to serve the online petrochemical plants located near Alexandria and Damietta,” noted the industry expert . Sherif El Gabaly, Chairman of Board of the Egyptian Chamber of Chemical Industries, Federation of Egyptian Industries (FEI) noted commenting on the Impact of bringing Zohr online on Egypt’s Petrochemical Sector. It is worth noting that most of Egypt’s petrochemical companies have operated at 50% or less of their total capacity since 2011 due to natural gas scarcity, Amr El Shikh, a petrochemical engineer stated. “In my opinion petrochemicals will be leading the Egyptian industry especially once Zohr gas becomes available,” El Gabaly said. Egypt’s petroleum sector includes eight large petrochemical projects with investments worth almost $7 billion and a total capacity of about 4. The petroleum sector is pursuing two parallel paths in the development of the petrochemicals industry. Egypt is both developing existing petrochemical projects to increase their competitive capacities and establishing new projects, sources at ECHEM informed Amwal Al Ghad. Moreover, the Egyptian oil and gas sector is aiming to boost the production of petrochemical products to 40 million tons during FY 2017/2018 to meet the growing demand, sources at ECHEM told Amwal Al Ghad. Egypt plastics exports rose from $886. 17bilion in 2016, due to shortage in feedstock supply to both Polyethylene and Polyvinyl chloride plants, as well as the decrease in international petrochemicals prices, according to the United Nations (UN) trade statistics. “On the other side, Egypt’s petrochemicals exports are expected to increase in 2018, which is attributed to the recent start-up of some plants during 2017, namely MOPCO second train in Damietta (1. Egypt petrochemical industry is well positioned to benefit from the currently held economic reforms in addition to the growth of natural gas production. I can confirm that Egypt’s petrochemical sector will feature a prosperous stage in the coming years, by the support of the president and ministry of petroleum for considering this industry as a crucial industry for improving Egypt’s economic development. Egypt already has eight successful operating petrochemical plants […] Consequently, this can be the base for the coming era of producing more downstream finished products and more high value specialized products, meeting market needs and making use of technological development,” El Sherbiny noted. “In order for Egypt to achieve its ultimate goal in the petrochemical sector, the gas produced should go at least 50 to 60% of the industry instead of giving 70% of the natural gas to the power generation as is the case today,” El Gabaly stated. In addition, El Sherbiny explained that petrochemicals are a strategic industry that can drive economic development, therefore strategic support from all related governmental entities is required to boost forward this industry. Despite Egypt’s fluctuating economic performance, the profitability of the petrochemical industry has remained fairly positive and stable. How many blocks are offered in Egypt's 2021 digital bid round?.

Read More ...

Petrochemical Industry in Egypt.

https://egyptoil-gas.com/features/the-market-dynamics-of-egypts-petrochemical-industry-in-the-era-of-subsidy-elimination/https://egyptoil-gas.com/features/the-prospects-of-egypts-petrochemical-industry-upgrade-plan/

https://store.fitchsolutions.com/petrochemicals/egypt-petrochemicals-report